April's Jobs Report Was Indeed As Strong As The Headlines Suggested

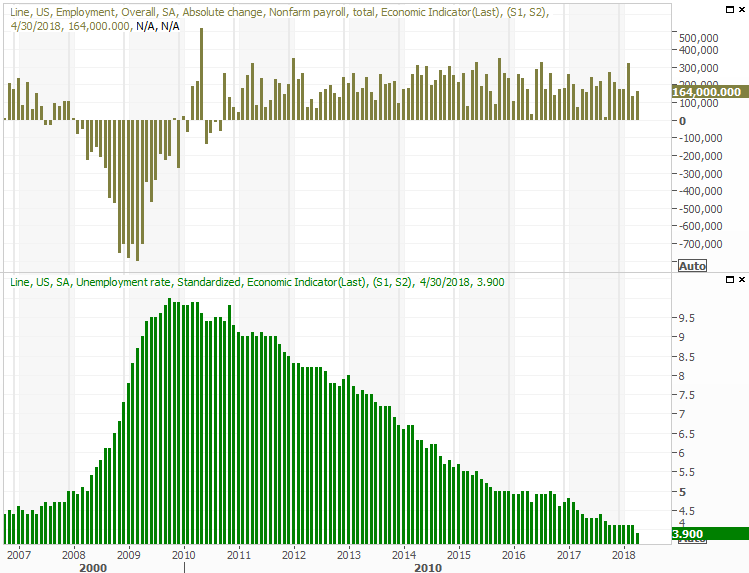

The headlines seem almost too good to be true. As of April, the United States' unemployment rate reached a multi-year low of 3.9%. There's got to be a catch or an anomaly, right?

Nope. As crazy as the number sounds, it's legit. That's not to say there aren't some curiosities worth noting and watching going forward though. But, in step with falling unemployment, wages are rising, fewer people are reporting they're searching for a job, and more people are reportedly working a job. The biggie of those three is wage growth, which surged last month, indicating employers are now getting much more serious about getting workers, competing with other employers.

First things first - the unemployment rate and job growth. Unemployment fell to 3.9% of the workforce, as the economy created 164,000 new jobs. That's actually less than the 193,000 economists had predicted, but those guesses mean little at this time. It's not so much a lack of jobs holding the job-growth figure back. It's the lack of available workers.

Nowhere is this more apparent than in wage growth.

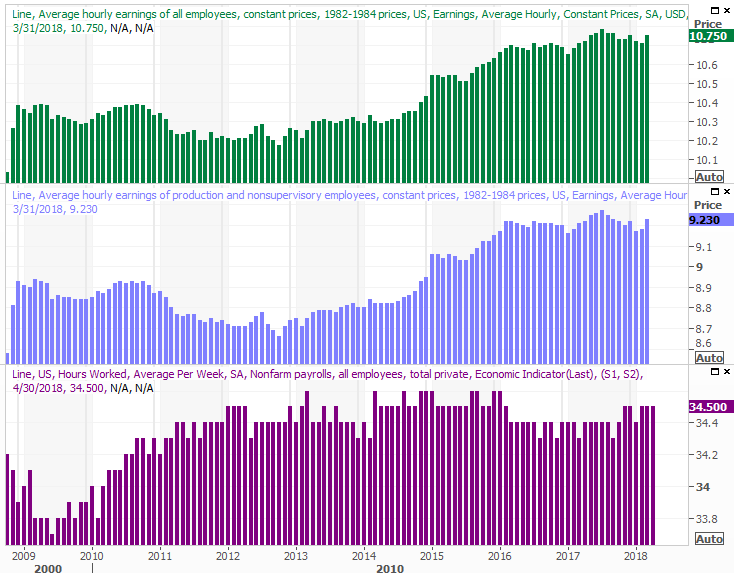

Unfortunately, the image below doesn't show hourly wages through April. The plots only go through March. We do have the figures though. Hourly wages were up 2.6% year-over-year, following through on March's nicely pronounced improvement... when the fight for employees went into high gear.

And for the record, workers didn't lose hours worked to fund higher hourly earnings. The average workweek has held steady at 34.5 hours for the past few months.

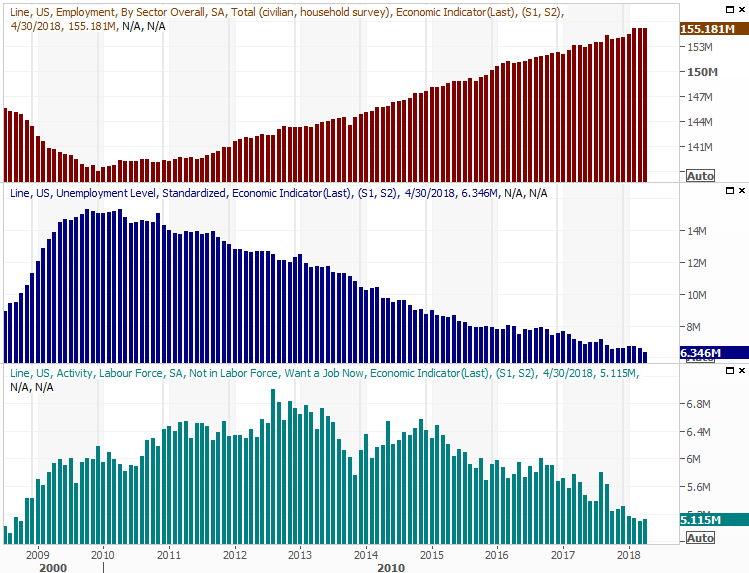

As was also noted, the big improvement in April's unemployment rate wasn't just some lucky math. The number of people with jobs edged higher, from 155,178,000 to 155,181,000. The number of people without jobs but want one fell from 6,585,000 to 6,346,000... another multi-year low. The number of people without jobs but want one - and aren't being counted as 'unemployed' actually moved a little higher, from 5,096,000 to 5,115,000, but that's still very near multi-year lows.

There is one confounding detail in April's jobs report the pessimists will surely latch onto - the sheer number of people who are in the labor pool (working or not) and the numbers of people who are actually employed, both relative to the population. Both slumped last month, quelling budding uptrends before they even have a chance to get started in earnest.

Under different circumstances, this would be a concern. When (literally) everything else is showing more demand for workers than the supply of them, however, we can only conclude there simply aren't as many people as there have been, historically, interested in a job. The biggest chunk of this crowd is arguably the baby boomers, who are alive and well, but enjoying retirement rather than clocking in.

Bottom line? The headlines on Friday were encouraging, and rightfully so. This bodes well for U.S. stocks, as we're primarily a consumer-driven economy. Most consumers have been waiting a long while for a healthier job market to really open their wallets wide. That's starting to happen... in a big way.

I don't think people are opening their wallets wide at all. In fact, those new to the market are less likely to do this for years as they pay off their debt accumulated through unemployment. The increase in expenses is due to increasing prices more than anything else and perhaps some from fear of increasing prices. The real issue is if companies can't pass on the raw material cost increases, businesses will be making more money but not more profits in the future.

That is what to look out for in the next few quarters as inflation has returned.

Excellent point.