Can A Stimulus Program Really Boost The U.S. Economy?

Speculation is rife regarding the Trump plans for a huge stimulus program. Government stimulus spending, whether on infrastructure or a reduction in taxes, is predicated on the Keynesian assumption that underutilized resources can be put to work to boost aggregate demand. Economists have long debated the size and extent of the multiplier that one can expect from government capital projects. It is expected that a dollar spent on capital projects--- public works, transportation, and public buildings—will generate more than one dollar in additional output. Moreover, stimulus programs are seen as a way in which to jump-start an economy towards longer-term sustained growth.

Just how effective is a stimulus program in today’s economy?

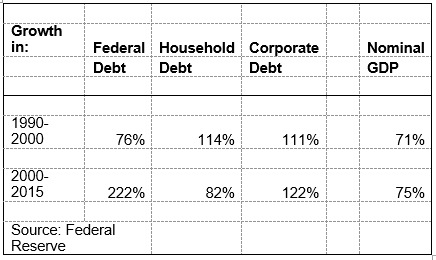

Let’s start out by comparing the growth of debt with the growth in nominal GDP. Debt is a form of capital and economists prefer to measure the additional income resulting from the use of an additional amount of capital---- in this case, how much national income can we expect from an additional dollar of (Federal ) debt ( accompanying table). In the 1990s, the Federal debt increased by 76 percent. During this decade, nominal GDP grew by 71 percent. Overall, the additional amount of Federal debt in line with economic expansion and ,hence debt-to –GDP ratio remained constant .

Over the past 15 years , however, Federal debt has been piling up at the same time that economic growth was slowing. Federal debt expanded three times faster than economic growth. Nominal GDP increased only by 75 percent and the Federal debt jumped by 222 per cent. In addition, the household and corporate sectors added debt faster than the growth in income. Simply put, U.S. was getting less bang for its buck from both the public and private sectors. What made it possible for each sector to assume greater debt, despite its lower contribution to growth, was the debt servicing costs fell dramatically under the zero rate regime of the Federal Reserve. Notwithstanding, the expansion of Federal government debt—let alone household and corporate debt—has proven to have less impact than in prior decades.

The reader will recall that the U.S, adopted a $850 billion stimulus bill in 2009 in response to huge run-up in unemployment following the financial crisis. It is widely agreed that the stimulus package has not created any acceleration in growth. At that time, the unemployment rate was 9 percent and capacity utilization was less than 70 percent. There was lots of room for the economy to expand, yet growth remained tepid. ( In relative terms, the 2009 stimulus program was greater than the one proposed by Trump today.) With this current expansion long in the tooth, we should not expect any rapid increase in output from a new fiscal stimulus.

Summing up, the debt loads have reached new highs relative to GDP at a time when there are diminishing rates of return on capital. These diminishing returns are, to an extent, a function of an economy already in the 7th year of expansion. Consumer demand is slowing and business investment continues to remain subdued. Chairperson Yellen’s admitted that the Fed is baffled as to why business investment and productivity have not been robust enough to lift the economy.

There are powerful headwinds facing the designers of a fiscal stimulus package.

"It is widely agreed that the stimulus package has not created any acceleration in growth."

I think you need to be a little careful of making statements such as this. I don't think there is actually widespread agreement regarding what the economy would have looked like under the actual scenario and a hypothetical scenario where there was no stimulus.

The 2009 stimulus was also largely geared towards tax relief or direct assistance to individuals. It's hard to compare that to the long term (or short term) impact of a direct infrastructure program.

Your point is well taken. The 2009 did have some infrastructure expenditures, but there were so few shovel-ready projects. Today, I have not seen any real evidence that the government has a well-documented list of infrastructure projects, just a lot vague ideas.

Yeah, I can agree with that. Should there be an infrastructure plan, the devil will really be in the details.

Since the Dollar value has been depreciating against the Euro market, I think that the zero rate regime has not produced a favorable outcome. Rather, it allowed for more divergence between debt and capital return. Moreover, in the long run the fixed aggregate supply acts as a sort of anchor for stabilizing the economy.

Considering that in Monetary Policy real interest rate is a function of inflation, increasing the rate will likely lead to higher inflation rates leading to lower output and decreasing unemployment.

Especially since financial central bank stimulus will drop as fiscal stimulus ramps up. The author is right that we are at the end of a very long cycle. If Trump understood economics he probably wouldn't have run because this Presidency will make whoever is elected look like a economic loser.