DJIA - Avoid The Urge To "Buy The Dip"

Image Source: Pixabay

This is a follow-up to my article of February 27, 2025. Tariffs And Counter-Tariffs. A Circular Firing Squad.

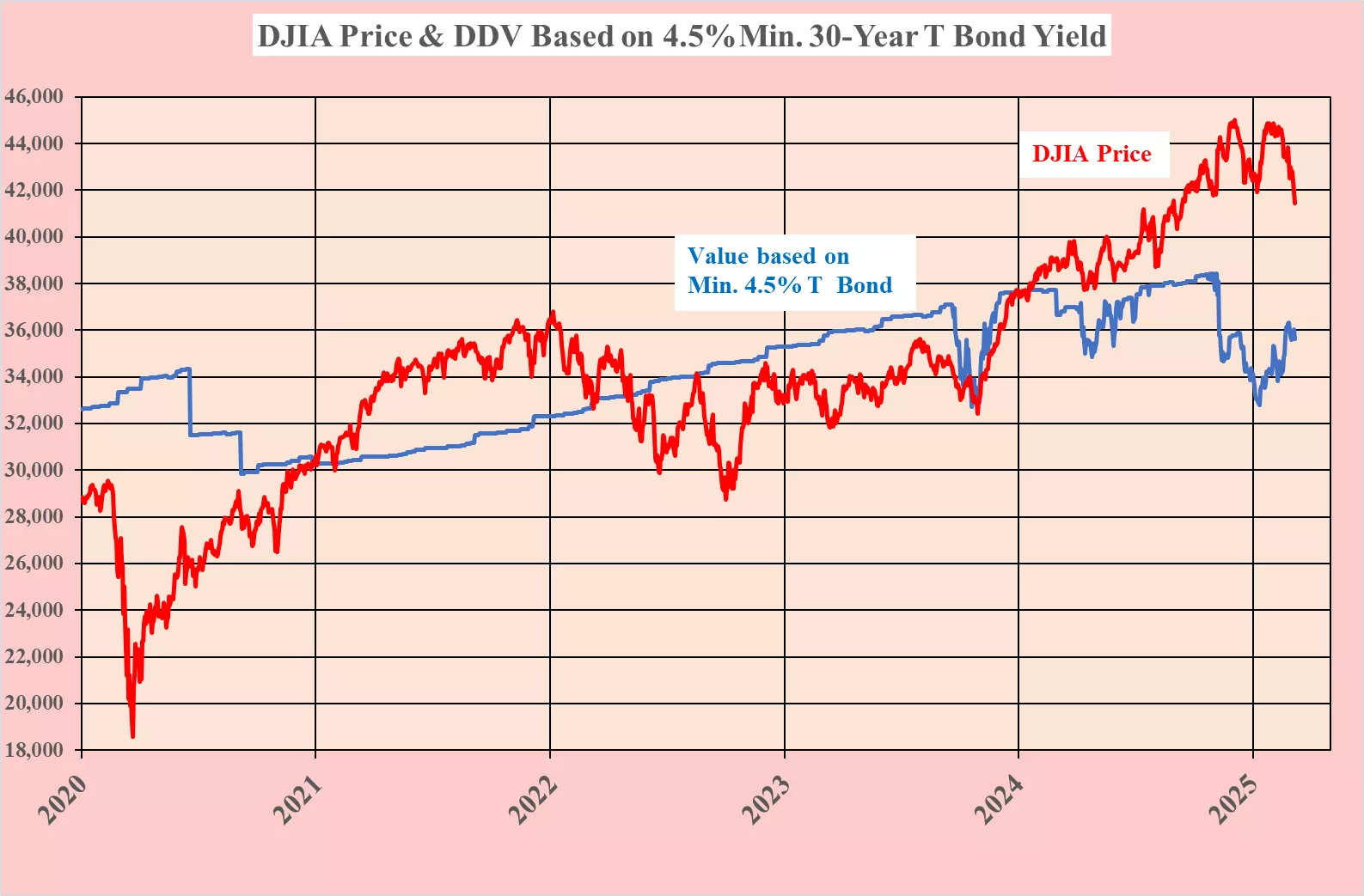

On December 4, 2024, the DJIA closed at a record 45,014. This was achieved by a bout of euphoric buying following Trump’s November election. The euphoria has dissipated and the DJIA is down 8% to 41,433 at the close on March 11, 2025, the lowest level since mid-September last year.

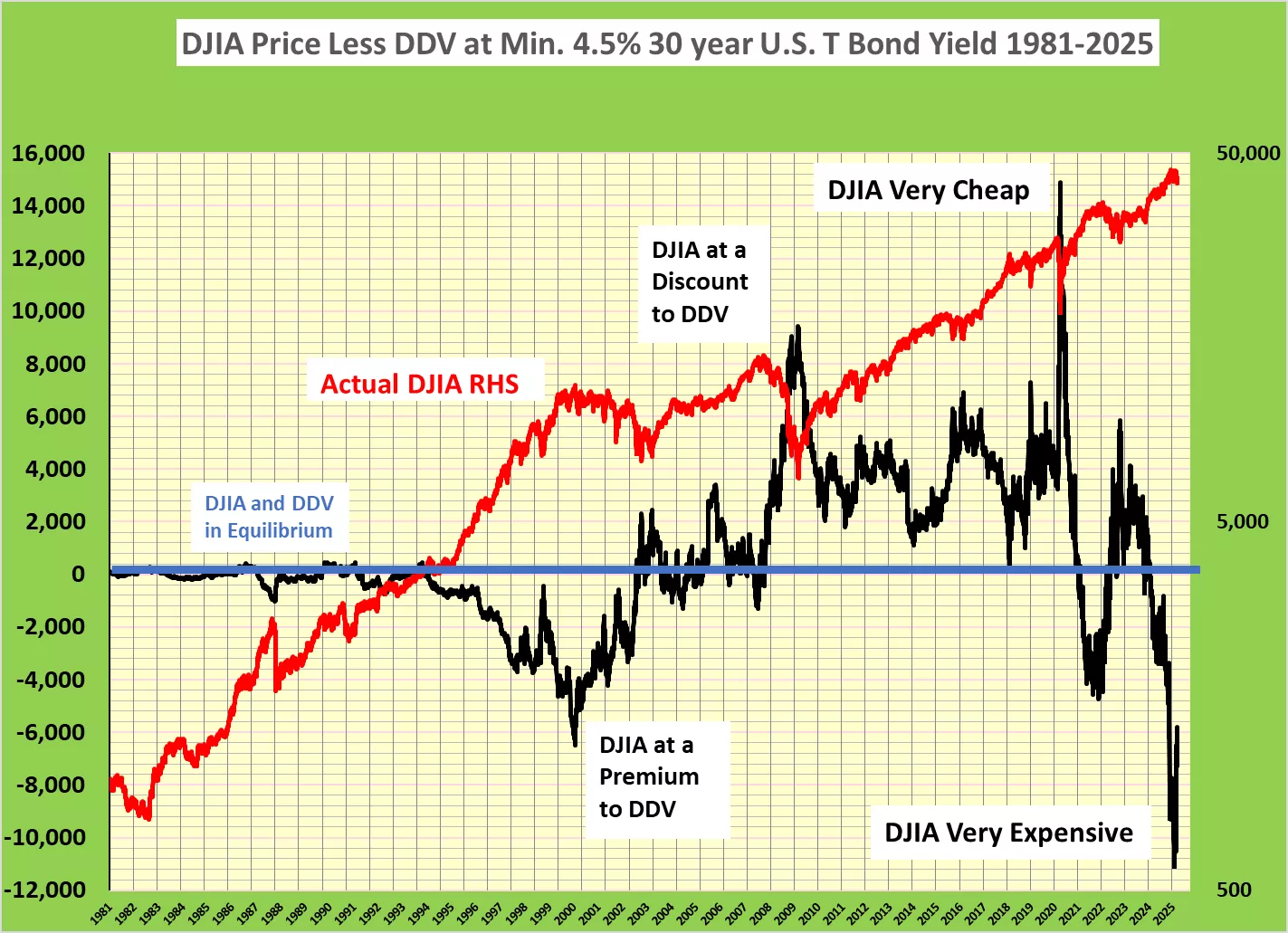

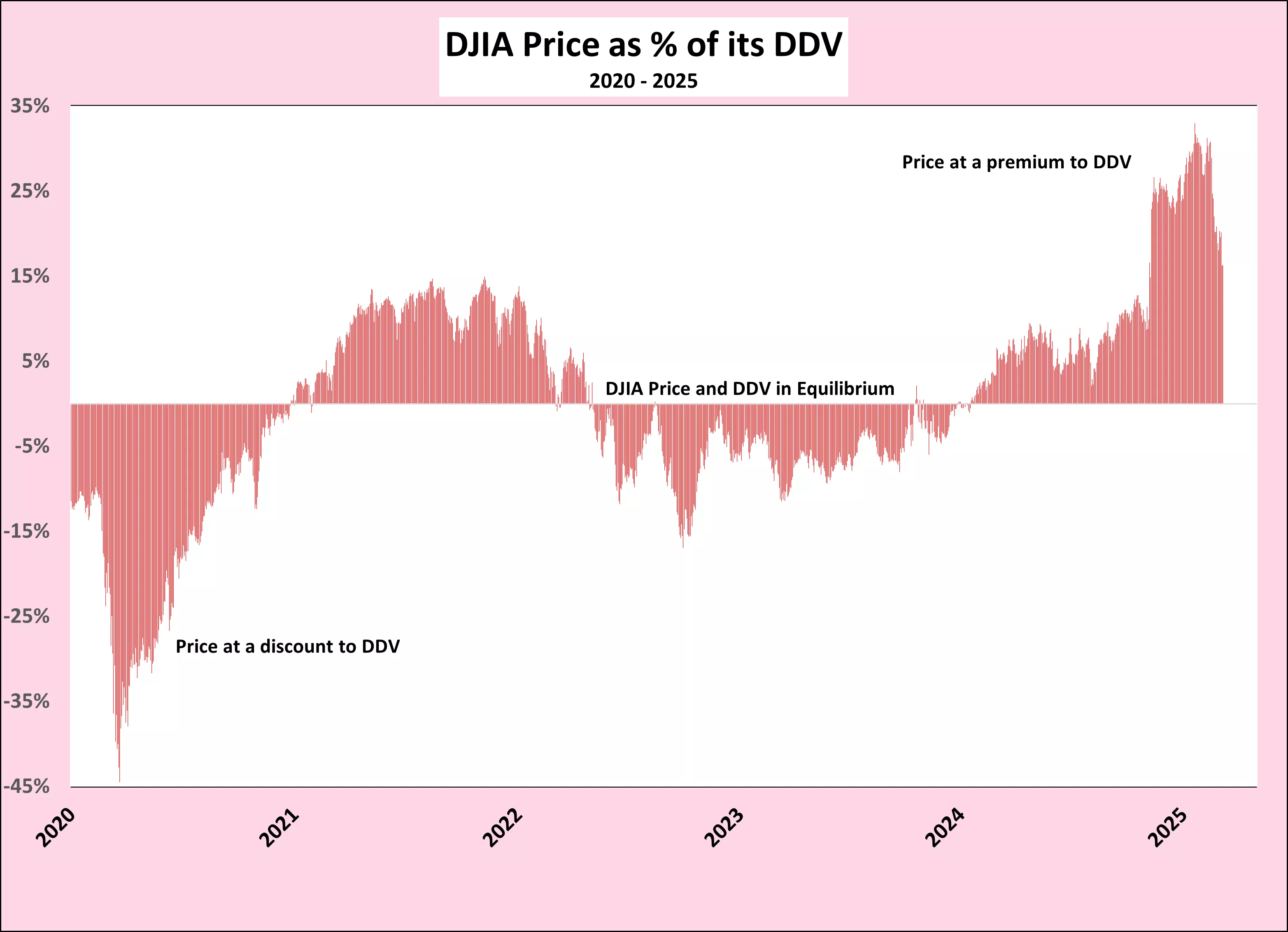

Despite the 8% decline from its peak, the DJIA remains at a 5,818, or 16.3%, premium to its Dividend Discount Value (DVD) of 35.616. This is a significant improvement from this year’s peak premium of 11,056, 33%, recorded on Jan 25, 2025. However, the DJIA remains too expensive, and investors should avoid the urge to “buy the dip”.

A thought on Tesla

Tesla is down 52% from its high of $483.99 on December 17, 2024, to $2230.58 at the close on March 11, 2025.

Messages to Elon:

- “Being Trump’s lackey is not good for your wealth!”

- “Quit trying to rule the world boytjie while you still have a few shekels left”

Note to Editor – “boytjie” is Afrikaans for “little boy”. I am sure that Elon will understand

More By This Author:

Tariffs And Counter-Tariffs. A Circular Firing Squad.

Already Falling, DJIA Remains At Record Premium Of 9,750 To Its DDV - Sell

DJIA Grossly Overpriced Vs. DDV

Disclosure: I wrote this article based on my research over the past 60 years. I receive no compensation for this article.