EUR/USD Forecast: Signal Ahead Of August NFP Jobs Data

The EUR/USD exchange rate has suffered a harsh reversal in the past few days as investors focus on the upcoming US non-farm payrolls (NFP) data. The pair retreated to a low of 1.1055, down from this month’s high of 1.1200.

European economic data

The EUR/USD pair retreated after the latest European economic data. A report by the German statistics agency showed that the country’s import price index retreated in August, raising concerns about the economy.

The index dropped by 0.4% in July after growing by 0.4% in the previous month, missing the estimated 0.1%. This slowdown translated to a YoY increase of 0.9%, lower than the expected 1.5%.

Another report from Germany revealed that the German unemployment rate remained at 6.0% in August.

Meanwhile, Europe’s inflation retreated to its lowest point in over 2 years in August. The flash CPI fell from 2.6% in July to 2.2% in August while the core CPI fell from 2.9% to 2.8%.

These numbers mean that the European Central Bank will likely continue cutting interest rates in the next few meetings. In a note, analysts at ING said:

“For the ECB, the modest progress in core inflation and wages now and expectations for next year seem enough to cut by 25bps in September. But this remains a slow and gradual process of releasing the brakes on the economy as the ECB continues to be concerned about upside risks to the inflation outlook.”

US nonfarm payrolls data ahead

The most important catalyst for the EUR/USD exchange rate will be next week’s US jobs numbers, which will provide more information about the next rate cut.

The Fed has already hinted that it will cut interest rates in the next meeting. What is unclear, however, is the size of the next rate cut and the NFP data will confirm that.

Data by Investing.com shows that analysts expect the numbers to reveal that the US unemployment rate improved from 4.3% in July to 4.2% in August.

They also expect the report to show that the non-farm payrolls (NFP) increased from 114k in July to over 163k in August while the average hourly earnings improved from 0.2% to 0.3%.

Weak jobs numbers will push the Fed to deliver a jumbo 0.50% rate cut in the next meeting while strong ones will have it cut by 0.25%.

These numbers will come after the Bureau of Labor Statistics (BLS) published the revised estimates of the last US NFP data for the 12 months to March this year. The data revealed that the payrolls were fewer by 818,000 than the official ones, meaning that the labor market is softer than expected.

The EUR/USD pair will likely react mildly to Friday’s Personal Consumption Expenditure (PCE) report because the Fed is now fully focused on the labor market. The most recent Consumer Price Index (CPI) dropped from 3.2% in June to 2.9% in July.

EUR/USD technical analysis

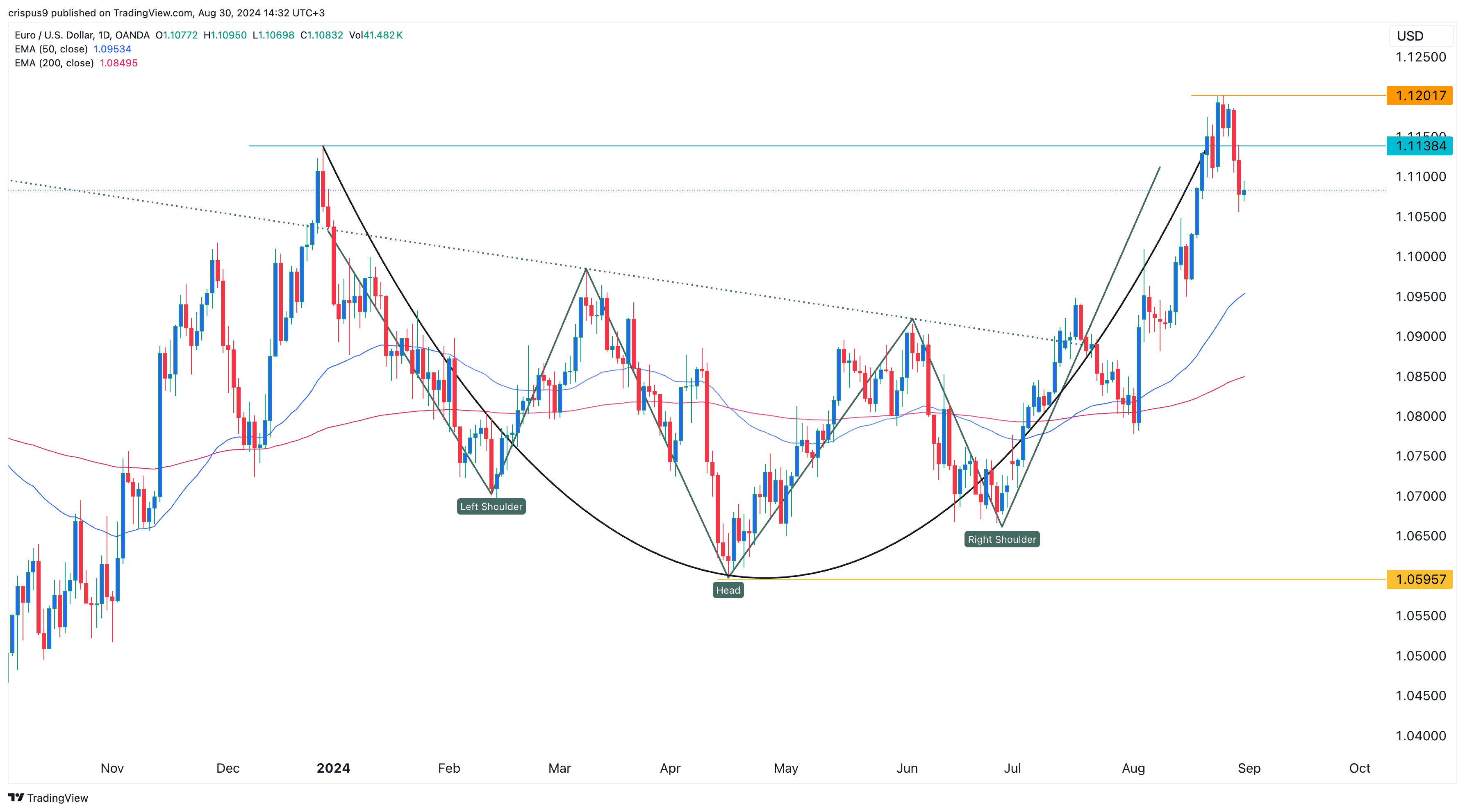

(Click on image to enlarge)

EUR/USD chart by TradingView

The daily chart shows that the EUR/USD pair bottomed at 1.0595 in April and then staged a strong comeback after the Fed pointed to rate cuts and peaked at 1.1200 this week.

While the ECB is also cutting, the actions of the Fed tends to more notable because of its role in the economy.

The pair formed an inverse head and shoulders pattern, which has worked well in the past few weeks. Most importantly, it has formed a cup and handle pattern, which is a popular sign of a continuation. The current retreat is part of the handle section.

The pair has remained above the 50-day and 200-day Exponential Moving Averages (EMA), which formed a golden cross in July.

Therefore, the outlook is bullish, with the next point to watch being at 1.1200. A break above that point will see it retest the resistance at 1.1300.

More By This Author:

Asia-Pacific Markets Rise As US Economic Data Eases Recession FearsIntel CEO Pat Gelsinger Addresses Investor Concerns Amid Stock Plunge

Lulu Stock: Apparel Maker Lowers Annual Sales Forecasts Following Disappointing Product Launch

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more