Corporate Bond Spreads Widen Signalling Greater Risks Ahead

While all eyes are on the volatility in the stock market, the bigger story might well turn out to be the potential blow out in the corporate bond and leveraged loan markets. Ever since the 2008 financial crisis, the corporate sector has shunned banking lending and, in its place, has turned to the debt markets to fund its operations. The sheer size of these debt markets is now a cause of concern as their spreads widen, potentially threatening the stability of all non-sovereign debt markets.

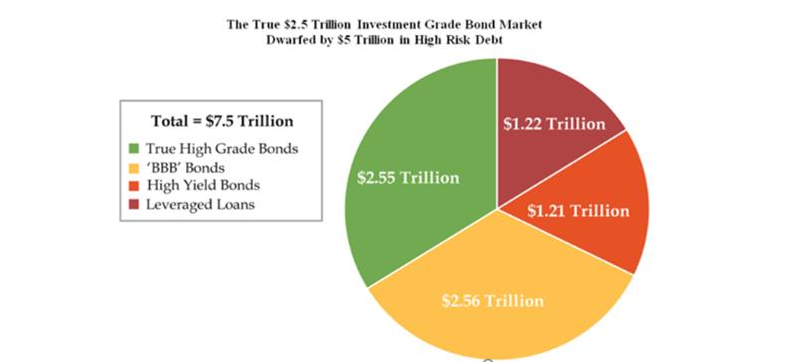

In total, the U.S. corporate bond market now totals $7.5 trillion, a little less than half the size of the outstanding U.S. Treasuries (figure 1). A step down from investment grade debt is the ‘BBB’ segment which now is the largest sector in the U.S. corporate bond market, reaching a record level of $2.6 trillion. There has been some “grade inflation” in that some names were elevated to BBB so they may qualify to be the lowest rank segment of investment grade, allowing for these bonds to qualify for purchase by more bond funds. High-yield and leverage loans comprise $2.4 trillion or a third of the entire corporate bond market.

Figure 1 US Corporate Bond Market

The leverage loan market, currently totaling $1.2 trillion, has come under greater scrutiny recently. A leveraged loan is a commercial loan provided to a borrower with a non-investment grade rating, by a group of lenders. Many of the loans pay a floating rate, typically based on LIBOR plus a stated interest margin. If the interest margin is above a certain level, it is considered a leveraged loan. Former Federal Reserve Chairperson, Janet Yellen said the leverage loan market is unregulated and given its size and scope poses a threat to the financial system. The Bank of England and Bank of Australia raised similar the alarm bells concerning the rapid expansion of leveraged loans worldwide. The BoE was so deeply concerned that it warned that the “global leveraged loan market was larger than – and was growing as quickly as – the U.S. subprime mortgage market had been in 2006”.

Credit markets begin to show cracks when spreads widen out and risk-takers demand greater yields. The additional yield over the risk-free rate of Treasuries compensates for credit and liquidity risks. The U.S. corporate ‘BBB’ spread is the widest in 26 months, putting many investors under water. It is the widening of credit spread that is creating considerable stress in this debt market. Since much of the high-yield market is occupied by the energy sector, the collapse in oil prices adds further to drop in returns. For the month of December, so far, both high-yield and leveraged loan debt have generated negative returns (figure 2).

Figure 2 Loan Losses in HY and Leverage Loan Markets

Why have spreads narrowed? Initially, the experiment with quantitative easing encouraged investors to bid up the prices of riskier assets as they moved out on the risk curve. Now that the Federal Reserve is shrinking its balance sheet and raising rates (reversing what it had done), investors are also reversing course. Central bank tightening, international trade restrictions and falling crude oil prices have combined to widen credit spreads. Falling asset prices, equity and debt can drive credit spreads even further. These spreads shine the light on a debt market that carries with its major risks to the financial sector.

Excellent article, prof. This is why banks have been shunned. Our own little subprime lending market run amok. And we worry about the Chinese off bank balance lending!

Thanks. Yes, there is real worry when Yellen, in retirement, comes out and says ' Houston, we have a problem'

So, subprime grew to include those alt A jumbo loans in California. It was far larger than what we normally think of subprime. These were loans made for over 500k with very easy money. These were not cra loans that Fox News railed about, but which were quite conservative by comparison. These jumbo loans turned out to be quite risky.