After The Fed

In my previous post, I questioned whether we could expect a change to a more dovish tone from the FOMC and Jay Powell regarding interest rate hikes would support last week’s strong market close. It did, and then it didn’t, with equities rising strongly on the release of the statement, which accompanied the expected 75 bps increase in rates (already priced in by the market). All seemed to be going well for the bulls until the press conference.

This part of the FOMC is when financial journalists have the opportunity to question Fed Chair Powell in detail, hoping to elicit current Fed thinking on rates, the pace and direction of future rises, the Labor market, inflation plus whether the much trailed ‘pivot’ would be mentioned. There was indeed a ‘pivot’ but not the ‘dovish’ one the market was expecting. Instead, there was an aggressively hawkish one. Powell’s words were clear: “It’s very premature to think about or talk about pausing our rate hikes.” which was the cue for stocks to sell off into the close.

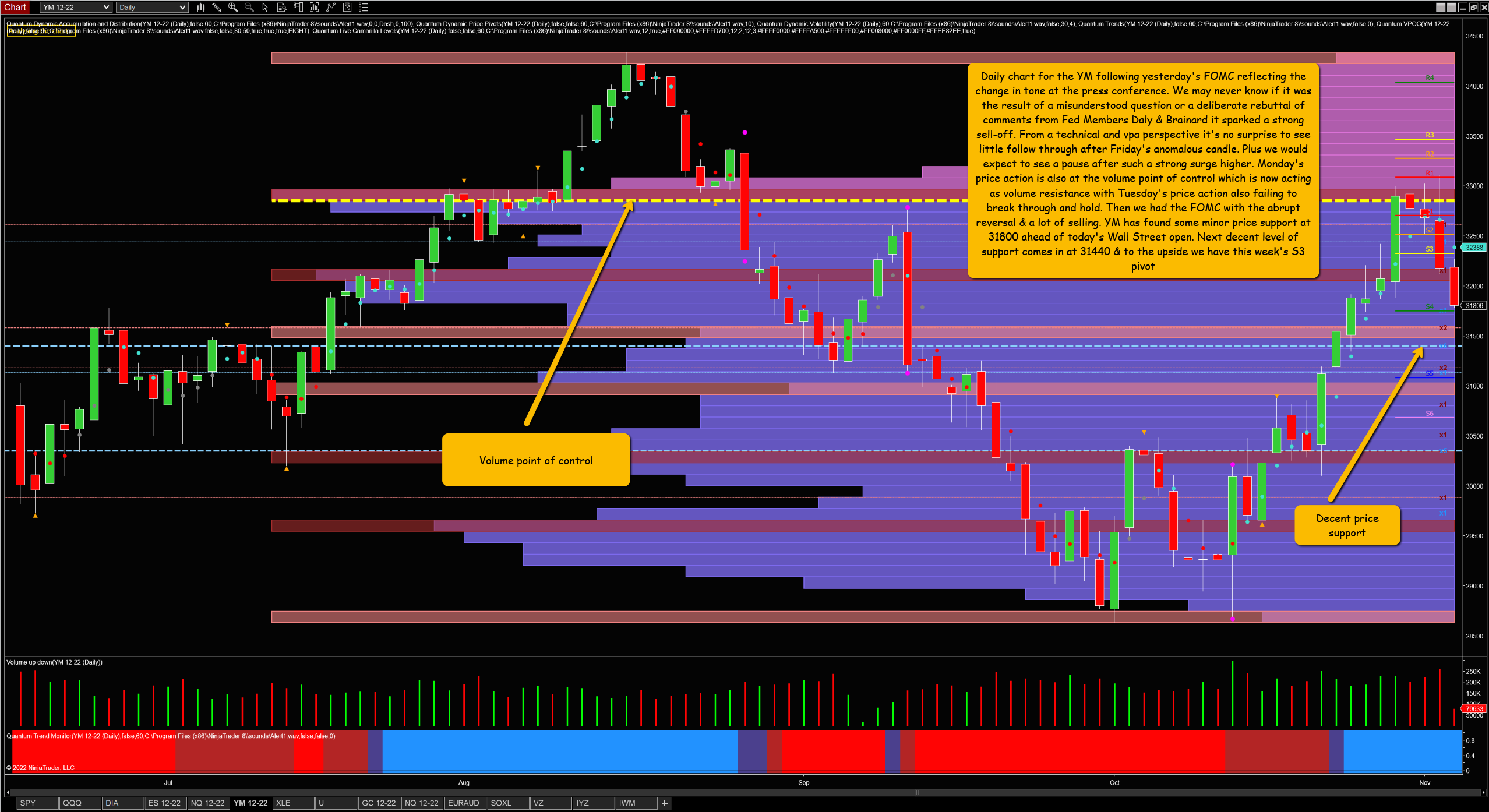

(Click on image to enlarge)

To see this action, I’ve taken the daily charts for the YM, ES & NQ, which are the E-Mini futures for the Dow, S&P, and Nasdaq respectively where we can see yesterday’s price action across all three is identical. However, what is interesting is the difference in the overall chart structure for these indices, with the YM outperforming the other two since the key 13th of October low.

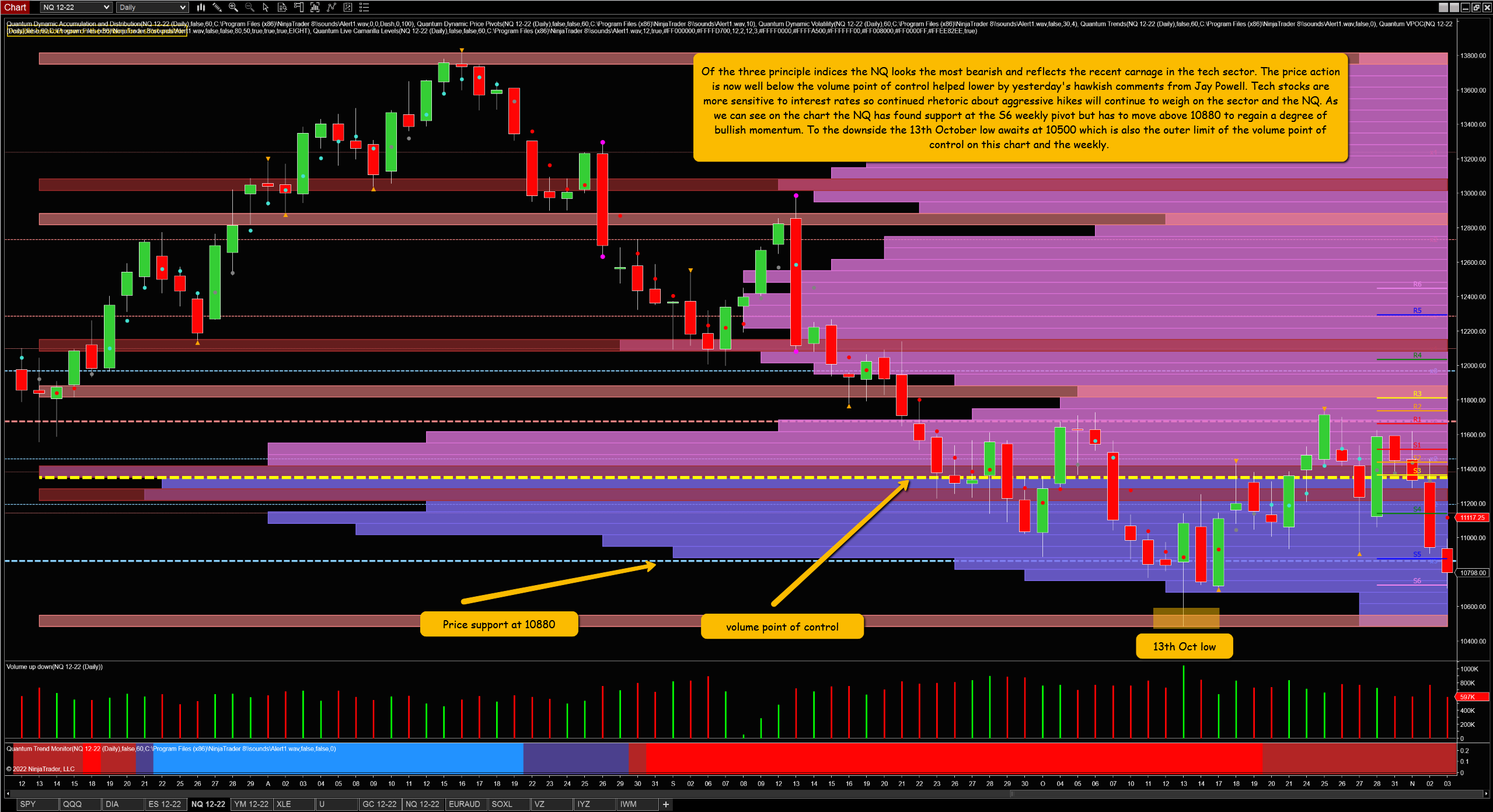

(Click on image to enlarge)

What is also striking is the position of the volume point of control with only the ES trading above this important support and resistance metric.

(Click on image to enlarge)

Of the three indices, the NQ looks the most vulnerable to a re-test of the October low as the index has been driven lower by a struggling tech sector. Technology stocks are also sensitive to interest rates, so Powell’s firm assertion that the ‘ultimate level of interest rates will be higher than previously expected’ would not have done them any favours.

Of course, hovering over the US is the specter of recession, and whilst the economy appears to be holding up well in comparison to other jurisdictions any data suggesting otherwise is when there would be a complete re-think about interest rates. This is when we can expect the ‘dovish’ pivot.

Tomorrow we have the Non-Farm Payroll release where the forecast is for another good number, albeit lower than last month. What is interesting about the NFP data is that since May, the monthly figures all come in much better than expected, which in an inflationary environment does not bode well for interest rates. In other words, a strong labor market and one where job openings outstrip the supply of available workers feed into inflation as workers can set higher wages which they also need to cope with rising inflation.

It is a vicious circle made more depressing when in answer to a question Jay Powell admitted that the Fed had no control over energy or food costs, the two items which are driving inflation higher. This makes one wonder whether the interest rate tool the Fed and other banks use to fight inflation is actually fit for purpose in the current environment.

More By This Author:

Just Another Short Squeeze Or Will Fed Change Of Tone Also Support Current Rally?

VPA signals on Lumen Technologies

VPA signals on the DXY, Indices & SOXL

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more