Bear Market Rally Or Stock Market Bottom? Form Your Trading Plan With Wyckoff Method

Image Source: Unsplash

Has the stock market hit the bottom or is this a bear market rally to trap the bull? The bullish momentum bar reacted to the CPI last Thursday marked a significant milestone in S&P 500.

Watch the video to find out how you can form a sound trading plan with the Wyckoff trading method to ride on the trend in either direction at these key levels.

Video Length: 00:14:17

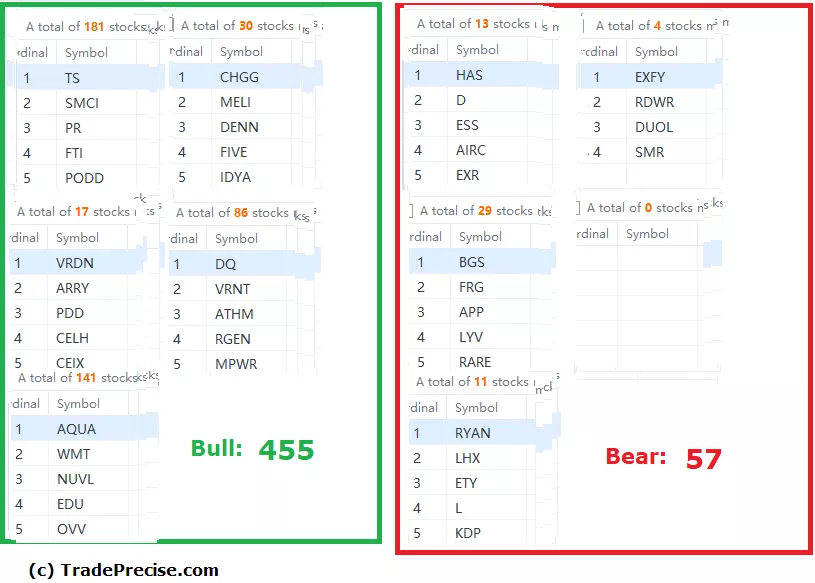

The bullish setup vs. the bearish setup is 455 to 57 from the screenshot of my stock screener below.

It is essential to pay attention to the price action and volume in S&P 500 and to identify a Wyckoff change of character for early detection of a potential trend change.

Meanwhile, there are many outperforming stocks trending up as shown up in the stock screener despite the choppiness formed in the indices. Do look for strong relative strength as shown up in the individual stocks when identifying the winning stocks for swing trading.

More By This Author:

A Trading Plan Of Reversal Trading For S&P 500 At This Axis Area

Is JPMorgan Chase Spared From The Bear?

Will Merck Continue Its Bullish Streak? A Wyckoff Analysis

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.