Failure Of The Market Breadth Thrust? Refer To The Wyckoff Logic From The Bear Market In 2011

Image Source: Unsplash

The market breadth thrust drops sharply from above 90 to 33 in 2 weeks, which is a weakness in the market. Will this sharp pullback violate the previous analysis on spotting the market bottom with the breadth thrust?

Let’s refer to the Wyckoff logic from the 2011 bear market to find out whether the current pullback in S&P 500 is still healthy. Watch the video below:

Video Length: 00:11:31

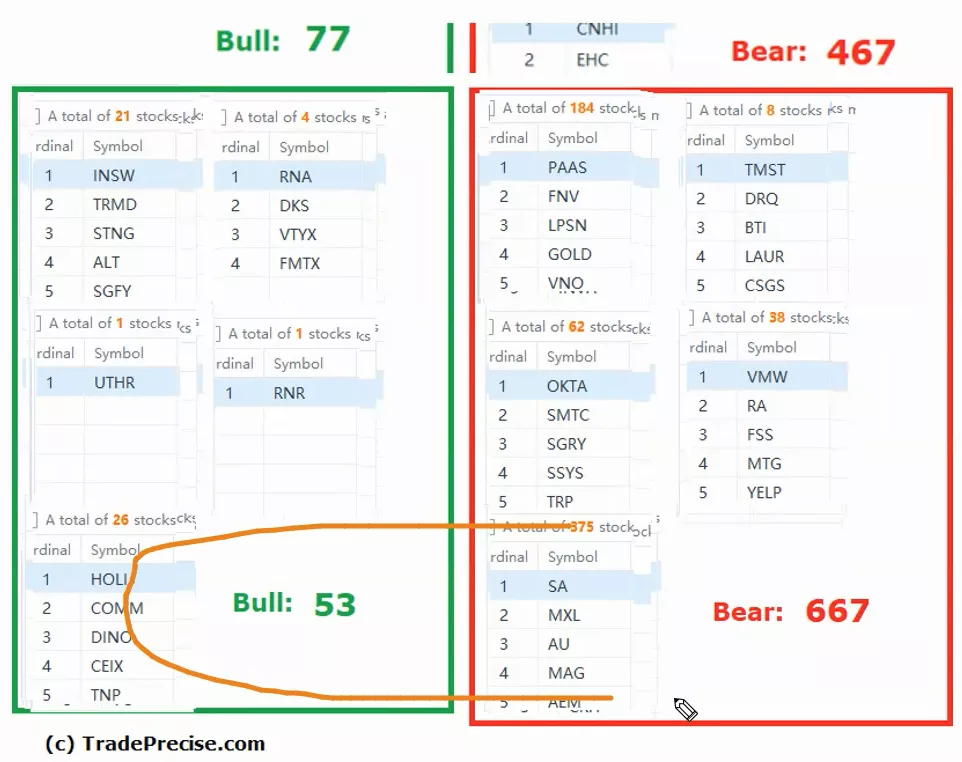

The bullish setup vs. the bearish setup is 53 to 667 from the screenshot of my stock screener below. More stock leaders were shot down with only a handful of stocks from the Biotech and Solar industry groups being resilient and bucking the trend.

Despite multiple attempts to stop the down move with the presence of demand, supply is still dominating. Hence S&P 500 is expected to have more weakness ahead.

More By This Author:

Here Is What To Expect As S&P 500 Is Approaching The Key Level With Increasing Volatility

Resume Of The Bear Market Selloff Or The Path From the 1990 Analogue & The Midterm Elections Cycle?

Market Breadth Thrust Hits The Critical Level; Bull Run Or Bear Rally?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.