Getting Back To Even

Image Source: Unsplash

It's been exactly a month since "Liberation Day" on April 2nd when President Trump announced massive reciprocal tariffs on the rest of the world. At its intraday low on April 8th, the S&P 500 ETF (SPY) was down 14.7% from its closing level on April 2nd. Since that low, SPY has now rallied 17.4%, and as of this morning, SPY has fully recovered all of its post-Liberation Day declines.

Below is a look at the performance of key index and sector ETFs since the close on Liberation Day (4/2). Technology (XLK) is now the best performing sector since 4/2 with a gain of 2.9%, followed by the Nasdaq 100 (QQQ), Semis (SMH), and Industrials (XLI). On the downside, the Energy sector (XLE) has been by far the biggest laggard with a decline of 12.7%.

We'd note that even though the stock market has fully recovered its post-Liberation Day drop, investor sentiment remains extremely bearish. This week marked a record 10th consecutive week where AAII Bearish Sentiment was above 50%. The prior record was seven straight weeks back in 1990. Will the bulls finally re-emerge next week? We won't find out until next Thursday when the weekly AAII numbers get posted.

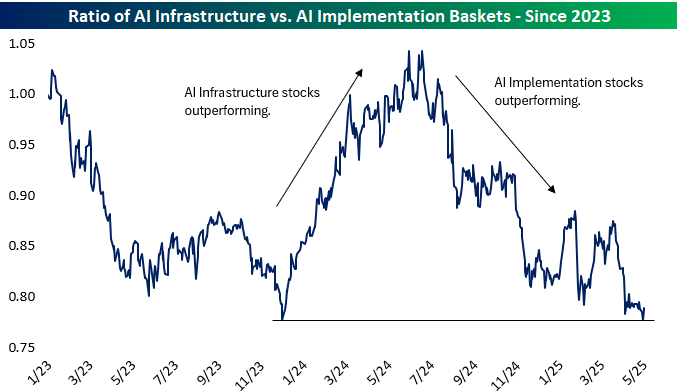

Back in early 2023, we created the Bespoke AI Basket to track key stocks in the space. We broke the basket into two sub-groups: one for AI Infrastructure stocks and one for AI Implementation stocks. The AI Infrastructure basket contains stocks that power the AI Boom like NVIDIA (NVDA), while the AI Implementation basket contains stocks like Meta (META) that are implementing AI to boost the user experience and increase margins and productivity.

As shown below, the AI Implementation basket has outperformed the AI Infrastructure basket since the end of 2022 by quite a wide margin.

There have been periods of significant out- and underperformance for each basket, however. Below is a look at the ratio between the AI Infrastructure and AI Implementation baskets. When the line is rising, AI Infrastructure is outperforming, and vice versa.

The first half of 2024 saw AI Infrastructure outperform quite dramatically, but since mid-2024 for about the last year now, AI Implementation stocks have been outperforming. Are we now due for a reversal that sees AI Infrastructure start to bounce again?

More By This Author:

Records In RichmondWorst Start To A Presidency Ever For U.S. Stocks

Picking Up Where Last Week Left Off

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more