Here Is What To Expect As S&P 500 Is Approaching The Key Level With Increasing Volatility

The increasing of volatility in the S&P 500 after Powell’s speech at Jackson Hole caused a fresh round of market correction. The current pullback in the market is still within the analog based on the midterm election cycle for the market bottom scenario in 2022.

Watch the video below to find out the likely scenarios and the characteristics of the price and volume as the S&P 500 is approaching the key level.

Video Length: 00:10:42

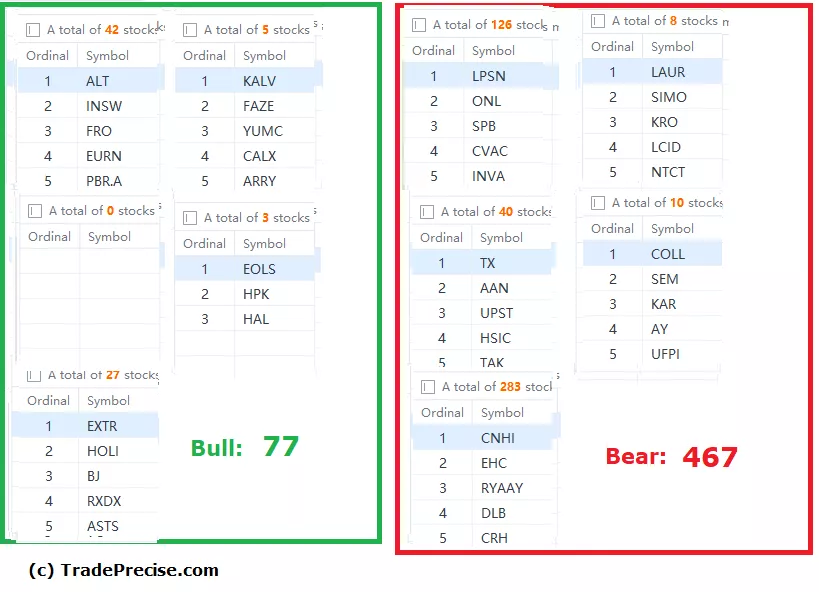

The bullish setup vs. the bearish setup is 77 to 467 from the screenshot of my stock screener below. This reflects the current bearish sentiment in the market. Conservative money and risk management in trading and execution in only grade A trade entry setup are essential.

Despite the severe market correction with the overall market breadth taking a bad hit, a handful of the stocks from the outperforming industry groups are still resilient.

Solar, renewable energy, biotech, automotive, oil, and gas industry groups are showing outperformance, especially during this current market correction. A handful of the stocks that are qualified by the Wyckoff trading method are likely to emerge as future leaders and potential multi-baggers in the next bull run.

More By This Author:

Resume Of The Bear Market Selloff Or The Path From the 1990 Analogue & The Midterm Elections Cycle?

Market Breadth Thrust Hits The Critical Level; Bull Run Or Bear Rally?

Tell-Tale Signs To Determine If S&P 500 Could Break Above The Resistance Zone

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.