Price Poised For Upside – Not All Is Strong

My good friend, Helene Meisler, who is a great read on Twitter noticed last week that the stock market has had a pattern of up, down, up, down for many days. Each day she wrote about it, I thought she was jinxing it and it would end. I think it’s now 11 straight days of this pattern and I am sure it will end today. Why? Because I decided to mention it.

Week two of October has historically been down roughly .0.25%. The market, however, looks like it is set up for a push higher to new highs in the S&P 500 and Dow Industrials. The Nasdaq looks a bit more powerful. With that said the market internals are not good at all. During Tuesday’s big rally, there were only 110 more stocks going up than down. It should have been over 1000.

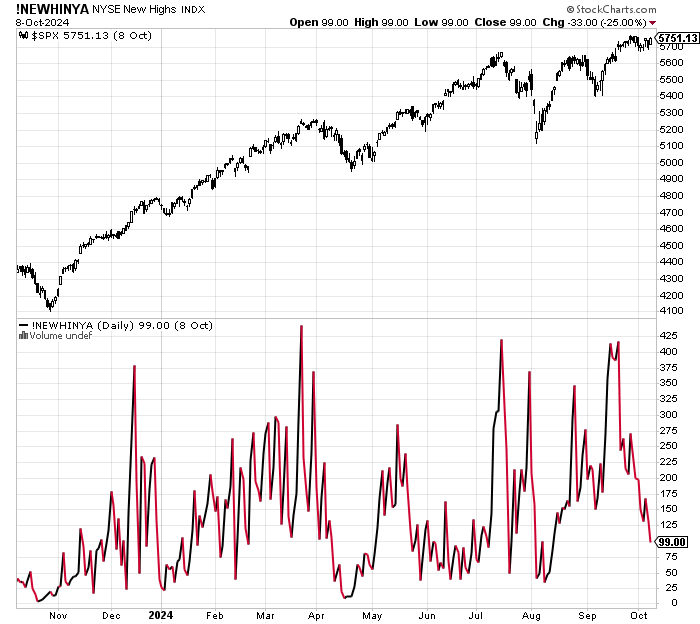

The chart below shows the new highs on the NYSE. That’s not really inspiring and shows some lack of momentum.

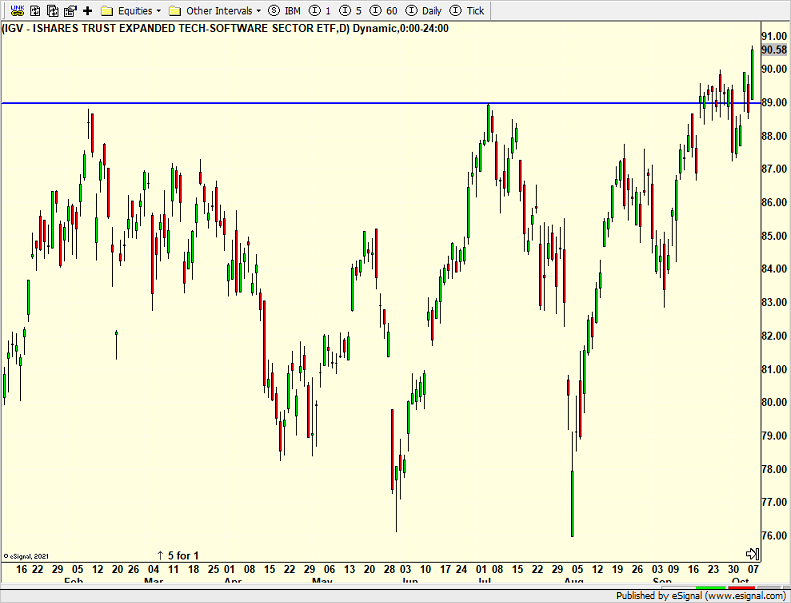

However, an old sector friend which had been left for dead saw a big breakout on Tuesday. That is software which you can see below.

On Tuesday we bought FBND.

More By This Author:

Q4 Setting Up For The Bulls – Buy Weakness

Here Comes Big Bad October

Weakest Week Of The Year Is Here – Fed Wrong

Please see HC's full disclosure here.