ADRs Best & Worst Report - November 23, 2015

- The best sector across ADRs is services.

- The top regions are North America, MENA, & UK/Ireland

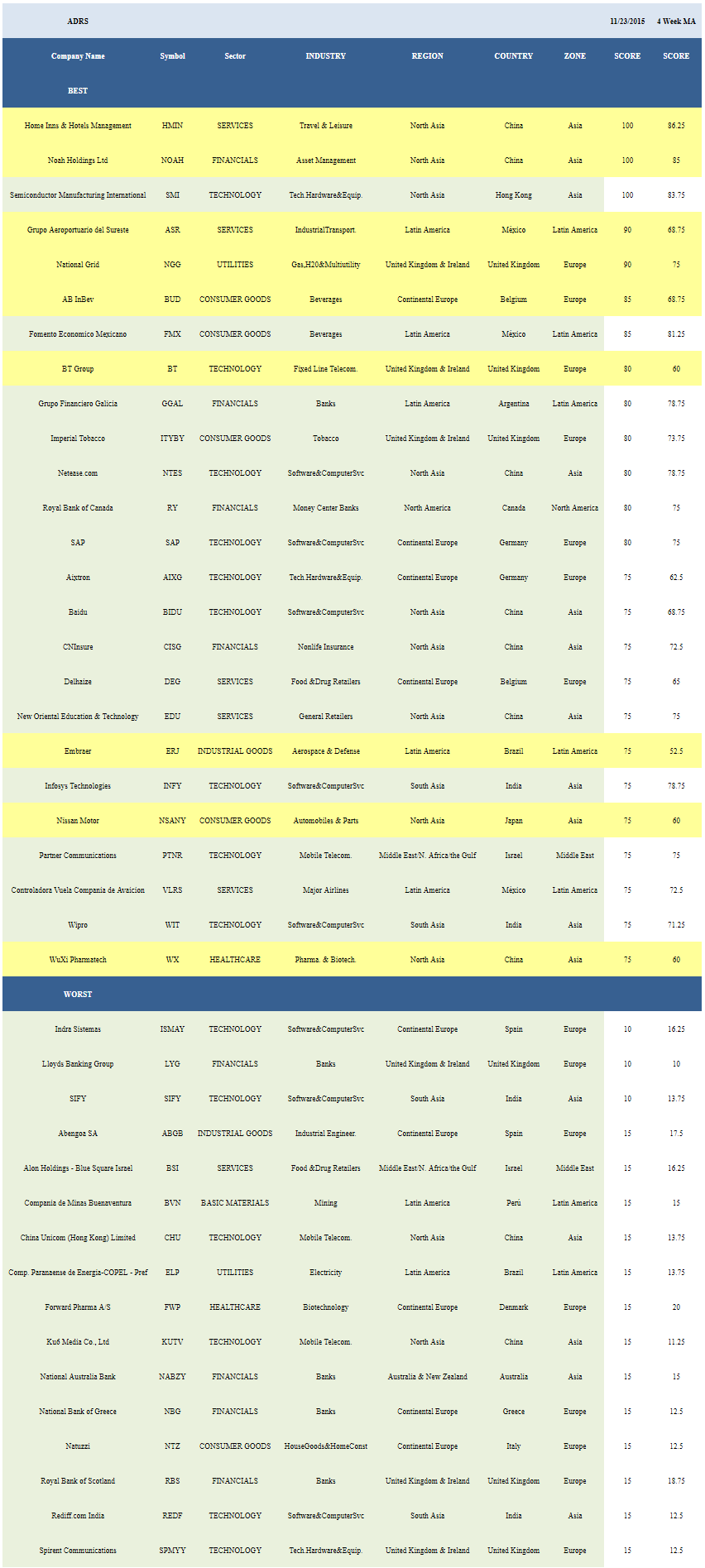

The average ADR score is 45.81 and that's above both the four and weight week average score of 43.56 and 43.72. The average ADR in our ADR universe is trading -26.81% below its 52 week high, -5.65% below its 200 dma, has 4.39 days to cover held short, and is expected to grow EPS by 10.12% in the coming year.

(Click on image to enlarge)

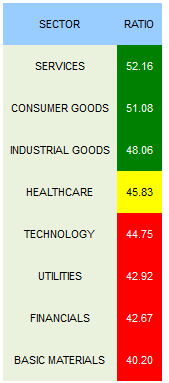

Services (HMIN, ASR, VLRS, EDU, DEG, WMMVY, SIG, PAC, AHONY), consumer goods (FMX, BUD, ITYBY, NSANY, UPMKY, TTM), and industrial goods (ERJ, NJ, MXCYY, KUBTY, DNZOY) score best. Healthcare scores are in line. Technology, financials, and basics score below average and should be underweight.

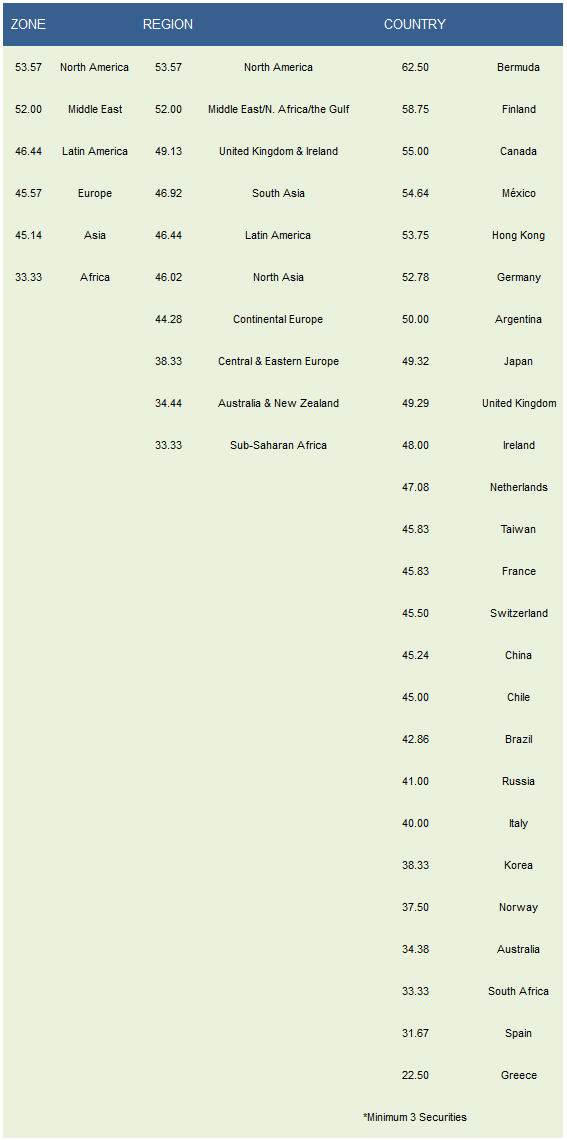

North America (RY, BCE, BMO) and MENA (PTNR, TKC, NICE) are the best zones. North America, MENA, and UK/Ireland (NGG, BT, ITYBY, ARMH, SNN, PUK, BTI) are the top scoring regions. Bermuda (GSOL, SIG), Finland (UPMKY), Canada (RY, BCE), Mexico (ASR, FMX, VLRS, WMMVY, PAC, KOF), and Hong Kong (SMI) should be heavily weighted.

Disclosure: None.

Some technical questions: 1) How do you make up your ADR universe which includes both listed and OTC stocks

2) How do you decide the sectr, like calling a telephone company technology rather than services or a utility; or calling a civilian airplane maker "defense". What about a car manufacturer is remotely like a maker of soda?

3) how do you determine the "nationality" of firms incorporated in offshore sites in the Caribbean?

4) since Canada has NO ADRs how do you managed to include Canadian firms in your list?

My reasoning is that any statistical exercise like yours must be rules-based and your rules seem very slippery

are the OTC ADRs the ones which used to be listed and left because of Sarbanes-Oxley? or ones which used to be listed and left more recently? or any old stuff you happen to like in the MSCI EAFE index? I do not consider Yahoo Finance a serious source, but maybe I am wrong.

also another problematic sector in your scheme is healthcare into which you put major drug companies under the rubric of "biotechnology" not what most of them are about.

There are about 1800 ADRs out there plus another 500 Canadians which are not listed here and another 30-odd which are. Any selection bias in what you cover leads to distortions in the statistics you produce and the advice you give, which is why I am focusing on this matter

Thanks for your questions. The ADR universe is primarily based on the components of the MSCI EAFE index. Additional names, including those in Canada, have been added at the request of our institutional client base. Many former ADRs became OTC to avoid regulatory compliance post Sarbanes Oxley. Sector allocation is based on common industry practice (aerospace fall into defense, carmakers fall into consumer, etc). You can see this evidenced by other sites, including Yahoo!Finance, that get their feeds from industry service providers, such as Capital IQ. For consistency purposes, companies are (generally) allocated to the country they are incorporated in (ie. Bermuda).