A Momentary Selling Respite Can Help Gold Miners Jump

With our highly profitable short position in the GDXJ ETF now converted into a long position, a selling reprieve across Wall Street could help elicit a short-term bounce. For example, the Consumer Price Index (CPI) hit the wire this morning, and investors have been selling assets in anticipation of another scorching print. However, with market participants known to ‘sell the rumor and buy the news,’ the GDXJ ETF could be a major beneficiary.

Gauging Sentiment

To explain, the euro collapsed to parity with the U.S. dollar on Jul. 12. Moreover, while I’ve been bearish on the EUR/USD for many months, the drawdown highlights how you can’t run from fundamental reality.

Please see below:

For context, I wrote on Mar. 12, 2021:

If you haven’t noticed, I spend a lot of time analyzing the EUR/USD because the currency pair accounts for nearly 58% of the movement in the USD Index. And due to Europe’s economic underperformance and the relative outprinting by the ECB, a sharp rerating of the EUR/USD could be the engine that drives the USD Index back above 94.5.

For some time, I’ve warned that the ECB’s bond-buying program was likely to accelerate. On Jan. 22, I wrote:

The ECB decreased its bond purchases toward the end of December 2020. Then, once January hit (2021), it was back to business as usual. As a result, the ECB’s attempt to scale back its asset purchases was (and will be) short-lived. And as the economic conditions worsen, the money printer will be working overtime for the foreseeable future.

Thus, while the Fed has run off six rate hikes (25 basis point increments) and begun selling assets on its balance sheet (QT), the ECB has done nothing. Therefore, the EUR/USD’s plight unfolded as expected.

However, with euro negativity now at extreme levels, investors that were bullish on the currency pair – and forecasting 1.30 – are now bearish. Thus, a short-covering rally in the EUR/USD could help uplift the GDXJ ETF.

Please see below:

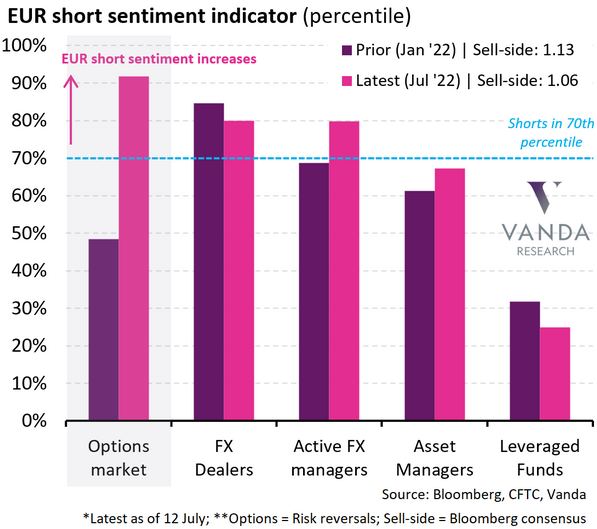

To explain, the purple and pink bars above track the expectations/positioning of various market participants in January 2022 and now. If you analyze the changes, you can see that three of the five cohorts (pink bars) are more short the euro now than in January.

Furthermore, the pink bar furthest to the left highlights how options traders have nearly doubled their euro shorts. As a result, with momentum investors chasing the euro’s collapse rather than anticipating the fundamentals, over-positioning could result in a short-term reversion. Thus, the prospect is bearish for the USD Index and bullish for the GDXJ ETF.

Second, hedge funds and speculative futures traders are all-in on a CPI sell-off.

Please see below:

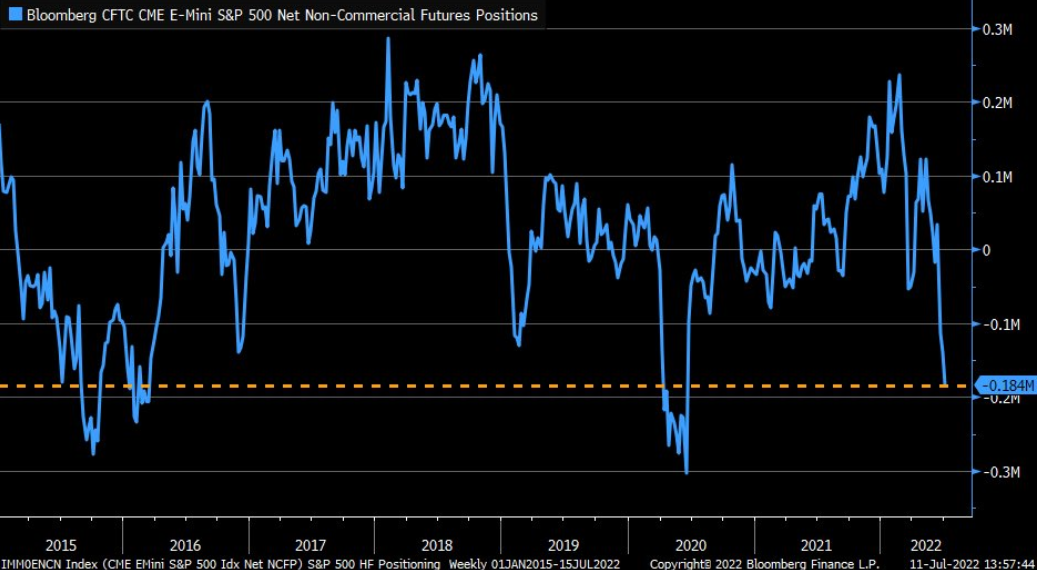

To explain, the blue line above tracks non-commercial traders’ (based on the CoT report) net E-Mini S&P 500 futures positioning. If you analyze the right side of the chart, you can see that net shorts have ballooned to their highest level since the COVID-19 crash. Likewise, the current reading has surpassed the 2018/2019 sell-off but remains below the 2015/2016 growth scare.

As such, with investors heavily positioned for a risk-off outcome, a bout of short-covering may spur a relief rally across Wall Street. Moreover, with the GDXJ ETF collapsing recently, the junior miners should benefit from a potential sentiment shift.

For context, our expectation for a short-term rally doesn’t change the medium-term thesis: the PMs are likely far from their final bottoms, as is the S&P 500. However, asset prices don’t move in a straight line, and bear market rallies are born out of over-positioning. Thus, the conditions should be ripe for a short-term reversal.

The Ominous Months Ahead

Since technical analysis and sentiment are much more prescient in predicting short-term moves, they're better gauges of near-term price action than the fundamentals. However, while it took time for the EUR/USD to reflect its fundamental value, the PMs and the S&P 500 should suffer similar re-ratings as the Fed's rate hike cycle continues.

For example, the NFIB released its Small Business Optimism Index on Jul. 12. The headline index declined from 93.1 in May to 89.5 in June. The report revealed:

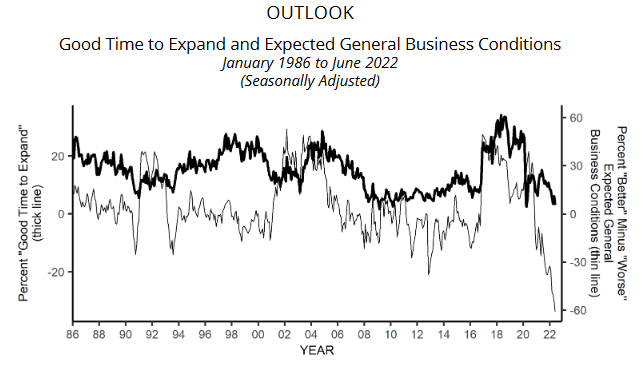

“Small business owners expecting better business conditions over the next six months decreased seven points to a net negative 61%, the lowest level recorded in the 48-year survey. Expectations for better conditions have worsened every month this year.”

Please see below:

Source: NFIB

To explain, the gray line above highlights how inflation has rattled U.S. small businesses. If you analyze the right side of the chart, you can see that the gray line has plunged to an all-time low. Therefore, recession fears are rampant on Main Street.

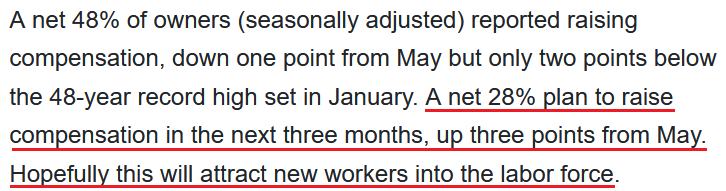

However, I noted previously that the NFIB’s Small Business Jobs Report (released on Jul. 7) was bullish for wage inflation.

Please see below:

Source: NFIB

Moreover, the NFIB’s Jul. 12 report revealed:

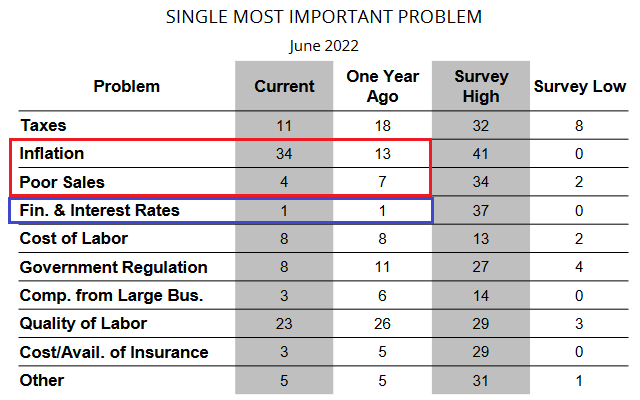

“Inflation continues to be a top problem for small businesses with 34% of owners reporting it was their single most important problem in operating their business, an increase of six points from May and the highest level since quarter four in 1980.”

Thus, while six-month sentiment has fallen off a cliff, the overall report was profoundly bullish for Fed policy. For context, the U.S. will likely enter a real (not technical) recession as the Fed attempts to rein in inflation. However, the current economic backdrop is far from dreadful.

Yes, activity has slowed, but that’s expected when the Fed hikes interest rates six times. Furthermore, with small businesses’ current activity contrasting their expectations, the Fed should focus more on the former than the latter when conducting monetary policy.

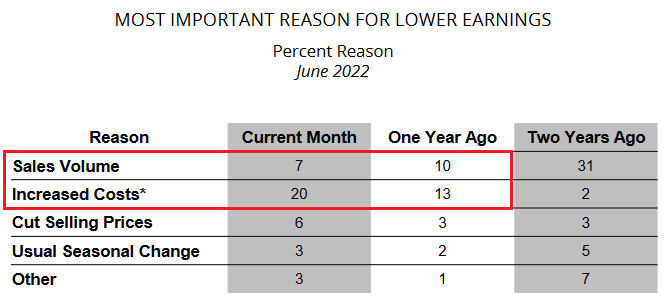

For example, only 7% of small business owners cited depressed sales volume as the reason for lower earnings. Moreover, the figure was three points lower than the 10% recorded in June 2021. Conversely, 20% of small business owners cited increased costs as the driver of lower earnings, an increase of seven points from June 2021.

As a result, the gloomy outlook on Main Street is a function of unanchored inflation, not evaporating demand.

Please see below:

Source: NFIB

As further evidence, I noted above how 34% of respondents cited inflation as their “most important problem.” Well, that figure is up from 13% in June 2021 and is only seven points below the all-time high of 41%.

In contrast, the percentage of small businesses lamenting poor sales declined from 7% in June 2021 to 4% in June 2022. Furthermore, the far-right column shows that the current reading is only two points above the all-time low of 2%.

Please see below:

Source: NFIB

Even more revealing, the blue rectangle above shows that only 1% of small businesses cite interest rates as their most important problem. Therefore, while the Fed has hiked interest rates six times in 2022, the figure matches 2021 and is only one point above the all-time low of 0%.

As such, sales volume is not a problem, interest rates are not a problem, and more small businesses are raising wages to “attract new workers into the labor force.” Therefore, does it seem like demand destruction has unfolded?

In reality, unanchored inflation has annihilated business confidence and has decision-makers bracing for the worst. As a result, the Fed needs to raise interest rates to curb inflation and restore predictability to the U.S. economy.

Think about it: how can CEOs make business decisions when they’re unsure of the cost of goods, labor, and whether or not demand will be present in the future. Moreover, when uncertainty reigns, the logical response is to become risk-averse and avoid decisions that could spur large potential losses.

Thus, while raising interest rates should elicit short-term pain and an eventual recession, I’ve warned on numerous occasions that not doing so would result in the worst possible outcome for Americans and the U.S. economy.

The Bottom Line

With asset prices selling off in advance of the CPI, today's release may result in a short-term reversal that catches over-positioned investors by surprise. Moreover, while it's happened many times in 2022, small bouts of positivity can amplify themselves when the shorts run for cover. Therefore, we may witness another re-enactment in the days ahead.

In contrast, the PMs' medium-term outlooks remain profoundly bearish. With the U.S. economy in better shape than the narrative suggests, inflation would have collapsed if demand had fallen off a cliff. Therefore, while sentiment has taken a plunge, the Fed will have to do the heavy lifting to make material progress on inflation.

In conclusion, the PMs declined on Jul. 12, as investors continued to front-run the CPI. However, with the markets often moving counterintuitively, pessimism can quickly turn to optimism. As a result, short-term upside should be on the horizon before the PMs continue their medium-term downtrends.

More By This Author:

The USD Equals The Euro, Gold Is Not Willing To React

These Signs May Indicate A Short-Term Reversal In Gold Miners

What Needs To Happen For The GDXJ To Hit New Lows?

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more