Tariffs And Counter-Tariffs. A Circular Firing Squad.

Image Source: Pixabay

This is a follow-up to my article of January 9, 2025: Already Falling, DJIA Remains At Record Premium Of 9,750 To Its DDV - Sell.

The DJIA remains at a premium to its DDV

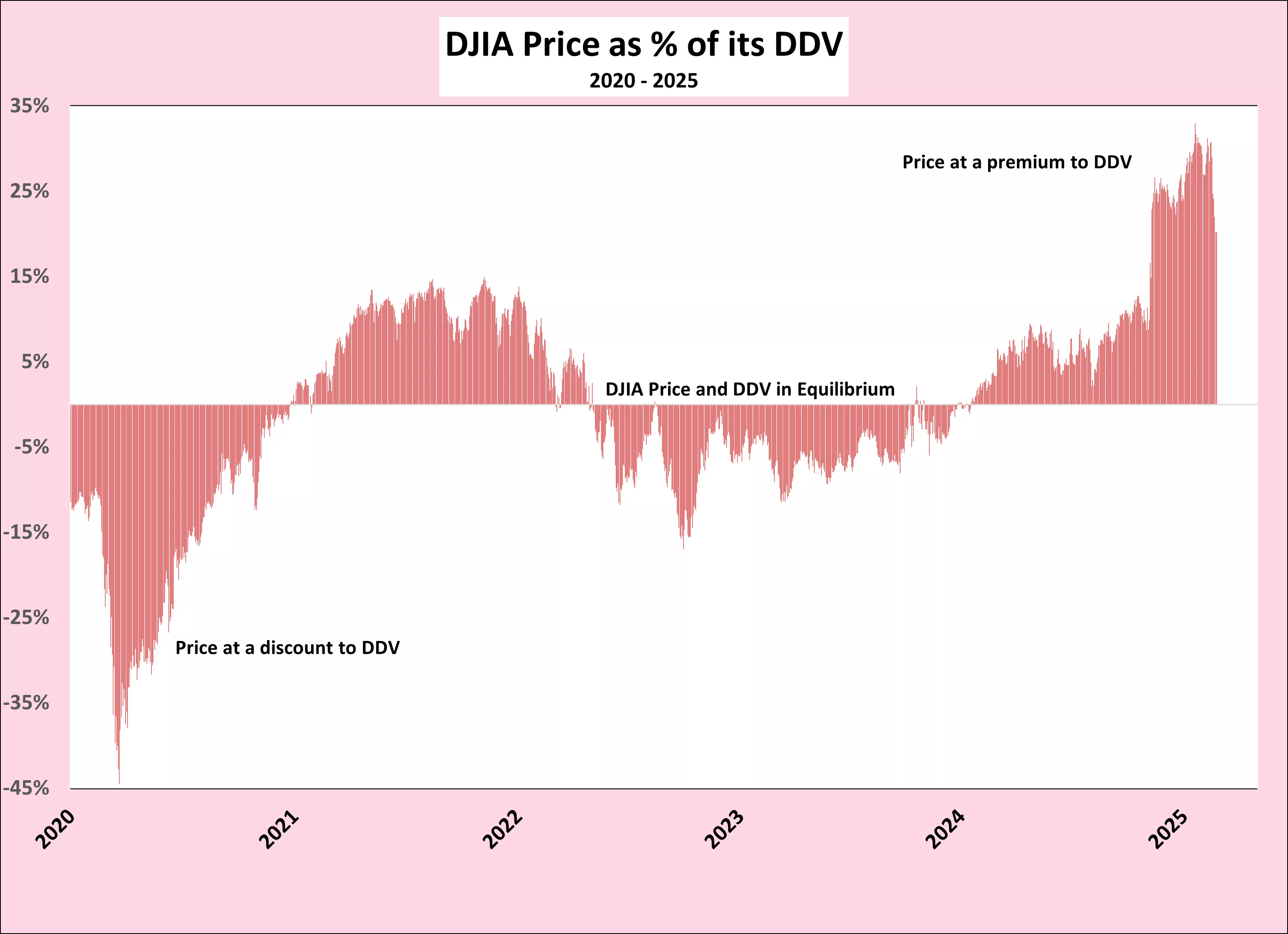

On October 3, 2024, I cautioned that the price of the DJIA, at 42,330, was at a premium of 11.1% to its Dividend Discount Value (DDV) of 38,111. Following this, I published four increasingly urgent warnings as the Trump euphoria drove the DJIA to a record of 45,014 on December 4, 2024, and held it at an elevated premium to its DDV of up to 33%.

On October 3, 2024, I cautioned that the price of the DJIA, at 42,330, was at a premium of 11.1% to its Dividend Discount Value (DDV) of 38,111. Following this, I published four increasingly urgent warnings as the Trump euphoria drove the DJIA to a record of 45,014 on December 4, 2024, and held it at an elevated premium to its DDV of up to 33%.

The past four months have not been a good time to buy, and I recommended selling the DJIA on January 9, this year when the DJIA at 42,635 stood at a 29% premium to its DDV of 33,065. Since then, the DJIA has remained elevated to its DDV but below 45,014 leaving ample time to either, liquidate or hedge portfolios. Some, like Waren Buffet, have been doing this for the past few months, especially, among stocks with very high multiples.

Consumer Confidence Fades

The sharp decline in the DJIA last week drove the long bond yield lower in a short-term flight to safety. The yield of 30-year T bond has fallen further with the February release of the Consumer Confidence Index which sank seven points to 98.3 from 105.3 in January—the largest month-to-month decline since August of 2021.

Tuesday's report stated that short-term expectations for income, business and the job market fell 9.3 points to 72.9. The Conference Board says a reading under 80 can signal a potential recession soon.

Confusion Breeds Uncertainty

Uncertainty is the enemy of financial markets, and the new administration's first month has certainly provided a great deal. From tariffs to bureaucratic firings, changes in foreign relations with Ukraine, Canada, Greenland, Europe et al. Along with declining economic outlooks from Walmart and other retailers. Confusion is starting to impact the DJIA which remains at a 20.2% premium to its DDV of 36,128.

Tariffs Are a TAX on the Citizens of the Importing Country

Despite Trump (and Canada)’s apparent belief and protestations about tariffs being paid by foreign countries, they are in effect a tax on the citizens of the importing country. While this boosts the US treasury, it is a tax increase which Trump may see as a sneaky way to balance the US budget.

Tariffs Result in Self-Imposed Recessions and Inflation

OPEC1 in late 1973 resulted in a huge jump in the price of oil. In turn, this became a huge tax increase on US and world citizens, through the price of gasoline. While different from tariffs, as the coffers of oil-producing countries were filled, today’s tariffs/tax hikes will probably result in a similar US recession that followed both OPEC 1 and OPEC 2. Imposing retaliatory tariffs, as promised by Canada, will also result in a tax hike for Canadians, which will no doubt be squandered by the current regime on high-speed trains instead of high-speed approvals of pipelines.Tariffs and counter-tariffs are the equivalent of participating in a circular firing squad.

The DDV of the DIIA

The main vectors of the DDV are the trailing 52-week DJIA dividend and the US 30-year T bond yield when above 4.5%. The DJIA dividend may also be impacted by the reluctance of corporate board members to raise payouts in uncertain times. With the dark clouds of economic uncertainty amassing on the horizon dividends may even be cut.

Below a 30-year T bond of 4.5%, the DDV will not be affected by further declines as the minimum yield of 4.5% kicks in. Changes in the other vector, the DJIA dividend, will continue to impact the DDV, which could either remain static or fall.

On Feb 26, 2025, the DDV closed at 36,128 based on a DJIA dividend of $705.97 and a 30-year T bond yield of 4.51%, while the DJIA closed at 43,433, a 20.2% premium to its DVD.

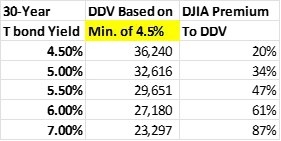

Without any change in the DJIA, the following table shows how changes in the yield of the 30-year T bond will impact the DDV and the premium of the DJIA price to that.

Over the past 50 years, when the 30-year bond yield went below 4.5% it had no impact on the DDV so there is no reason to expect that to change. Hence, do not expect the DDV to rise above 36.240 as the 30-year T bond yield falls under 4.5% and the dividend remains static at best

Should the 30-year T bond yield fall in the near term, it will result from either the fear of or the reality of a recession brought on by the increasing uncertainty about Trump’s new administration.

Furthermore, there is a pressing need to pass a budget and avoid a government shutdown in March, to say nothing of the need to refund some $7 trillion of US Government debt in 2025, pay for the extension of the 2017 tax cuts and the promise of further tax cuts at a time of continued stubborn inflation. The yield of the 30-year bond could thus rise as the year progresses and put downward pressure on the DDV.

The DJIA Remains too expensive

More By This Author:

Already Falling, DJIA Remains At Record Premium Of 9,750 To Its DDV - Sell

DJIA Grossly Overpriced Vs. DDV

DDV Heading Down As 30-Year T Bond Yield Hits 4.58%.

Disclosure: I wrote this article based on my research over the past 60 years. I receive no compensation for this article.