Buy Dips, Chase Rallies, Lever Up

Image Source: Unsplash

Let me be very clear: the title of today’s piece is NOT investment advice. Instead, it appears to reflect many investors’ mantra. And it’s working out for quite a few of them right now. While I have no access to customer data, I do see a table of the 25 most active names on our platform over the past week, and the activities mentioned in today’s title – buy dips, chase rallies, lever up – are usually reflected in that report.

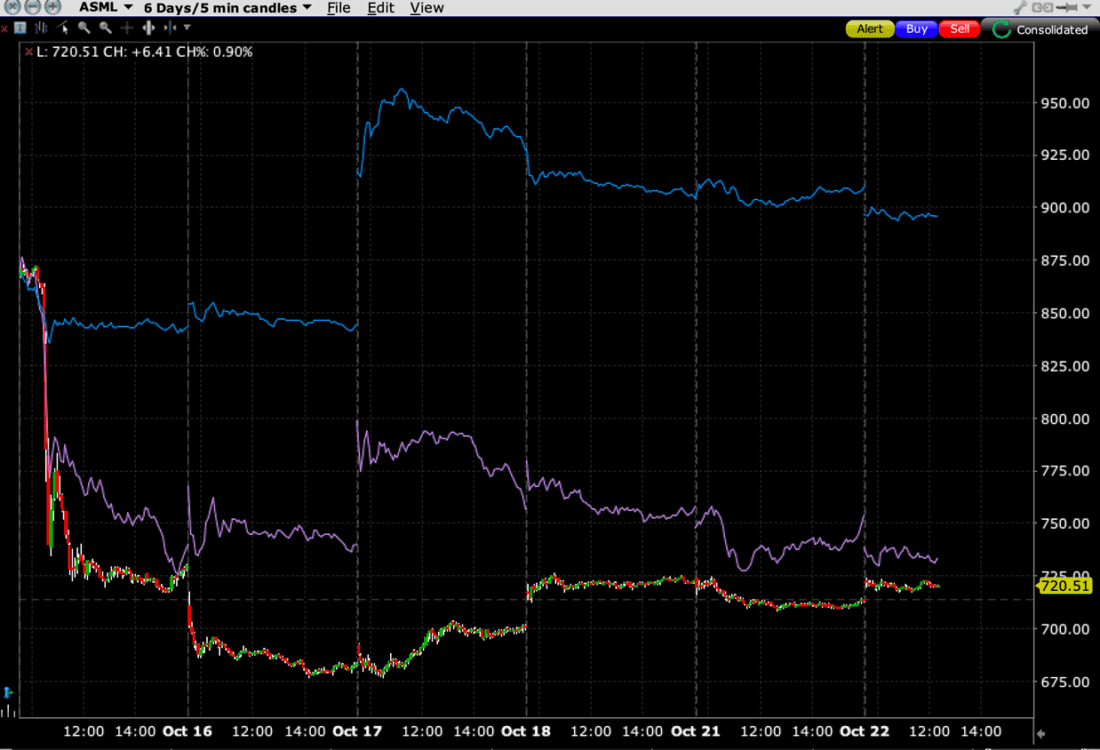

It should be no surprise that Nvidia (NVDA) and Tesla (TSLA) are perpetually the top two names. Over the past year, as NVDA became the market’s bellwether, it surpassed TSLA in both market and mindshare. We’ve written about the dominance of semiconductors in both the market narrative and its returns, and that is certainly the case among our trading activity. Last week was a particularly wild one for the semis. A week ago, ASML plunged after offering poor guidance despite solid quarterly earnings. The following day, Taiwan Semiconductor (TSM) shot up after offering positive guidance. Taken as a whole, investors chose to prefer TSM’s narrative.The chart below shows the recent movements of ASML and TSM plotted against SOXL, a 3X leveraged ETF based on the Philadelphia Semiconductor Index.

6-Day Chart, ASML (red/green bars), TSM (blue), SOXL (purple)

(Click on image to enlarge)

Source: Interactive Brokers

Some of you might be wondering why I chose to portray SOXL rather than SOX. That speaks to the activity that we see on our platform. SOXL was #3, trailing only the aforementioned NVDA and TSLA, while ASML was #5 and TSM was #7.ASML was by far the name with the most net buying activity, nearly double that of SOXL, though TSM only showed marginal net buying.Remember today’s title.The dip in ASML was obviously bought (with some success, depending upon timing), and there was a preference for utilizing a levered product over a standard ETF.

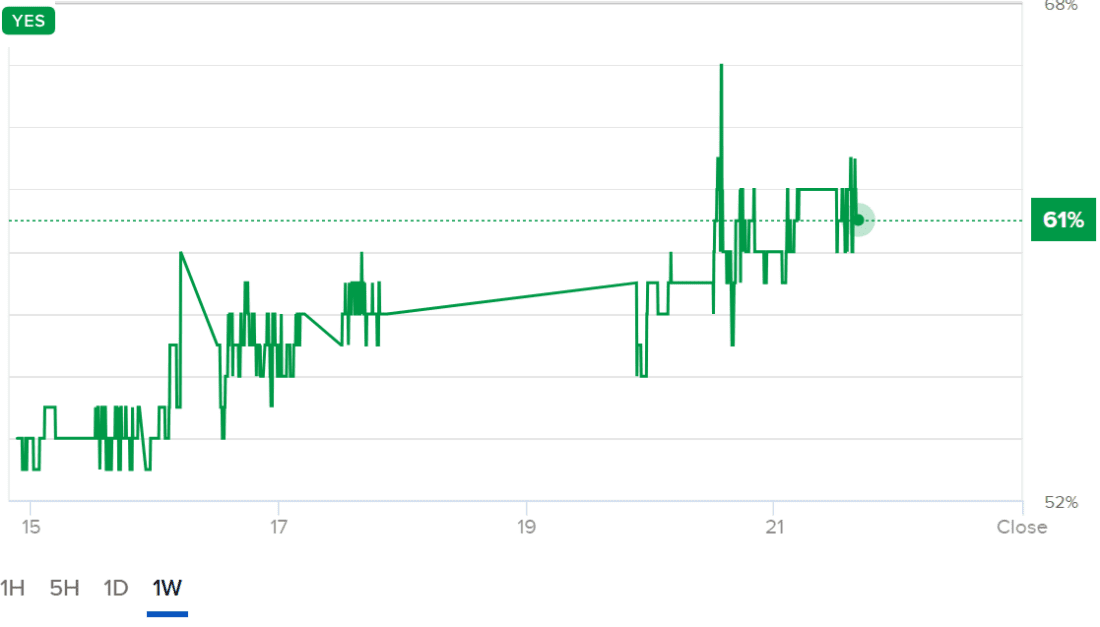

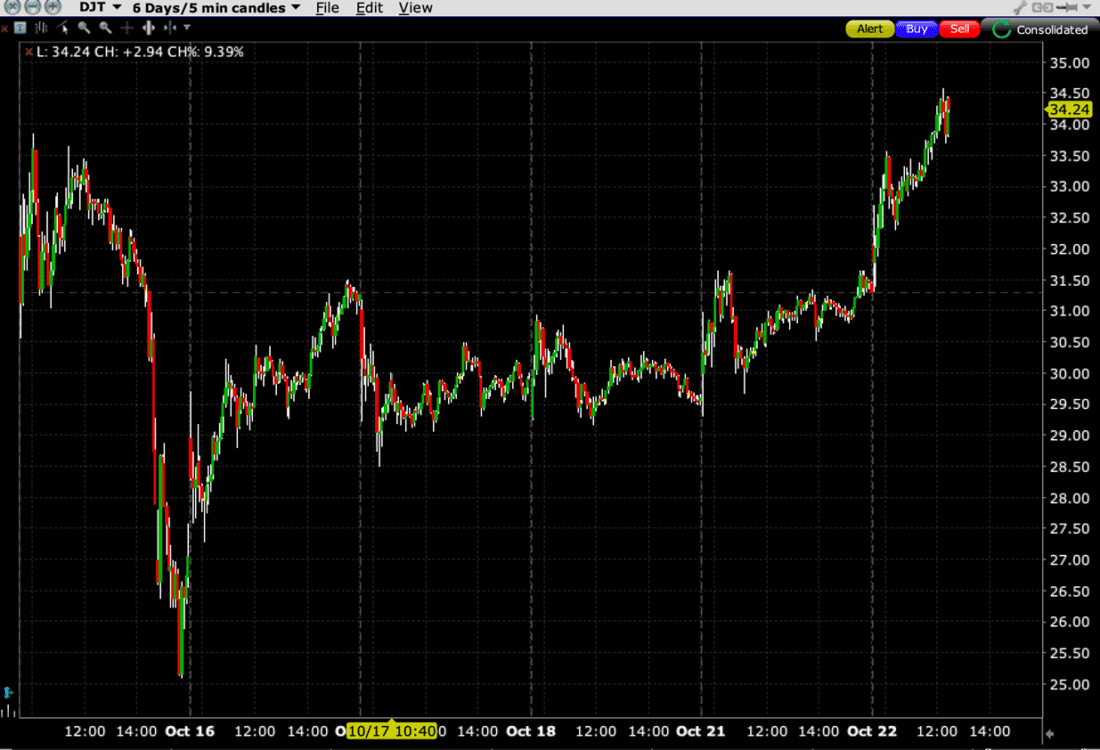

The ultimate leveraged election play, Trump Media & Technology (DJT), moves up to #6.Even as major polls remain largely split, prediction markets have been increasingly favoring the former President’s electoral chances.DJT’s stock moves generally parallel with of its namesake’s pricing on prediction markets, but with much more volatility.Note the comparison below, between the 5-day movement for a “Yes” vote on IBKR ForecastTrader with that of DJT shares.Many traders seem to prefer the more leveraged play.

1-Week Price History of IBKR ForecastTrader “Yes” Vote for “Will Donald Trump win the US Presidential Election in 2024?”

(Click on image to enlarge)

Source: Interactive Brokers

DJT, 6-Days, 5-Minute Candles

(Click on image to enlarge)

Source: Interactive Brokers

Usually, when I peruse the table there is one symbol that I need to look up.This week we have three names that I was unfamiliar with: #8 OKLO, #15 DRUG, and #24 ATNF.

- OKLO Inc. was clearly a beneficiary of the AI-fueled resurgence of nuclear power as this reactor company more than doubled last week. There is an understandable reason for enthusiasm ever since Microsoft’s (MSFT) agreement to buy power from Constellation Energy’s (CEG) Three Mile Island nuclear plant.

- Vancouver-based Bright Minds Biosciences (DRUG) traded with a $1 handle at the start of last week and nearly $80 by Friday.Even the company claimed to be unaware of any material changes last Tuesday to trigger its jump from $2.49 to over $40 that day (yes, one day).The company did a private placement at $21.70 on Thursday, and somehow that triggered a move on Friday to $79.02 before closing at $47.21 that day.This seems totally normal, no?

- With a name like 180 Life Sciences (ATNF), one might expect a biotech company.It went from $1.52 on Monday to a high of $17.75 shortly after the open on Tuesday, powered by an announcement that the company plans to enter the online casino market.Never mind its name, apparently.The stock quickly gave back most of its immediate gains, but it remains about 4X above its prior levels.

I’ll leave it to you to decide whether we’re seeing a bit of froth right now, based on some of these moves. But for many of you, the concept of buying dips, chasing rallies, and adding leverage is working out. It certainly allowed equities to largely ignore a 10 basis point rise in bond yields yesterday. NYSE decliners outpaced advancers 3:1, but the lone positive S&P 500 (SPX) sector that rose was information technology, the group that includes semis.A new high in NVDA couldn’t push SPX into positive territory, but it minimized its losses. Surfing the wave is working for many. Hopefully it doesn’t result in a treacherous wipeout.

More By This Author:

As Go The Semis, So Go The Markets

Guidance, Not Current EPS, Is the Key This Season

Some Necessary Long-Term Perspective

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx ...

more