EJ Antoni On The Current Recession

From EJ Antoni (Heritage), article entitled “Coming recession may already have arrived” in the Boston Herald (8/21):

“…an increasing number of indicators say the recession has arrived in the broader economy.”

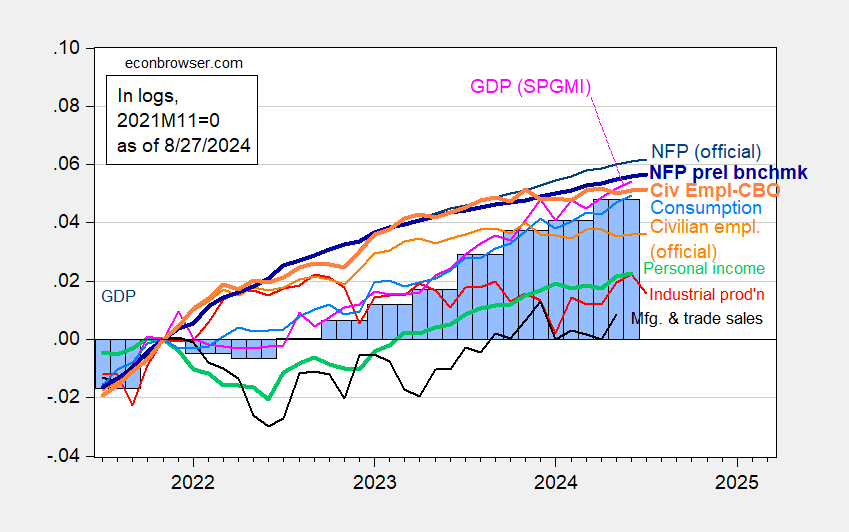

Here are key indicators followed by the NBER Business Cycle Dating Committee:

Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), NFP implied preliminary benchmark revision (bold blue), civilian employment (orange), implied civilian employment using CBO estimates of immigration (bold orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (8/1/2024 release), and author’s calculations.

For preliminary benchmark revision, see here; for alternative civilian employment using CBO estimates of immigration, see here. Note I used 2024 CBO estimates in these estimates as well; in the previous iteration, I used CBO estimates only up through 2023M06.

Of these indicators, I’d only count civilian employment from the household survey and perhaps industrial production as signaling a possible recession.

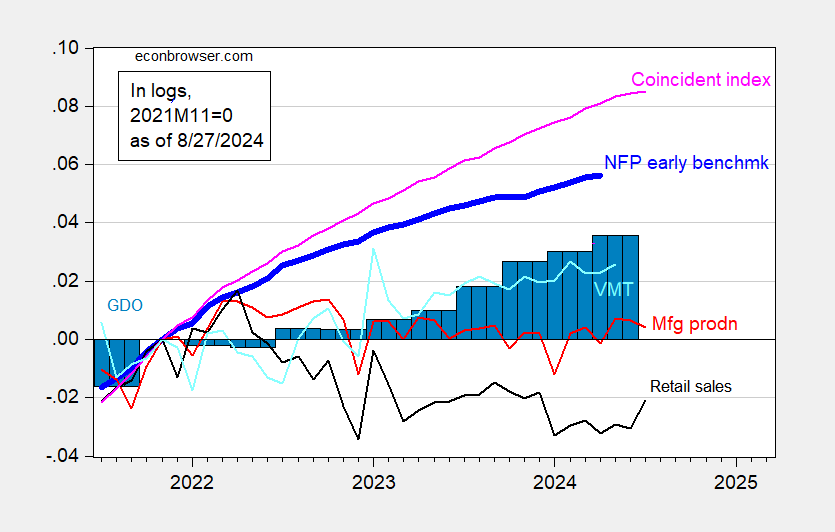

Here are some alternative indicators. Note that the vertical scale is the same for Figure 2 as for Figure 1, for the sake of comparability.

Figure 2: Nonfarm Payroll early benchmark (NFP) (bold blue), manufacturing production (red), retail ales in 2019M12$ (black), vehicle miles traveled (light blue), and coincident index (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed, Federal Reserve, Census, via FRED, BEA 2024Q2 advance release and estimated (by author) enterprise surplus, and author’s calculations.

Among these indicators, retail sales and manufacturing production might be signaling a recession, although the former has picked up on the latest available month. The coincident index rose at an annualized 1.8% over the last three months reported.

The usual caveat applies — all these series will be revised, particularly the GDP series, which is why the NBER BCDC does not place primary reliance upon this series (see how the 2001 recession only briefly fit the two consecutive quarter rule-of-thumb, here).

The one indicator in favor of the recession call is the Sahm rule. The caveat here is that the indicator is pulled up because of a major labor force increase, rather than employment decrease, as shown in this post. A year ago, I noted that the standard term spread models indicated a high likelihood of recession by mid-year 2024, so I’m loath to declare the outlook safe now, despite the fact that weekly indicators (e.g., WEI, for data thru 8/17) still indicate growth at 2.32%. Nonetheless, not quite ready to be put in the recession camp, yet.

More By This Author:

Economic Sentiment And Confidence In August

Spreads In The Meatpacking Industry: Beef

Manufacturing In Recession?