VPA Signals On Lumen Technologies

In last week’s webinar, David & I considered the extent of this year’s market sell-off, which sectors and markets had suffered the most, and whether a reversal of fortune beckons as we move towards year-end and perhaps a Santa’s rally. Of course, we have the FOMC in November when the Fed is expected to raise rates by 0.75% once again and the fourth by this amount in a row; plus, we do have the last FOMC to look forward to in December.

Regardless of the above and from a technical and VPA perspective, stocks in this year’s worst-performing sectors look interesting which is why I’ve drawn up a list of stocks for analysis in the coming weeks.

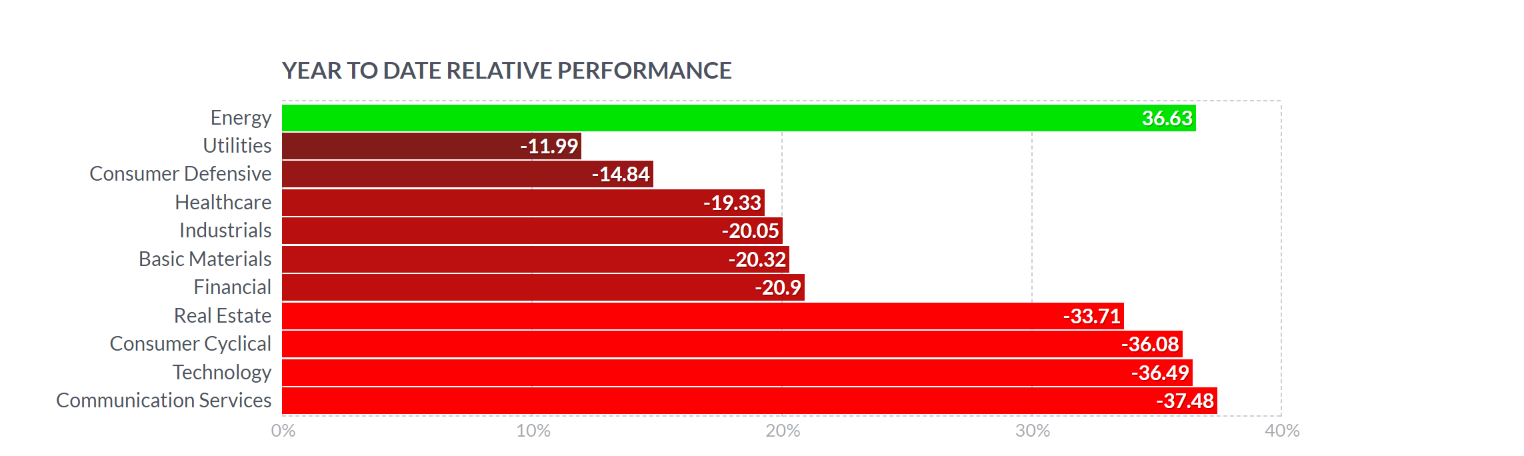

The image below is from Finviz and confirms that the two worst-performing sectors/groups YTD are Technology and Communication Services. As I mentioned in the webinar, I am using a very simple filtering system which is 1. Only US stocks. 2. Stocks with a market cap of over $2bn, and 3. Must have an average volume of over 1m. This has resulted in 24 Communication Services stocks, although some are also Tech stocks.

(Click on image to enlarge)

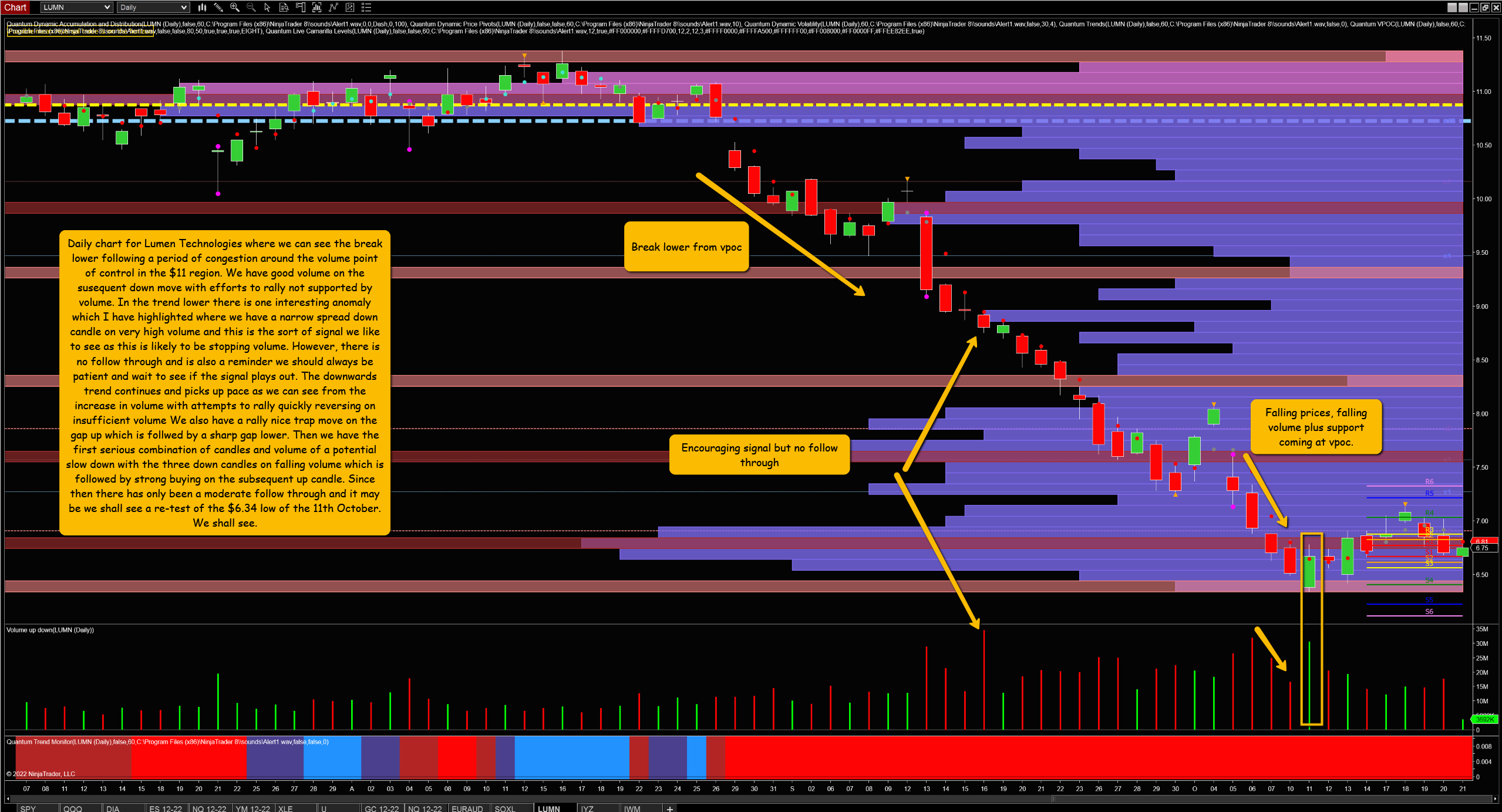

The first stock I want to cover is Lumen Technology (LUMN), not only because of the really nice VPA signatures on the daily chart but also because almost 16% of Lumen shares are currently sold short, resulting in a short ratio of 12, and any short ratio over 10 increases the possibility of a sharp squeeze higher. FINRA requires all short positions to be reported twice a month, and the next date is Tuesday, 25th October, so a nice confluence of fundamental factors alongside our technical signals.

Earnings season is also underway, and Lumen is due to report on the 2nd of November.

(Click on image to enlarge)

More By This Author:

VPA signals on the DXY, Indices & SOXL

Forex Volatility & Volume Price Analysis

Mid-June Reversal In Stocks Continues – Even In Tech & Small Caps

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more