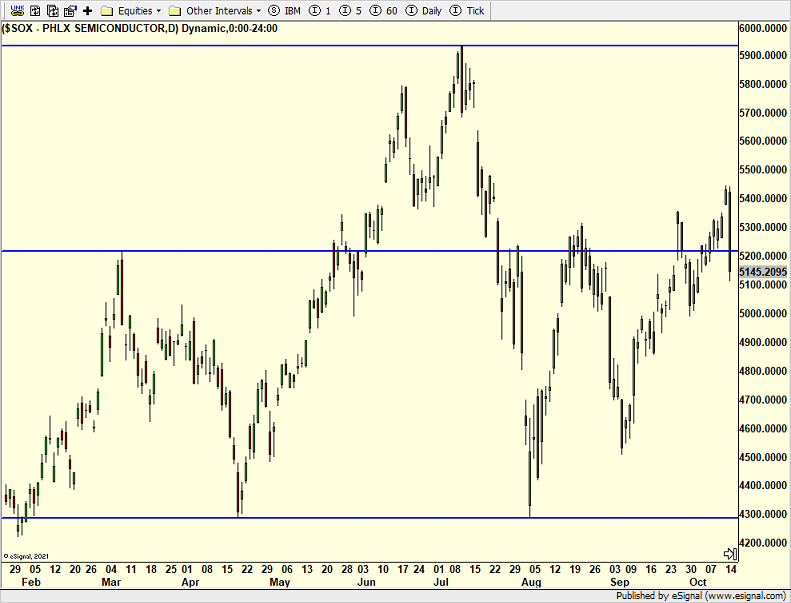

Canary In The Coal Mine – What’s Up With Semis?

The stock market encountered its first real shot across the bow on Tuesday when international semiconductor stock, ASML, surprised with a revenue warning during trading hours. No one needs any training in finance to figure out where the announcement occurred on the chart below. The action was swift and punishing. The question is whether this is idiosyncratic or industry wide.

(Click on image to enlarge)

As many of you know except for a brief period starting with the mini-crash on August 5th, we have shied away from semis as a sector play since early July. First, they melted up which is a yellow flag in our work. Then they reversed sharply on heavy volume which is a red flag for us on the heels of the yellow flag. Then they just lagged.

(Click on image to enlarge)

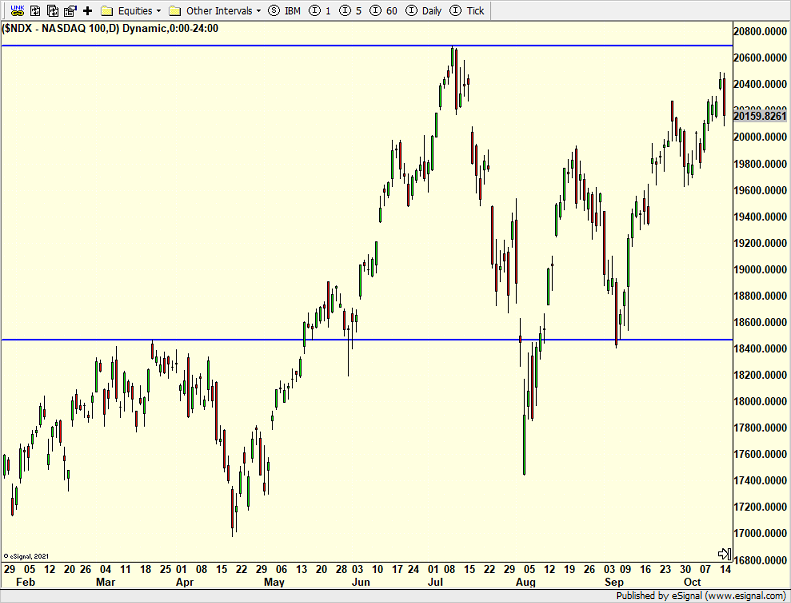

In turn, the Nasdaq 100 went from leading index to lagging index in Q3.

(Click on image to enlarge)

That one single warning from a Dutch company reverberated through the markets and further solidified the “other” stocks leading. You know the ones. I keep mentioning the mid and small caps. People seem to be fighting it, but that is what has been happening.

On Monday we bought SPYB and more TAN. We sold QQQW, some GDX and some RYCIX. On Tuesday we bought PCY, EMB, more GOOG and more AAPL. We sold some QQQW, some SPYB and some RYZAX.

More By This Author:

Small And Mid Cap Stocks Leading

Market Still Poised To Move Higher

Price Poised For Upside – Not All Is Strong

Please see HC's full disclosure here.