Blackrock Vs Blackstone: Which Is A Better Stock To Buy?

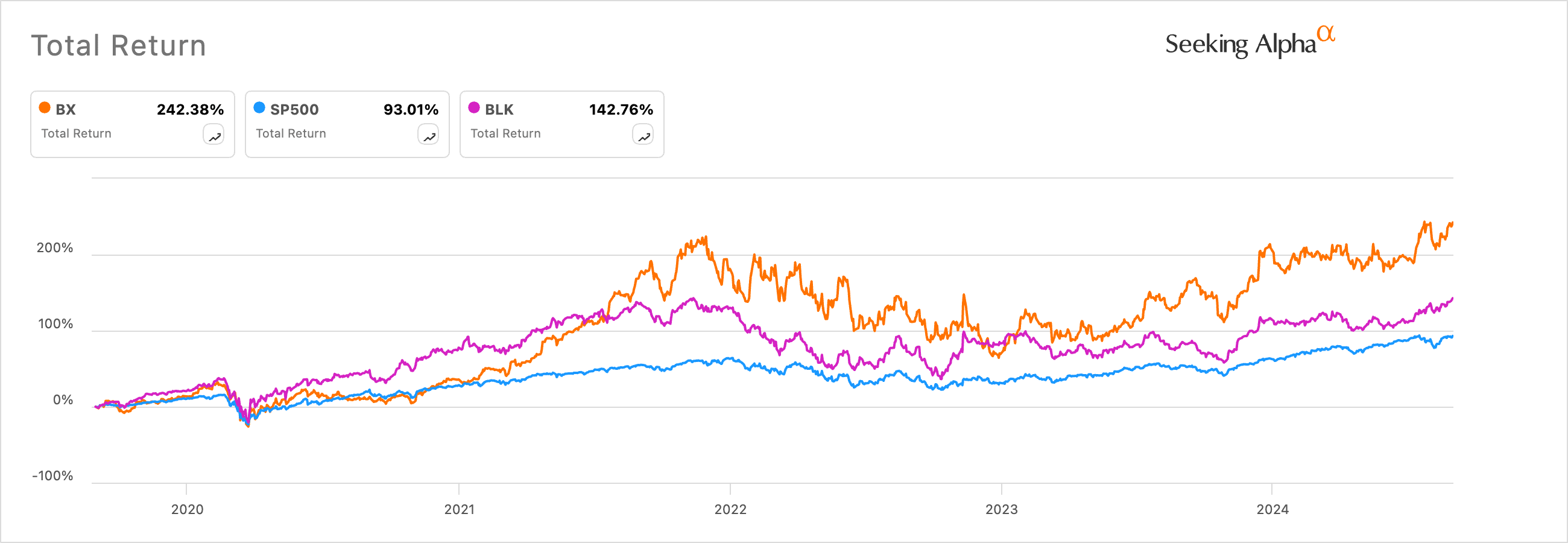

Blackrock (BLK) and Blackstone (BX) stocks have rewarded their investors well for decades as they continued becoming dominant players in their respective industries. BX’s total return in the last five years stood at over 242% while BLK’s return came in at 142%. The S&P 500 index has risen by over 93% in the same period.

Dominant players in their industries

Blackrock and Blackstone have become dominant players in the industry. Over the years, Blackstone has become the biggest player in the private equity industry with over $1 trillion in assets under management. Its assets are spread across key areas like real estate, credit and insurance, hedge fund solutions, and private equity, Blackstone, on the other hand, is the biggest asset manager in the world with over $10.6 trillion in assets. Its assets are spread across key industries like equity, fixed income, multi-asset, and alternatives.

The company has also become a key player in the financial tech industry, where it provides a platform known as Aladdin, which is used by some of the biggest asset managers and investment banks globally.

Aladdin, which stands for Asset, Liability, Debt, and Derivative Investment Network, is used by these firms to help them manage risks, construct portfolios, and execute trades. Blackrock also expanded its software solutions by acquiring Prequin, a company that aggregates investments globally. To a large extent, Blackrock became the giant it is today by acquiring iShares from Barclays at the height of the Global Financial Crisis. Today, iShares holds over $3 trillion in assets and is growing fast. For example, the iShares Bitcoin ETF (IBIT) has over $21 billion in assets this year.

Blackrock and Blackstone have a similar background. Stephen Schwarzman and Pete Peterson started Blackstone in 1985, with Larry Fink being an employee. Larry Fink and a small team then left Blackstone and started Blackrock in 1985.

BX and BLK have different strategies

Blackrock and Blackstone have different strategies, which explains why they have different market caps and revenue figures. While Blackrock has more assets, it has a market cap of over $133 billion while Blackstone has $173 billion.

Blackstone generated over $7.6 billion in annual revenue in 2023 while Blackrock had over $17.85 billion. The two had net profits of over $1.39 billion and $5.5 billion, respectively.

Blackrock’s recent results showed that its revenue rose by 8% to $4.80 billion while its net income was $1.5 billion. Blackstone’s revenue rose to over $2.8 billion while its net income was over $1.2 billion.

These companies have different approaches. Blackrock makes lower fees, especially on its ETF business. For example, the iShares Core S&P 500 ETF, which has over $521 billion in assets, has an expense ratio of 0.03%, meaning that it makes about $162 million in annual fees.

Blackstone, on the other hand, makes its money by charging an administrative fee, often between 1% to 2% and then a performance fee, often about 20%. Therefore, in good times, the company tends to make more money.

Better buy between Blackrock and Blackstone?

Blackstone and Blackrock will likely generate strong results in the future as their assets continue growing. They are significantly ahead of their rivals. For example, Brookfield, the second-biggest player in the private equity industry, has under $900 billion in assets while Vanguard has $8.6 trillion in assets.

Therefore, investing in the two companies will likely generate positive returns in the next decades. For stability, I think that Blackrock is a better investment because it seems quite undervalued.

However, based on historical performance, Blackstone stock may continue doing better than Blackrock in the long term.

More By This Author:

Apple Stock Price Analysis: Can It's Valuation Be Justified?

JP Morgan Stock: Fortress Balance Sheet, One Way To Bet On The USA

JD.com Stock Analysis: JD Might Be A Big Bargain

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more