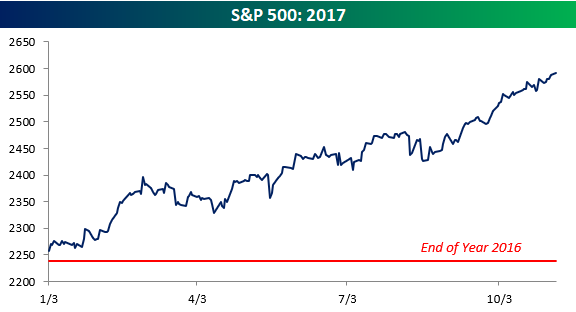

All Year In The Black

With the S&P 500 currently up 15% year-to-date, we’d basically need to see a market crash for the index to close down on the year when all is said and done on December 29th, 2017 (the last trading day of the year). If the market doesn’t crash, the S&P will likely go the entire year without trading into negative territory at any point.

(Click on image to enlarge)

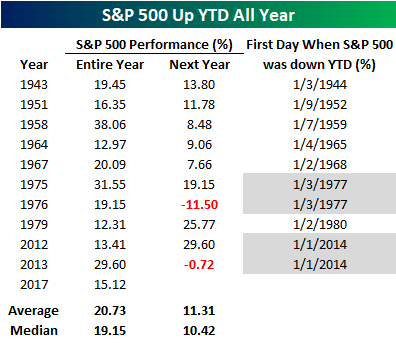

As shown below, there have only been ten prior years where the S&P went the entire year without trading into negative territory. The last two were relatively recent in 2012 and 2013. What’s notable in the table is the performance in the following year after the S&P goes an entire year “in the black. ”Following the ten prior occurrences, the index traded up the next year eight times and down twice. On average, the next-year gain was +11.31%.Investors would surely sign up for another 10%+ gain in 2018!

(Click on image to enlarge)

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more

It's not good to get people's expectations even higher than what they already are although the past data looks good. The simple fact is that almost all investments in assets including stock and real estate have disturbing expectations, not so much as to the expected increases, but as the the wanton disregard of the risks in owning them. The good news is that unlike housing, the buyer isn't saddled with debt and can get out of their positions relatively fast if need be.

We will see how healthy the market really is when we get a downturn and see how many survive and are long term holders. Sadly, I have a feeling a lot will drop off.

I suspect you are correct.