Back To Overbought

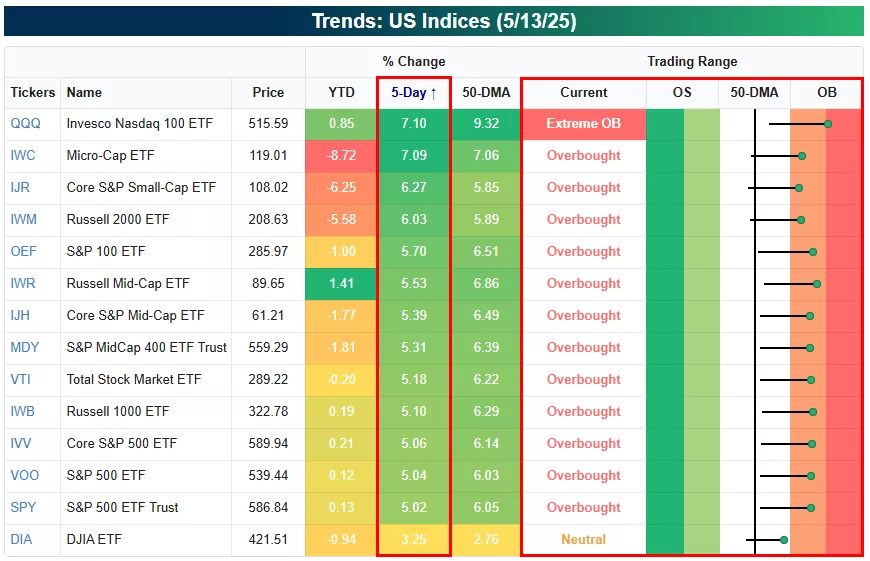

After trading at some of the most extreme oversold levels we've seen in years back in April during the tariff crash, major US index ETFs have all moved in lock-step up into overbought territory with the exception of the Dow 30, which has been weighed down by a 48% drawdown in UnitedHealth (UNH) since April 11th.

The Nasdaq 100 (QQQ) is the only one that's at "extreme overbought" levels, which means it's more than two standard deviations above its 50-DMA.Even the micro-cap ETF (IWC) has rallied more than 7% over the last week.

(Click on image to enlarge)

Heading into today, there were nine stocks in the Dow 30 that were up 9% or more over the last week.The list of large-cap blue chips was led by a huge 20.8% gain in shares of Disney (DIS) and 14%+ gains for NVIDIA (NVDA) and Amazon (AMZN).

(Click on image to enlarge)

_638828538272312149.webp)

We highlighted the very low percentage of stocks above their 50-day moving averages when it got down to extreme levels back in April, and now we're seeing extremes on the upside for a few sectors.As shown below, more than 90% of stocks in the Technology and Industrials sectors were above their 50-DMAs heading into today. In today's Chart of the Day sent to members, we looked at how the Tech sector has historically done in the weeks and months after prior extreme readings for this breadth indicator.It's an interesting analysis.

_638828538836571984.webp)

More By This Author:

No Slowdown In "AI"

Getting Back To Even

Records In Richmond

You can monitor these overbought and oversold levels across a large universe of US stocks and ETFs by using our Trend Analyzer tool available to more