Is JPMorgan Chase Spared From The Bear?

JPMorgan Chase & Co. (JPM) is one of the largest multinational investment banks.

It provides a wide range of financial services including investment banking, asset management, private banking, commercial banking and many more. JPM is listed on NYSE and is a component of DJI and S&P 500 under Finance.

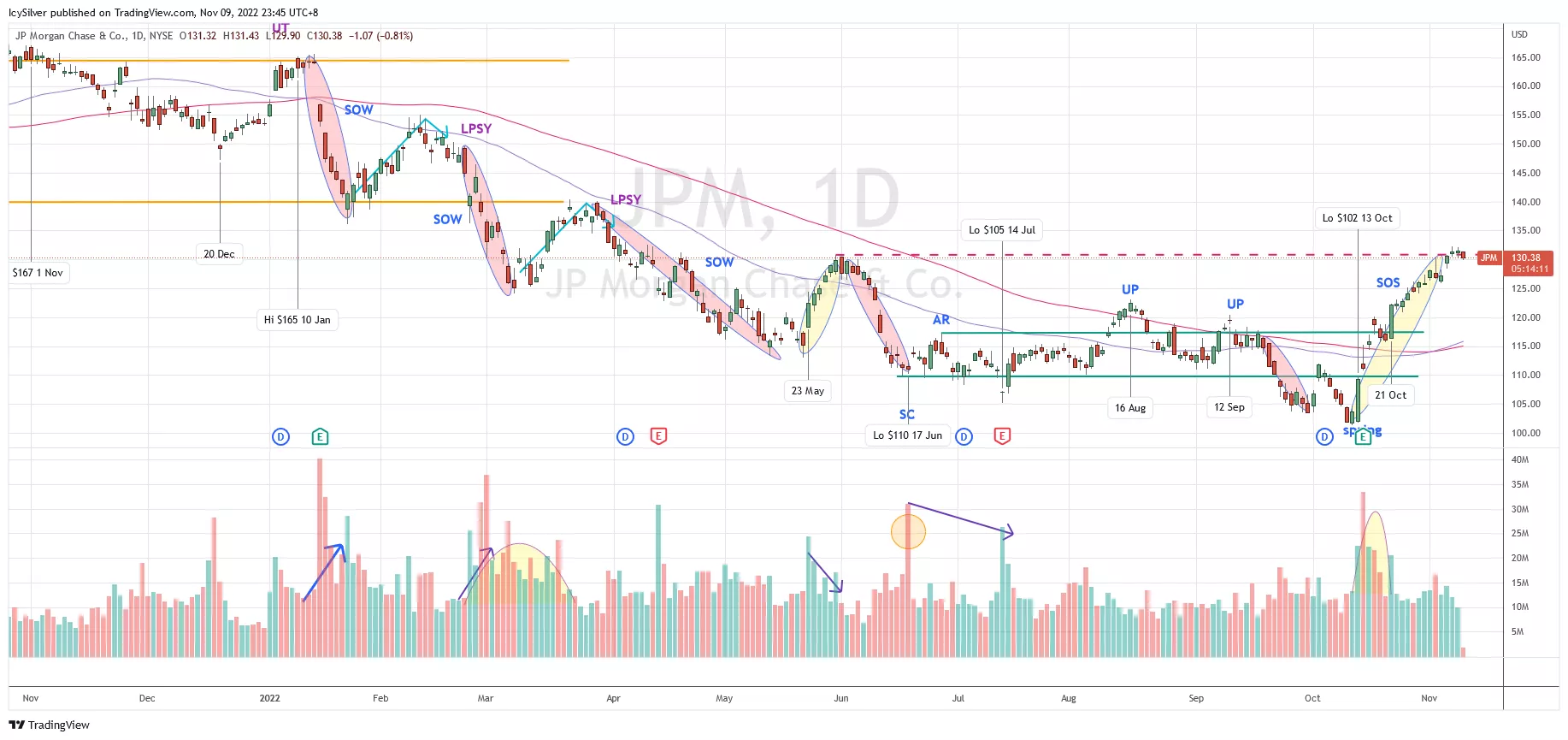

JPM was in a trading range between $140 and $165 in 2021. On 1 November 2021, the price did a Wyckoff upthrust around $167, which is confirmed by the subsequent down move. However, the price tried another rally up to hit $165 on 10 January 2022. But this proved to be another upthrust as the price was unable to commit above $165 and had a sharp Wyckoff sign of weakness (SOW) down to test $140. This SOW was accompanied by an increase in volume, suggesting the presence of supply.

The next price movement was several more SOW with weak attempts to rally. The volume in March 2022 was relatively higher than in December 2021, which is likely selling by institutional players, a typical Wyckoff distribution characteristic.

JPM was clearly in a downtrend, until a Wyckoff selling climax (SC) was formed on 17 June after hitting the low of $110. Then, the price did an automatic rally (AR) to around $117 and defined the new narrow trading range. The price rallied to break above the range, but retraced twice in 16 August and 12 September. The volume during this period was also lower, suggesting lack of demand. Furthermore, the September upthrust was weaker which was followed by another sign of weakness that broke $105 on 30 September.

The price was unable to rally and finally did a Wyckoff spring on 13 October with a big spike in volume. This set the stage for the best Wyckoff sign of strength (SOS) rally. It broke out of the range with momentum on 21 October and continued to test the previous resistance at $130.

Bias

Slightly bullish. JPM has just completed a Wyckoff accumulation phase which began in July 2022. The price is now testing the $130 previous high. It could be forming Wyckoff backing up (BU) before moving up to test the next resistance at $140.

If the price is unable to commit above $130, it will likely retrace to test $125 or $117.

It's hard to find winning stocks at the moment because the market has been volatile. In order to gain an advantage, you must focus on those outperforming stocks that stand out like a sore thumb in this market.

More By This Author:

Will Merck Continue Its Bullish Streak? A Wyckoff Analysis

Would Boeing Continue To Soar Or Crash?

Is Microsoft Giving In To The Bears? A Wyckoff Analysis

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.