EUR/USD Dips Amid Strong U.S. Data As Market Awaits Fed Minutes

Image Source: Unsplash

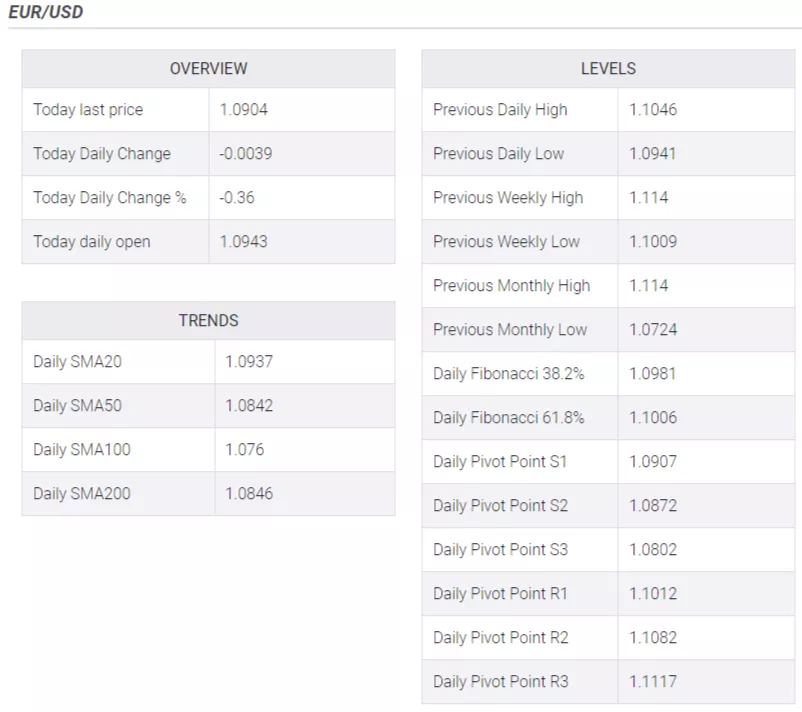

The EUR/USD remained on the defensive since the first trading day of 2024, falling 0.27% on the day after economic data from the United States (US) suggests the economy remains robust, though the labor market cooled down. At the time of writing, the major is trading at 1.0910 after posting a daily high of 1.0965.

Euro struggles as US data signals robust economy

The US economic agenda revealed upbeat data. The Institute for Supply Management (ISM) announced December’s Manufacturing PMI improved to 47.4, above forecasts and November’s readings, but it remained in recessionary territory for 14 straight months. At the same time, the US Bureau of Labor Statistics (BLS), revealed the JOLTS report, which showed a slight increase to 8.79 million, below the anticipated 8.85 million.

Aside from this, traders are awaiting the release of December’s Federal Open Market Committee (FOMC) minutes. In that meeting, Fed officials opened the door to ease monetary policy in 2024, with the majority projecting three 25 basis points rate cuts toward the end of the year. Nevertheless, according to futures data from the Chicago Board of Trade (CBOT), market participants had priced in six rate cuts.

Meanwhile, Federal Reserve’s (Fed) speakers had begun to cross newswires, led by the Richmond Fed President Thomas Barkin. He said that although the US central bank is making real progress on curbing stickier inflation, and the economy remains robust, the risks of missing a soft landing remain.

Across the pond, the Eurozone’s (EU) economic docket featured Germany’s employment data, which showed the unemployment rate stood pat at 5.9%, as estimated by economists polled by Reuters.

Ahead of the week, the EU’s calendar will feature S&P Services and Composite PMIs on Thursday. In the US, Flash PMIs would be updated, and jobs data could rock the boat, with ADP and Initial Jobless Claims pending to be released.

EUR/USD Price Analysis: Technical outlook

The EUR/USD daily chart depicts the formation of a golden cross, which could pave the way for further gains, but a three-dark crows chart pattern could keep the pair downward pressured. Nevertheless, sellers failure to push prices below 1.0900, and buyers could lift the exchange rate to test a 32-month-old downslope trendline that passes around 1.1025/40.

(Click on image to enlarge)

More By This Author:

Gold Price Eases Ahead Of FOMC Minutes, US Data

USD/CAD Price Analysis: Maintains Its Position Near 1.3330 Ahead Of The US Key Events

Silver Price Analysis: Silver Hits Multi-Week Low, Seems Vulnerable Below 50% Fibo.

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more