Canada Is In No Rush To Make A Long-Term Trade Deal With U.S.

Image Source: Unsplash

While Trump pursues his grand delusion of signing 90 trade deals in 90 days, Canada, the US largest trade partner, seems in no hurry to strike a long-term trade deal. Initially, Trump slapped a series of unilateral tariffs on Canadian imports, only to be met with countervailing tariffs from Canada. President Trump and Prime Minister Carney have communicated several times on trade issues, but nothing has changed since the initial salvos.Let’s look at the where the tariffs are most important to Canada.

The essential US tariffs are:

- 25% on all goods that are not covered by the free trade agreement in North America, Canada-US-Mexico Agreement (CUSMA).

- 10% tariff on energy and potash.

- 25% tariff on all steel and aluminium imports from Canada, subsequently increased to 50% on June 3rd.

- 25% tariff on passenger cars and light trucks from Canada; but parts originating within the CUSMA – compliant vehicles are exempt.

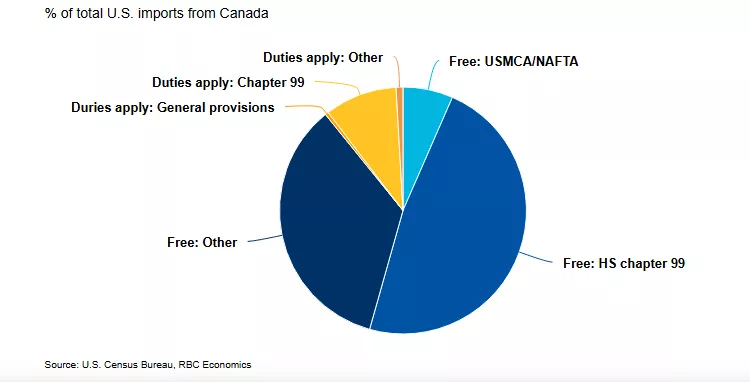

While it is daunting for those industries that have been singled for specific tariff applications, on the whole Canadian exports are largely duty free or subject to relatively small tariffs, such as 10% in the energy sector.

(Click on image to enlarge)

In its latest forecast, RBC stresses that

“The big story doesn’t change that U.S. tariffs at (its highest level since at least the 1930s) are still enough to slow growth, particularly, in trade sensitive sectors like manufacturing that have already reported softening but won’t push the economy into a recession.... Still, the tone of the U.S. administration on prospective trade deals has been broadly positive, and the most severe downside scenarios look less likely than they did in March and April.

Canadians recalled how headlines featured doom and gloom for Canada this past winter when Trump started his trade war with us. That reaction proved to be overdone, especially as the US has backed away from the more severe threats issued at the time.

Even the steel and aluminum industries are able to manage within these high tariffs. Canada is the largest exporter of steel and aluminium products to the U.S. This means that US customers will bear the brunt of the higher tariffs, since there are no readily available cheaper sources internationally nearby. And, the excess capacity within these US industries is not nearly enough to offset the need for Canadian products.

As the accompanying chart indicates, CUSMA provides so many exemptions, that Canada continues to face the lowest tariff rates compared to other nations .RBC reckons that nearly 90% of Canadian exports continues to access the U.S. market duty free. In large measure , RBC upgraded its Canadian GDP forecasts for 2025 and 2026 to reflect the more tame news regarding the impact of tariffs.Any weakness in the current Canadian economy can be traced to traditional business cycle developments such as a pull back in the housing sector and a more cautious consumer in the face of relatively higher interest costs.

PM Carney is correct in slow walking the negotiations on the next phase of Trumpian tariffs.

More By This Author:

The US Government Incompatible Goals: Eliminate Trade Deficits While Running Large Fiscal Deficits

Central Bankers Just Don’t Know Where We Are Headed

The Falling U.S. Dollar Signals The Decline In American Exceptionalism