DJIA Far Too Early To Buy. Trump Chaos Reigns

Image Source: Pexels

The DJIA is still far too expensive to warrant buying.

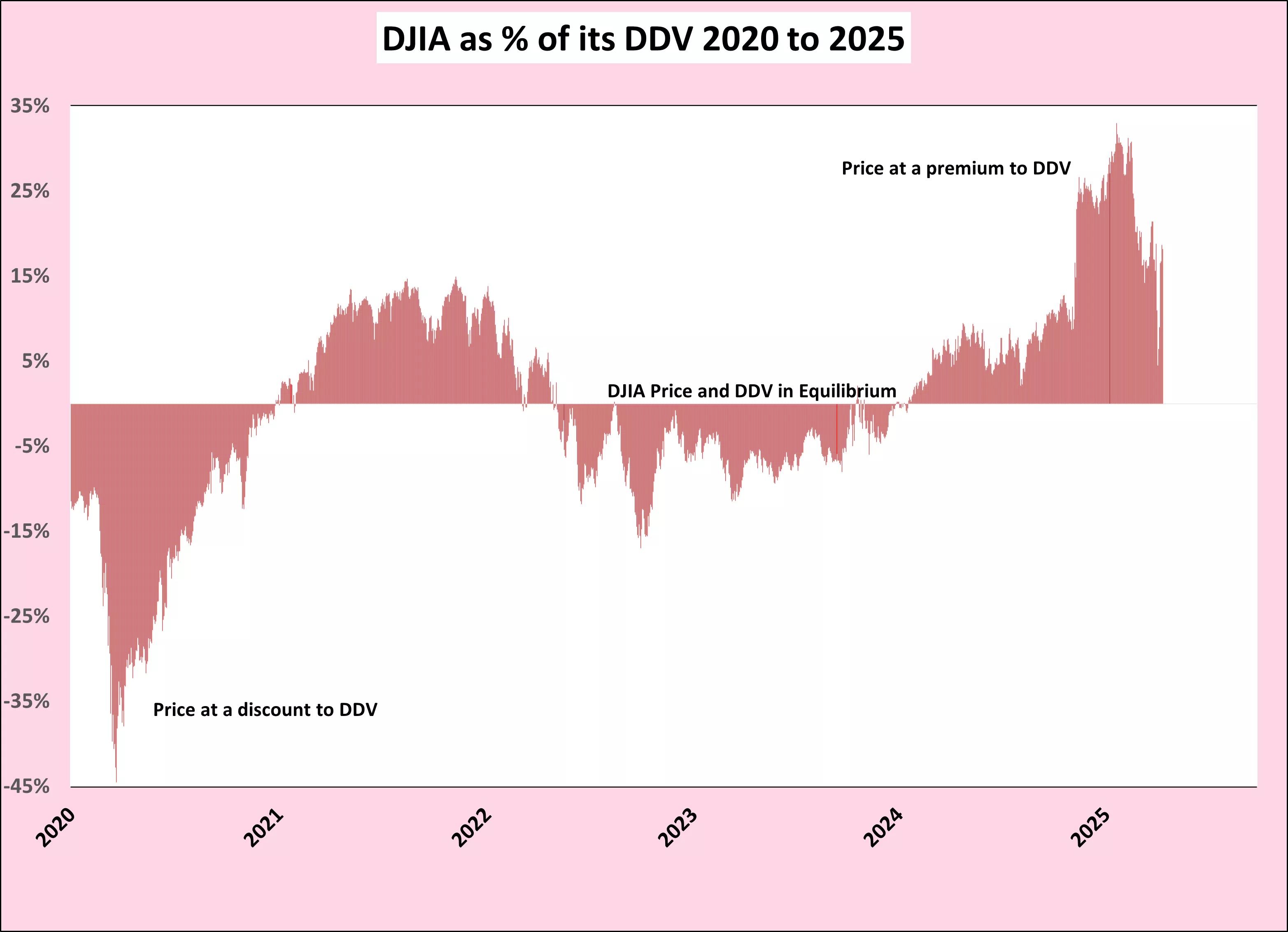

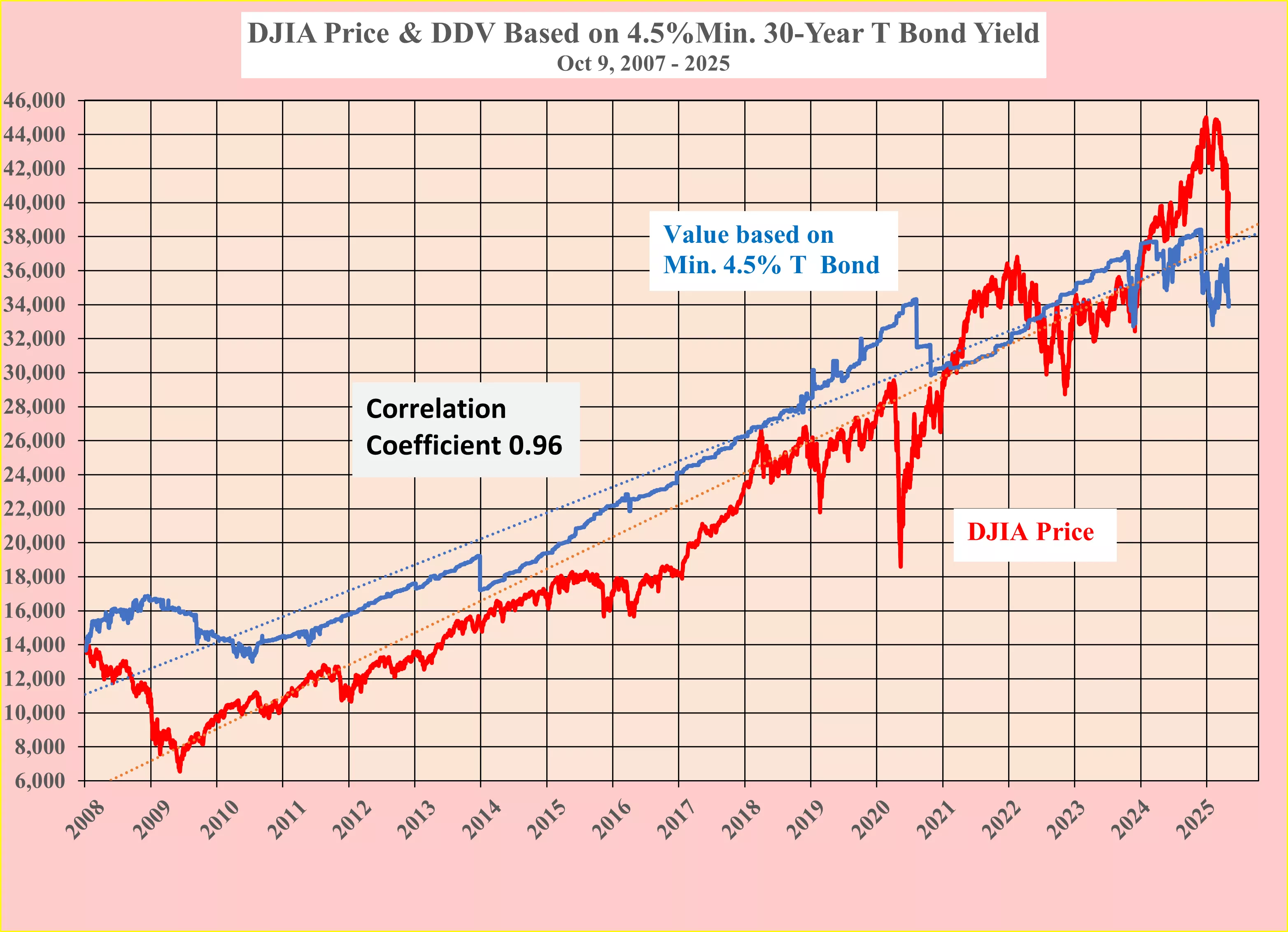

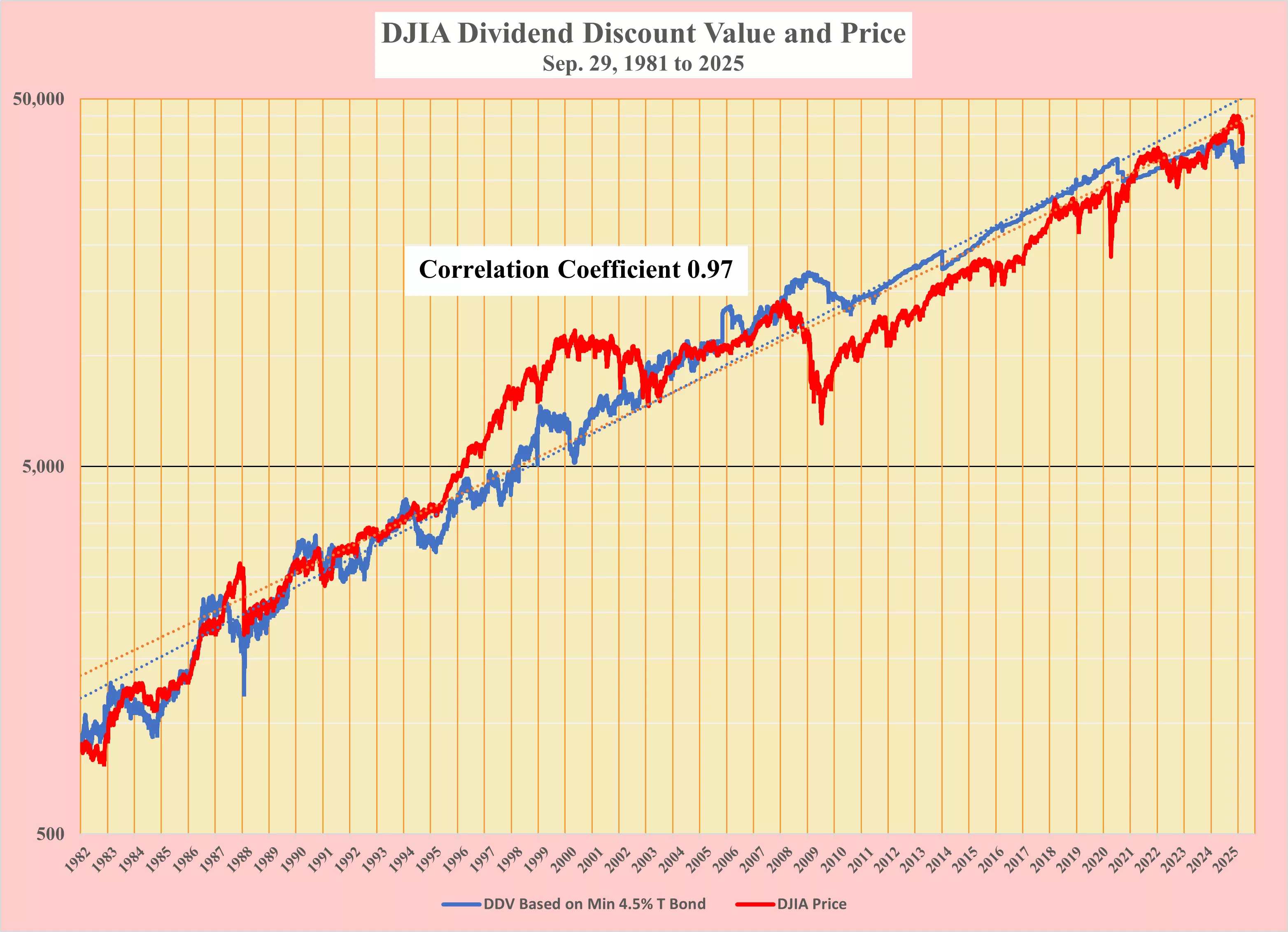

Having been a bull on the DJIA since 2010, I moved to being cautious in October last year, recommended its sale in January 2025 and against the urge to "buy the dip" on March 12. All recommendations were made based on the Dividend Discount Value (DDV) of the DJIA being at a discount to its price. At the close on April 14, the DDV stood at 34,294, a discount of 6,249 points, or 18.2%, to the DJIA price of 40.543.

The DDV shows where we are relative to the price of the DJIA. Figuring out where we are going is the difficult part. Given the uncertainty and turmoil foisted on the world by the Trump administration, a reasonable hypothesis would be for the DJIA to fall to equilibrium with its DDV of 34,294.

Until the Trump Madness ends, there is no need to rush back into the DJIA.

Should the Trump tariff turmoil continue, as seems likely, with the president repeatedly playing "Russian Roulette" with all six chambers loaded, there is a distinct possibility of the DJIA falling below its DDV or the 30-year T bond yield rising further, pushing the DDV even lower than today.

In the short term the 30-year T bond yield has fallen when the DJIA has fallen as might be expected with a flight to safety. However, confidence in the US dollar is waning and as soon as the DJIA stabilizes the 30-year T bond yield climes. Add to this the chaos surrounding the Trump administration as well as the needto refinance $9.2 trillion of the U.S. Goverment's $36.7 trillion of dedt and there seems a high probability of rates marching considerably higher. Foreign owners, such as China may be reluctant to roll over existing holdings and even worse sell outright.

For those who have not experienced one, bear markets can be brutal.

Holding the DJIA dividend steady and changing the yield ot the 30-year T bond the following Table outlines the range of possibile targets for the DJIA in the months ahead.Should the Trump chaos result in a deep recession itis possible for DJIA dividend to be cut which would result in even lower targets for the DDV and the DJIA price. Such possible outcomes may seem to be fantastical but they can and have happened. I correctly anticipated and have lived through such terrible times, One such occasions was in1974 following OPEC 1 at the end of 1973 when OPEC effectively imposed a huge tax on weatern nations and we had similtaneously inflation and arecession. As the old Chinese curse goes: "May we live in interesting times".

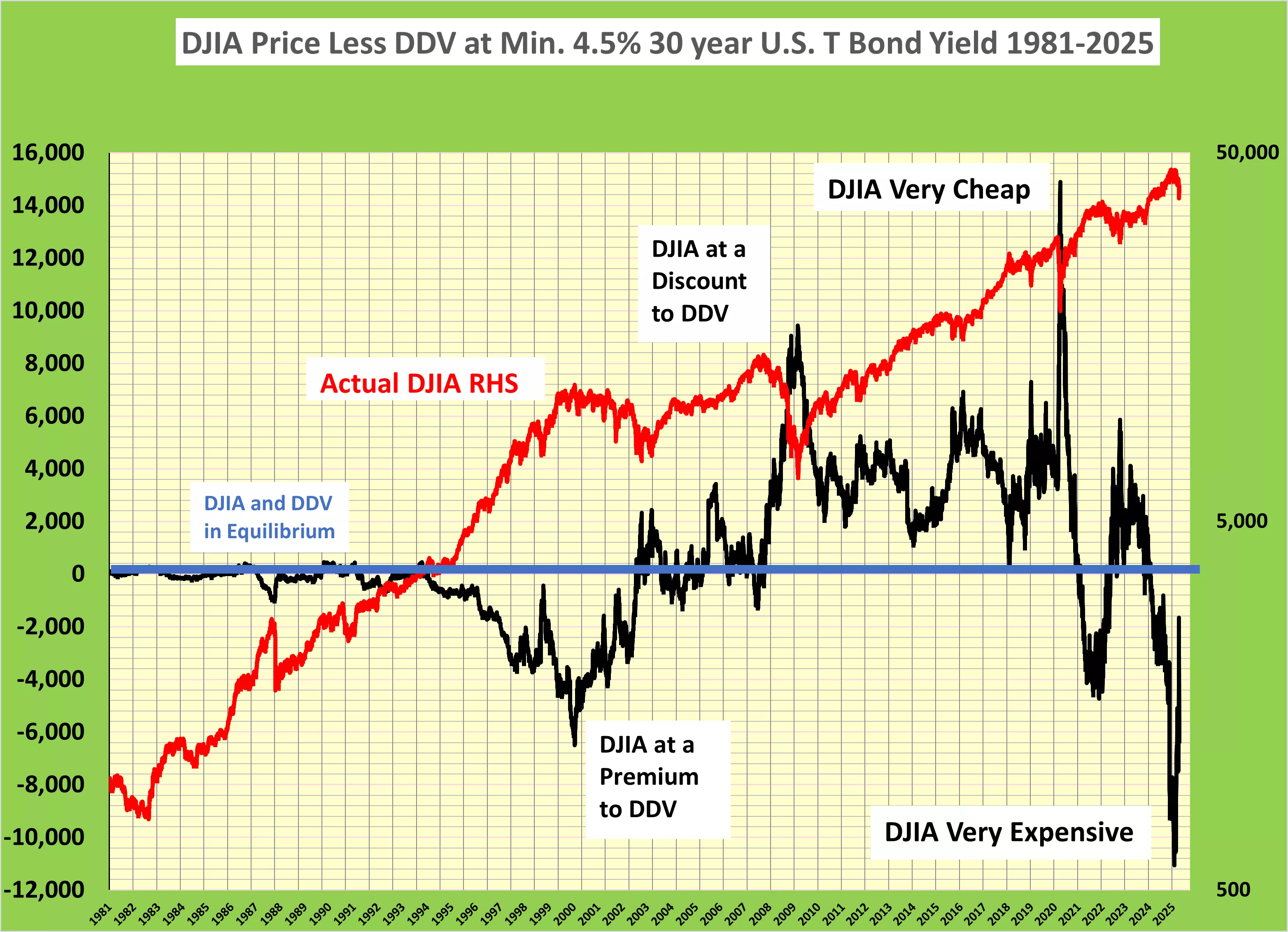

Recapitulation of DVD Model since 1981

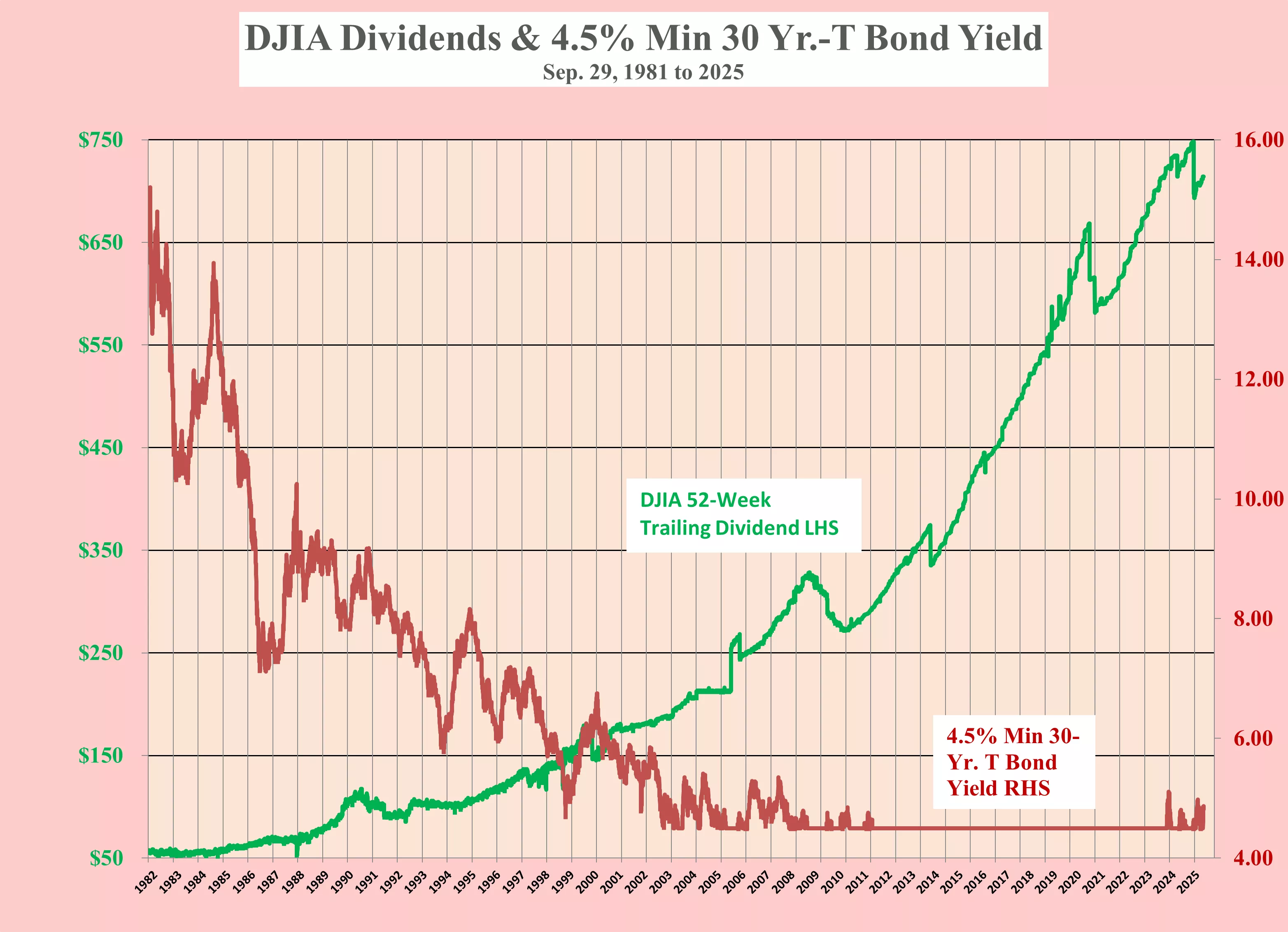

The next chart shows how the DJIA dividend has risen and the yield of the 30-year T bond has fallen from its all-time high of 15.2% recorded on September 29, 1981.

The vectors that drove the price of the DJIA from 1981 until October 9, 2007, the peak of the DJIA just before Lehman and the Great Recession, were a rising dividend and a falling 30-year T bond yield.

Since Lehman, the 30-year T-bond rate has been largely below 4.5% and has had little or no effect on the DDV. The heavy lifting of the DDV has been left entirely to the 163% rise in the dividend from $271.33 to $714.22 with no help from the 30-year T bond yield.

The argument for selecting a minimum yield on the T bond of the 4.5% rate is, in short, a combination of the last British Consol rate of 2.5%, at a time of no inflation, plus the desired inflation rate of 2.0%. For a more detailed explanation, please see my article published on September 26, 2023

More By This Author:

DJIA - Avoid The Urge To "Buy The Dip"

Tariffs And Counter-Tariffs. A Circular Firing Squad.

Already Falling, DJIA Remains At Record Premium Of 9,750 To Its DDV - Sell

Disclosure: I wrote this article based on my research over the past 60 years. I receive no compensation for this article.