Confluence Zone Swing Trading Opportunity With Big Move Coming Soon?

There is swing trading opportunity at this confluence zone with potential big move coming soon in S&P 500 based on the Wyckoff trading method upon the release of the CPI data and the upcoming FOMC meeting.

Watch the video below to find out the key levels for the swing trading entry point within the confluence area.

Video Length: 00:09:54

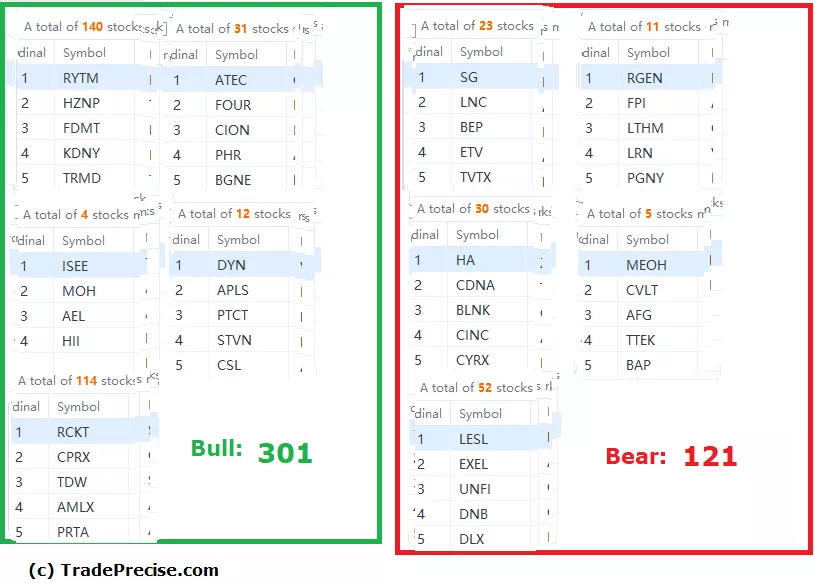

The bullish setup vs. the bearish setup is 301 to 121 from the screenshot of my stock screener below.

Excessive volatility is to be expected especially during the CPI data release and the FOMC by the Fed. Sign of strength rally breakout usually turns out as Wyckoff upthrust because of the volatility in 2022. Hence selling into strength is still the preferred trade management strategy in this year.

More By This Author:

Could This Be The Perfect Short Selling Entry Based On The Market Breadth & Wyckoff Upthrust Price Action?

Where Could This Bear Market Rally Peak?

Bear Market Rally Or Stock Market Bottom? Form Your Trading Plan With Wyckoff Method

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.