JD.com Stock Analysis: JD Might Be A Big Bargain

Chinese companies trading in the United States often trade at a big discount because of the ongoing geopolitical tensions, which will likely escalate if Donald Trump wins the presidency.

JD.com (JD) stock has retreated sharply in the last few years. After peaking at $106.09 in 2021, the stock retreated to $27, lowering its market cap from over $143.53 billion to below $39 billion.

The sell-off escalated this month after Walmart started selling its stake in the company worth over $3.6 billion and after the company published relatively weak financial results.

JD.com earnings

The most recent JD.com earnings showed that the company’s business was slowing down, which is understandable because of the elevated competition and weakening economy.

Recent data showed that China’s retail sales and industrial production has retreated while there are concerns about whether the country will hit its 5% growth target.

At the same time, competition with companies like Alibaba and Pinduoduo has intensified in the past few years.

The most recent results showed that the company’s revenue came in at over 291.3 billion RMB in the last quarter, a small increase from the RMB 287 billion it made in the same period last year. Its income from operations rose from over RMB 8.7 billion to over RMB 11.60 billion.

Analysts believe that JD.com’s best days of double-digit revenue growth are over because the Chinese e-commerce industry has now matured.

This is notable for JD because, unlike its top competitors, it has not invested widely in external markets. Instead, the company has mostly focused its operations in Mainland China and a few other Southeast Asian countries.

JD.com is not the only Chinese e-commerce company that is seeing slow growth. Alibaba’s recent results showed that its revenue rose from $32 billion to $33.4 billion. In the past, this was a company that was used to generating double-digit growth, helped by its e-commerce and cloud businesses.

The only company that is seeing robust growth is PDD Holdings whose revenue rose from over $7.2 billion to $13.35 billion. Its net income jumped from $1.86 billion to $4.4 billion.

However, a key concern for PDD is that most of its growth is coming from Temu, a company that faces significant risks, as I have written before.

JD is a cheap stock

JD.com’s stock slide has left it a significantly cheap company. Its market cap stands at about $38 billion and the company recently launched a $5 billion share repurchase program, or about 12% of its value.

Share repurchases boost companies’ valuations by increasing the earnings per share since their profits are distributed to fewer shareholders.

Now, looking at its balance sheet, we see that JD.com has over $11.6 billion in cash and equivalents and $16.15 billion in short-term investments, making it a total of $27.78 billion.

On top of this, it has over $1 billion in restricted cash and $9.7 billion in inventory. Its total current assets are $44.3 billion against current liabilities of $38 billion.

Looking at the other side, it has no short-term debt and just $7.8 billion in long-term debt, meaning that it can easily use its cash to clear the debt and be left with over $20 billion in cash.

Therefore, JD.com’s enterprise value stands at $31.9 billion against a market cap of $38 billion. This means that investors are not placing a big value on its business. While the company’s revenue is not growing, it is still making over $4 billion in annual profits.

In very simple terms, if you bought JD.com for $38 billion, you would be receiving over $20 billion in cash. You would also spend less than 10 years to pay yourself back.

To be clear: there is a reason why JD is a bargain. It is a Chinese company and investors often take its statements with a grain of salt. Also, if Trump wins, there is a likelihood that he will implement huge tariffs, leading to a return of the trade war. If tensions escalate, JD.com may be forced to delist from the US.

JD.com stock price analysis

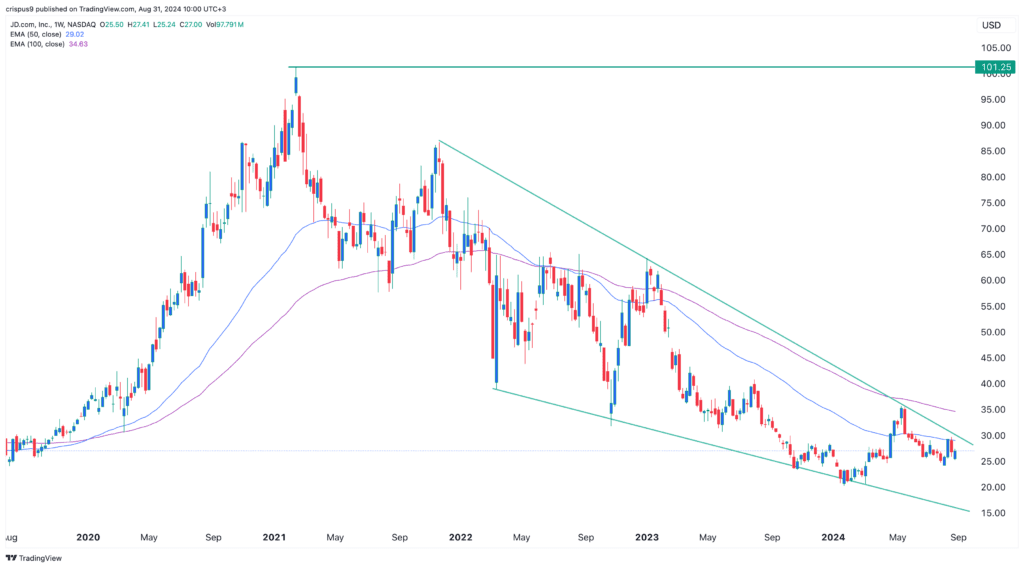

Turning to the weekly chart, we see that the JD share price peaked just above $106 and has dropped to about $27. It has dropped below the 50-day and 100-day moving averages, meaning that bears are in control.

Most recently, the stock has formed a falling wedge chart pattern, which often leads to more upside. This upside will take time since the wedge has more room to reach its confluence level.

If this happens, the JD share price stock may stage a comeback and rise to over $50 in the long term.

More By This Author:

EUR/USD Forecast: Signal Ahead Of August NFP Jobs Data

Asia-Pacific Markets Rise As US Economic Data Eases Recession Fears

Intel CEO Pat Gelsinger Addresses Investor Concerns Amid Stock Plunge

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more