Are Central Banks About To Shift Gears Towards Easing?

In rather short order, monetary policy debates took a sharp U-turn last week as the Fed committed to a “patient” approach towards rate hikes and openness to slow down the speed with which it reduces its balance sheet. Is the Fed prepared to move to the sidelines or is it going so far as to shift gears entirely and pivot towards the beginning of an easing cycle? The close of bond trading at the end of last week holds some clues as what we may expect from the Fed and from the Bank of Canada in the next six months or more.

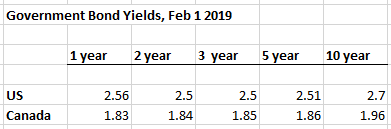

Yields on the US two- and five-year notes ended the week at 2.5% which is the upper band of the current Fed funds rate. The strong US jobs report did not dissuade bondholders from their view that growth remains tepid and inflation is well contained within the 2% target, especially given that wage growth last month actually moderated slightly from the prior month. Canadian yields for similar term periods closed at 1.8%, virtually at the same level as the Bank of Canada’s benchmark overnight bank rate. Both bond markets are confident that their respective central banks are done with regards to the recent tightening cycle. And, when extending the analysis to the long end of the curve, the premium required for the 10-year bond is just 20 bps for USTs and 10bps for Canadas. In essence, the yield curve has flattened from one -year onwards.

The bankers shifted course for very compelling reasons. For the past couple of months, investors have been hit with a barrage of weak data from China, additional weakness in the Eurozone (Italy has officially entered a recession) and continued stagnation in Japan. Adding to this list are the broader issues of the imposition of international trade restrictions and political turmoil over Brexit. In the United States investment has softened, especially in housing. Corporate earnings are recording single-digit returns and corporate executives are now offering up lower guidance for the next couple quarters, notwithstanding the bounce in equity prices in January. The Canadian GDP recorded declines in two of the last three months as a major downturn in the oil patch, a slow down in exports and the beginnings of a slump in housing sales and prices in the major metropolitan areas all take their toll.

There are some who believes that central bankers misjudged the strength of their respective economies and have tighten too much. Others argue it is too early to make that call. Nonetheless, the bond market sends a message that should not go unheeded.

More than misjudging, they actually kept a charade going, giving ample liquidity for stock buybacks and proceeding to normalize interest rates. That normalization was a pipe dream, really.

Gary, I fully agree. Central banks want to have real rates at about 2% so that is why they hanker for normalize rates of 4% or better. They cannot stand that we have had negative real rates for a decade and may have to revert to that should the Fed be forced to cut rates.