Financial Sector At Important Inflection Point

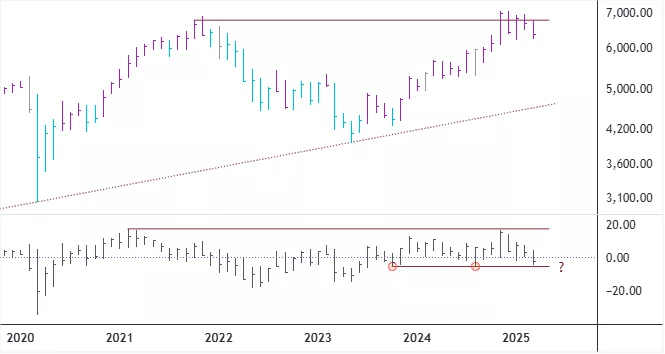

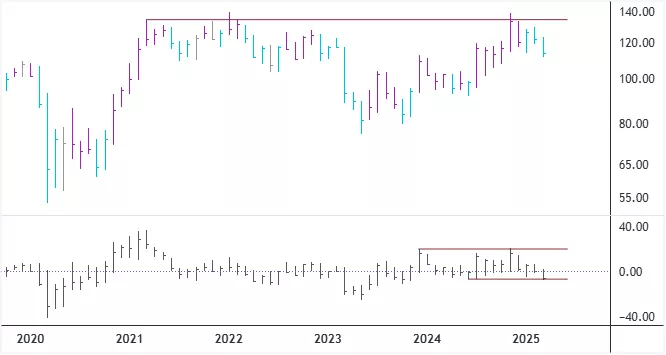

When a stock index or share price trends to the upside, it leaves behind structural inflection points on each correction which later may act as significant support levels. These underneath structures are often seen better through index level or stock price momentum.

The share price development of banks and other financial companies is important for the overall U.S. equity market. I am looking for potential breaks in long-term momentum structure of banking and financial sector indices, and in key constituent stocks such as Bank of America and Citigroup which could result in swift declines in their levels and prices.

In the lower windows of the charts below, I show a momentum measure. The brown horizontal lines under the zero level illustrate potential support in terms of momentum which will either break or hold.

Nasdaq 100 Financial Index - Monthly Chart

KBW Nasdaq Bank Index - Monthly Chart

KBW Nasdaq Regional Banking Index - Monthly Chart

More By This Author:

Inflation-Adjusted Gold Price Nearing $3000

Share Price Of Kvika Banki At An Important Conjuncture

Tech Giant Stock Prices Versus Gold´s Price At Critical Inflection Point

Disclosure: The author of the analysis presented does not own shares or have a position or other direct or indirect monetary interests in the financial instrument or product discussed in his ...

more