Tech Giant Stock Prices Versus Gold´s Price At Critical Inflection Point

Image Source: Unsplash

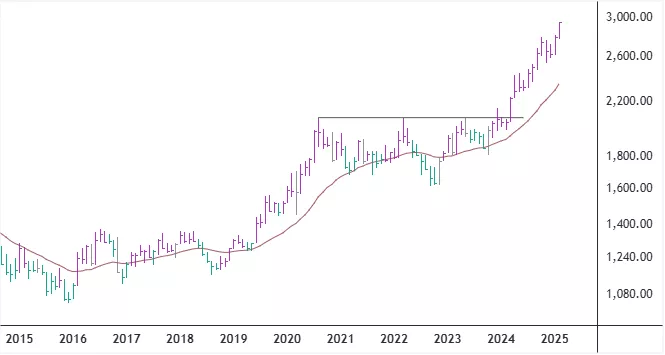

The price of gold in U.S. dollars is at all-time highs, approaching the $3,000 per ounce mark. My next possible target for gold´s price comes in the area between 3,279 and 3,336, given it rises convincingly through the psychological 3K level.

Spot Gold Price – Monthly Chart

I think the price of the yellow metal has the potential to advance dramatically if the S&P 500 and Nasdaq 100 indexes start to underperform the metal´s price, as capital flow rotates from one financial market asset to another.

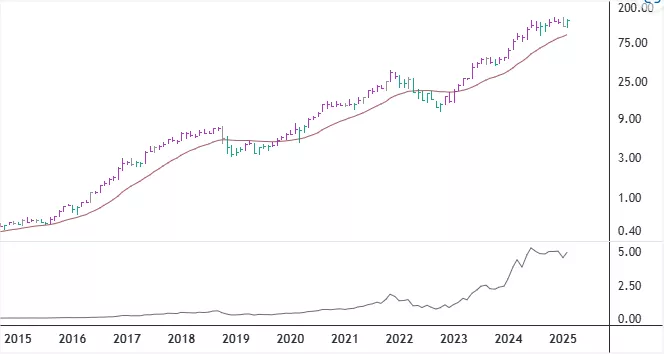

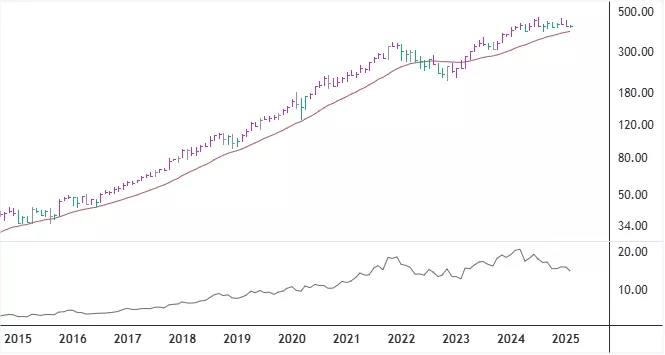

The shares of Apple, Nvidia and Microsoft have the largest weighting in the S&P 500 and Nasdaq 100 indices. Their combined weight is 19.5% (one-fifth) and 24.9% (one-fourth) respectively. That means the share price of the three companies has a great influence on the performance of the two indexes.

The charts below show how the stock prices of the three tech giants have performed in U.S. dollars and compared to the price of gold for the past +10 years. I am keeping a close eye on the latter, looking for a possible shift in relative performance where the price ratios reverse their long-term trends from up to down. The curved brown lines are moving averages of prices and the prices are adjusted for dividend payments.

Share Price of Apple – Monthly Chart

Share Price of Nvidia – Monthly Chart

Share Price of Microsoft – Monthly Chart

More By This Author:

Potential Upside Targets For Iceland´s Equity Market Indices

The Price Of Kvika Banki's Shares In An Uptrend

Iceland´s Stock Market Indexes Continue To Improve

Disclosure: The author of the analysis presented does not own shares or have a position or other direct or indirect monetary interests in the financial instrument or product discussed in his ...

more