Fed Credibility And Powell's Performance

Image source: Wikipedia

The Federal Reserve has been front and center in investors’ minds for a few years now, and President Trump’s open call for Chair Powell to resign (or be fired) hasn’t helped. We don’t think the Fed helps its cause, though, with so much “Fedspeak” all the time.

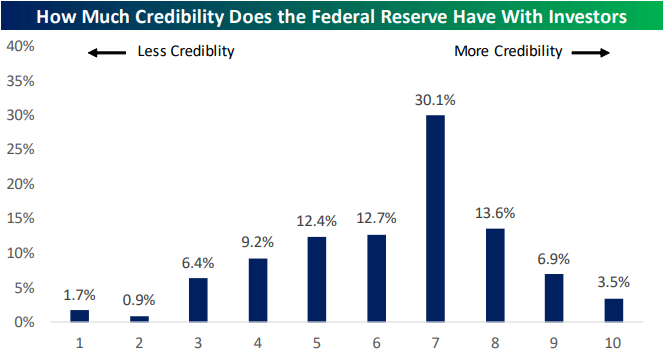

In our 2026 Investor Survey, we asked respondents to rate how much credibility the Fed has with investors on a scale of one to ten with one being no credibility and ten being full credibility.

As shown below, investors still think the Fed has more credibility than not. On a scale of one to ten, seven was the highest response rate at 30.1%, while less than 10% of respondents rated Fed credibility a three or less.

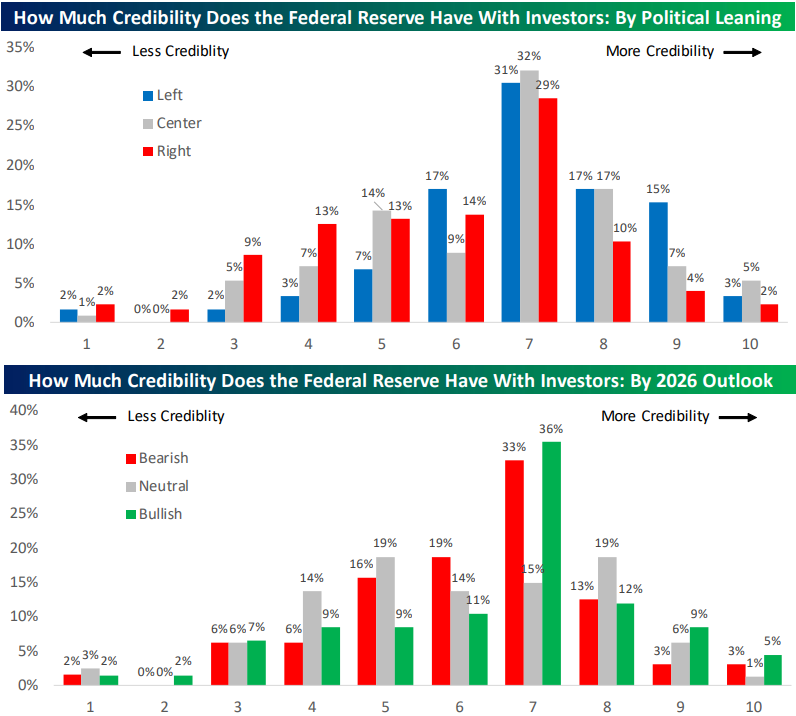

Those that lean left in our survey think the Fed has more credibility than those that lean right, but there's not too big of a difference by political leaning either way.

Those that are more bearish on markets in 2026 rated the Fed slightly less credible than those that are bullish, although again, the differences are small.

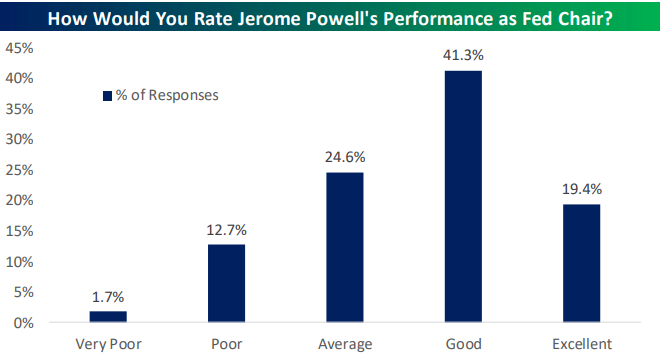

When it comes to Fed Chair Powell specifically, 60.7% of investors rate him as a Good or Excellent Fed Chair, while 24.6% say he’s been average, and just 14.4% rated him as Poor or Very Poor.

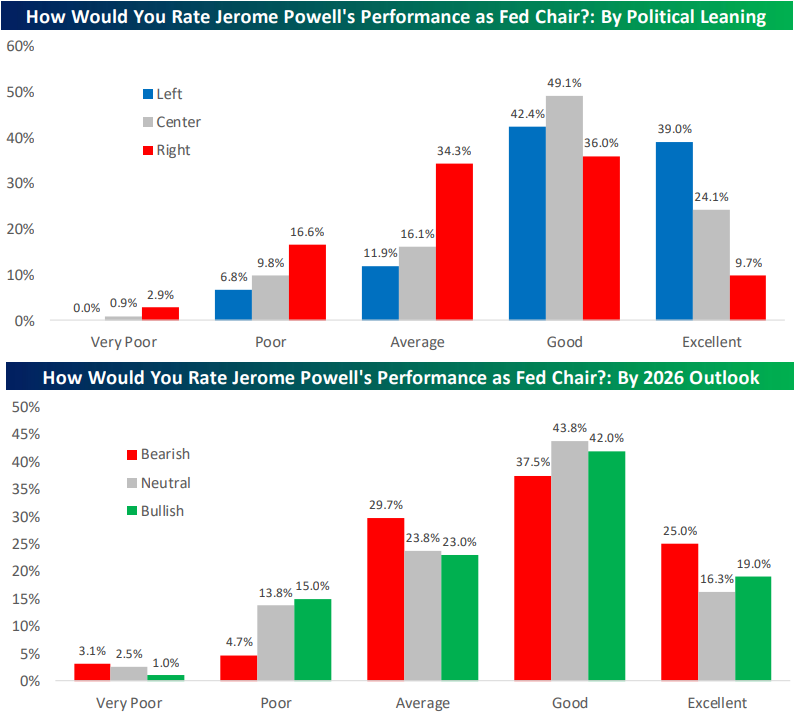

Those who lean left are much more likely to rate Powell as “Excellent” than those who lean right, while investor opinions on the stock market in 2026 had little impact on their views of Powell.

While a small minority views Powell and the Fed as captured or no longer having credibility, our survey results show that investors generally think the Fed is doing fine and as not anything to be too concerned about as it relates to market performance.

More By This Author:

Buffett Exits Stage LeftHow This Year Stacks Up

Whose Bubble Is It Anyway?

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more