Buckle Up For A Big Earnings Week

Image Source: Pexels

Enjoy the relative calm today, because we have a very busy week ahead. Five of the so-called “Magnificent Seven” stocks report over the course of this week (Alphabet (GOOG, GOOGL) on the 29th, Meta Platforms (META) and Microsoft (MSFT) on the 30th, and Apple (AAPL) and Amazon (AMZN) on the 31st[i]), while we also receive key economic reports on Thursday and Friday (the GDP and Payrolls reports, respectively). That’s quite a bit for markets to digest.

It is important to remember the weights of the reporting stocks in key indices.They have the five biggest weights in the S&P 500 (SPX)[ii], summing to over 20%. Because the Nasdaq 100 (NDX) uses a modified market cap weighting, Broadcom (AVGO) sneaks into 5th place, but when we sum the five stocks plus “Mag 7”-adjacent AMD (also reporting on the 29th), we arrive at about one-third of that index. No matter how we view it, these are all potentially market-movers. That said, if we get divergent results, the index effects can indeed be muted. Suppose META goes up while MSFT goes down by a similar amount (or vice versa) – the combined effect on the indices will be virtually nil.

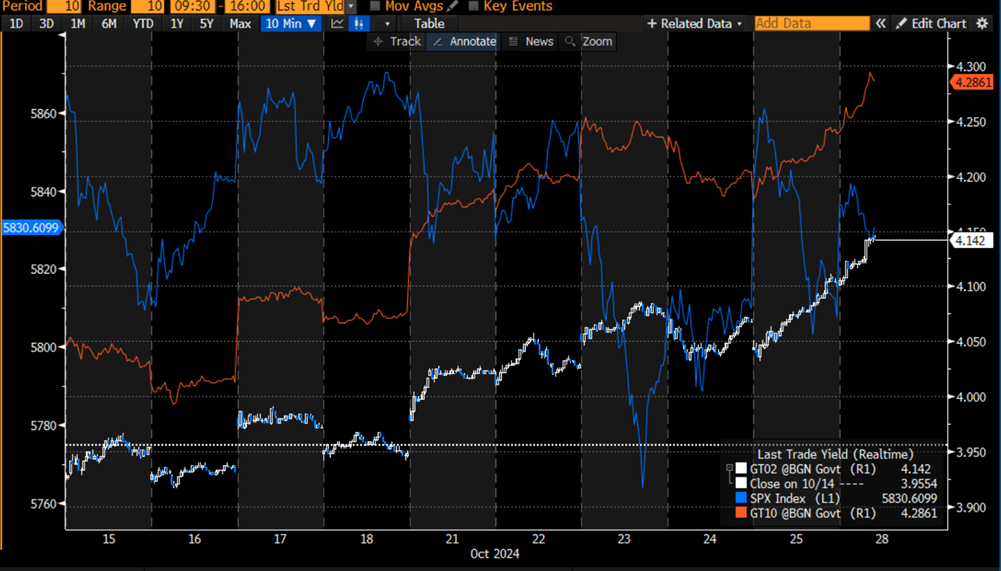

The same can’t easily be said for the economic reports. A significant surprise in either the GDP or Payrolls report would have a profound impact on bonds as well as stocks – and the bond market appears more fragile than the equity area. Over the past two weeks we have seen SPX meander around all-time high levels even as 2- and 10-year Treasury yields rose about 20 basis points, a very significant jump in a short period of time.

10 days, 2-Year (white, right scale), and 10-Year (red, right scale) Yields vs. SPX (blue, left scale)

(Click on image to enlarge)

Source: Bloomberg

Yields have a sometimes-elusive relationship with stock prices.In theory, higher yields depress the present value of a company’s earnings and cash flows, reducing its current stock price.In practice, however, that is infrequently the case, at least in the short term. Also, it depends on why the rates are rising.If they are increasing because of perceived economic strength, that should indeed be positive for stock prices because that boosts prospects for corporate earnings. Unfortunately, with the election just a week away, it is difficult to disentangle concerns about rising deficits from pure economics. Furthermore, some of the geopolitical “flight to safety” premium may have ebbed today along with the $4 drop in crude oil after Israel’s targeted attack spared Iran’s oil facilities.

The economic picture seems quite solid, with consensus estimates for a rise in Q3 GDP to 3.0%. The Atlanta Fed’s GDPNow is currently even higher, at 3.3%, and the IBKR ForecastTrader shows a 71% likelihood of the report being above 2.6%.The Core PCE Price Index, akin to the Fed’s preferred Core PCE Deflator, is expected to rise by 0.3% on a monthly basis.These may not be friendly for those hoping for aggressive rate cuts, but they are not dealbreakers for stock investors.

As for October Nonfarm Payrolls, the consensus is for a rise of 110k, down from September’s 254k, while the Unemployment Rate is expected to remain at 4.1%. Even with the potential for a big drop in payrolls, those combine for a relatively healthy labor market. Those trading on the ForecastTrader are more optimistic on payrolls, with 64% expecting a report higher than 129,000, and around consensus on unemployment, with 53% expecting more than 4.1%.

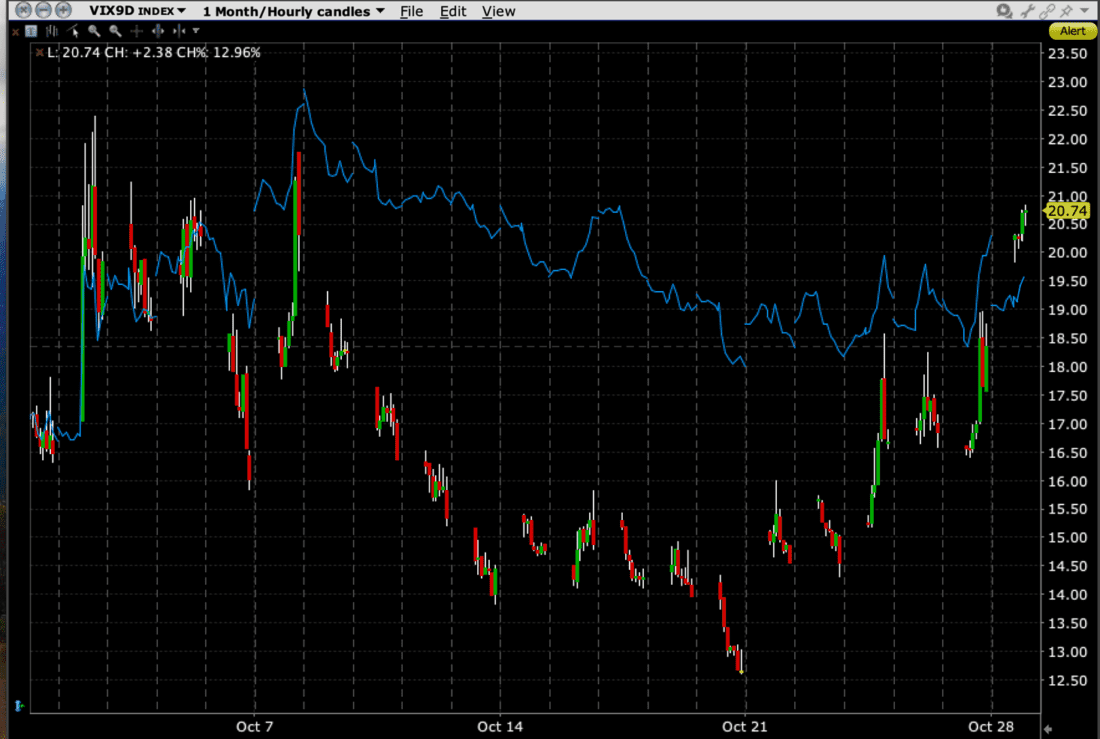

Finally, a good way to track the equity market’s expectations for short-term volatility is the VIX9D index. The calculation similar to VIX, but instead of using SPX options with about 30 days to expiry, this uses options with about 9 days left. We see that index increasing toward recent highs even as “big brother” VIX is unimpressed.

1-Month, VIX9D (red/green hourly candles), vs VIX (blue line)

(Click on image to enlarge)

Source: Interactive Brokers

[i] Nvidia (NVDA) is expected to report around November 21st, and of course Tesla (TSLA) reported last week.

[ii] Berkshire Hathaway (BRK-B) has a higher weight than either class of Alphabet, but the combination of GOOG and GOOGL outweighs Mr. Buffett’s company.

More By This Author:

What The Options Market Is Expecting For Tesla Earnings

Buy Dips, Chase Rallies, Lever Up

As Go The Semis, So Go The Markets

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more