Biggest Risks To The Market?

A bubble in AI has been discussed over and over again across financial media over the last year or so as that area of the market saw outsized gains. But is froth in the AI trade really the biggest concern among investors heading into 2026, or are there other issues that are just as worrisome?

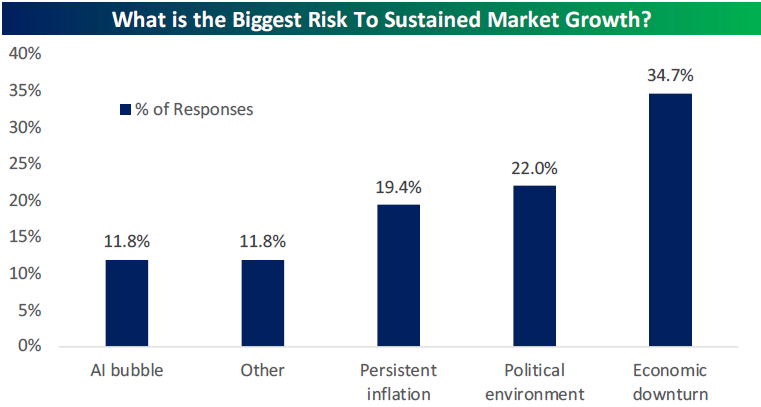

In a survey of investors (using Bespoke's large client base) at the end of 2025, we asked participants what the biggest risk is to sustained market growth in 2026 and beyond. As shown in the chart below, an "AI bubble" actually ranked as the least concerning issue of the various options provided. The answer that received the most votes at 34.7% was actually an "economic downturn," followed by the "political environment" at 22% and "persistent inflation" at 19.4%. "Other" received 11.8% of the vote, which was the same response rate that an "AI bubble" received.

(Click on image to enlarge)

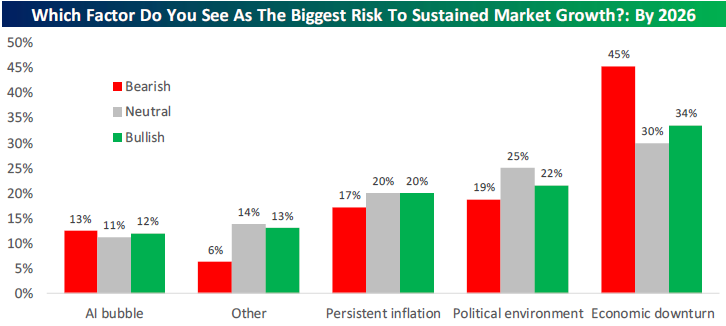

Below we've broken out the response rates to our question on the biggest risk to sustained market growth by whether the survey participant is bullish or bearish on the stock market in 2026.

Notably, those that are bearish on the market were even more concerned about an economic downturn at 45%.

Just this week we've gotten a number of releases on the US trade balance and productivity that caused the Atlanta Fed's GDPNow reading to pop up to 5.1% for Q4 2025. If this trend continues, worries about an economic downturn are likely to subside, which could cause bears to decide to increase their risk exposure. This would likely translate into higher share prices and potentially a broadening of the bull market into areas that aren't solely based on the AI trade.

(Click on image to enlarge)

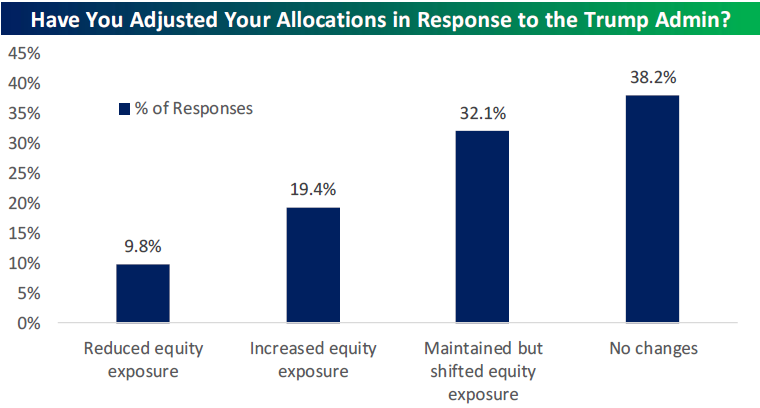

Another question we asked investors in our 2026 survey is how they have adjusted their equity allocations in response to the Trump Administration. We always urge investors to not let their politics impact their investment decisions, because historically, it would have been very unwise to try and jump in and out of the market based on who controls the White House or Congress. However, of course there are investors out there that have either gotten out of the market or increased exposure because of their opinions about President Trump.

What we found, though, is that while most investors have either made no changes or merely maintained but shifted equity exposure due to the Trump Administration, a considerably higher percentage (19.4%) said that they've increased equity exposure than those that said they've reduced exposure (9.8%). This suggests to us that regardless of whether you like Trump or not, the admin should remain a tailwind rather than a headwind for the market at least for another year or so. Again, jumping in or out of the market based on who's President is not recommended.

(Click on image to enlarge)

More By This Author:

Trillion Dollar Market Cap Changing Of The Guard

U.S. Market Cap Loses Ground

Fed Credibility And Powell's Performance

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more