The USD Equals The Euro, Gold Is Not Willing To React

The dollar is so strong to hit the euro for the first time in 20 years, but gold shows no weakness. How to profit from gold being so bullish?

And so, after taking profits from our short positions in them, we’re long juniors once again. We saw some bullish signals yesterday, and we also see them today. In fact, we have a few extra.

The most important reason behind the long position – on top of what I wrote yesterday – is the strength that gold currently shows relative to what’s happening in the USD Index.

The latter is soaring.

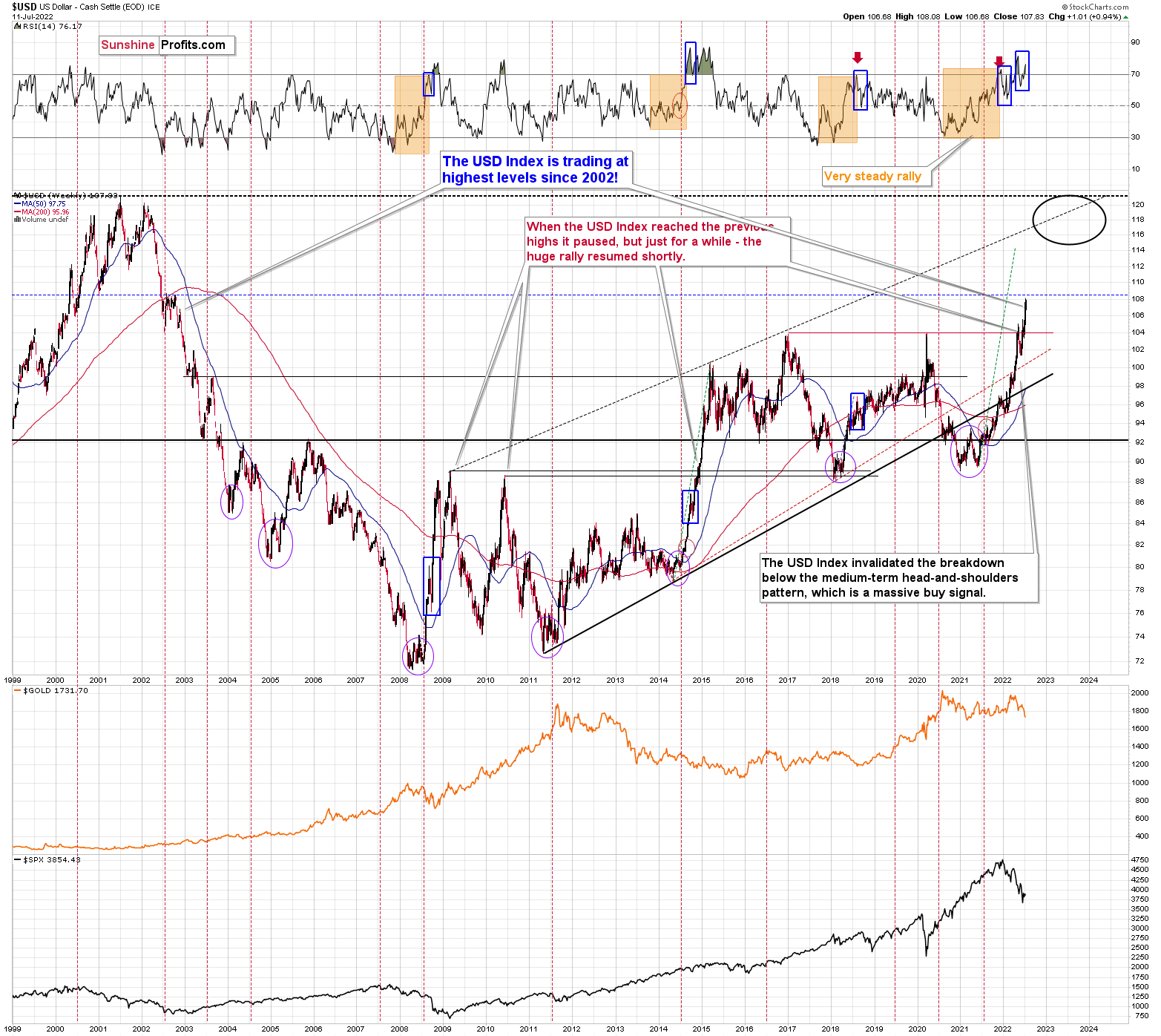

(Click on image to enlarge)

Yesterday’s intraday high was 108.08 and at the moment of writing these words, the USD Index futures are trading at 108.37. That’s very close to the long-term resistance level, which – especially given very overbought RSI – is likely to trigger at least a short-term pullback.

Let’s look under the hood.

The USD Index is a weighted average of individual currency exchanges, and the EUR/USD has the biggest weight (over 50%). Here is what it’s doing right now.

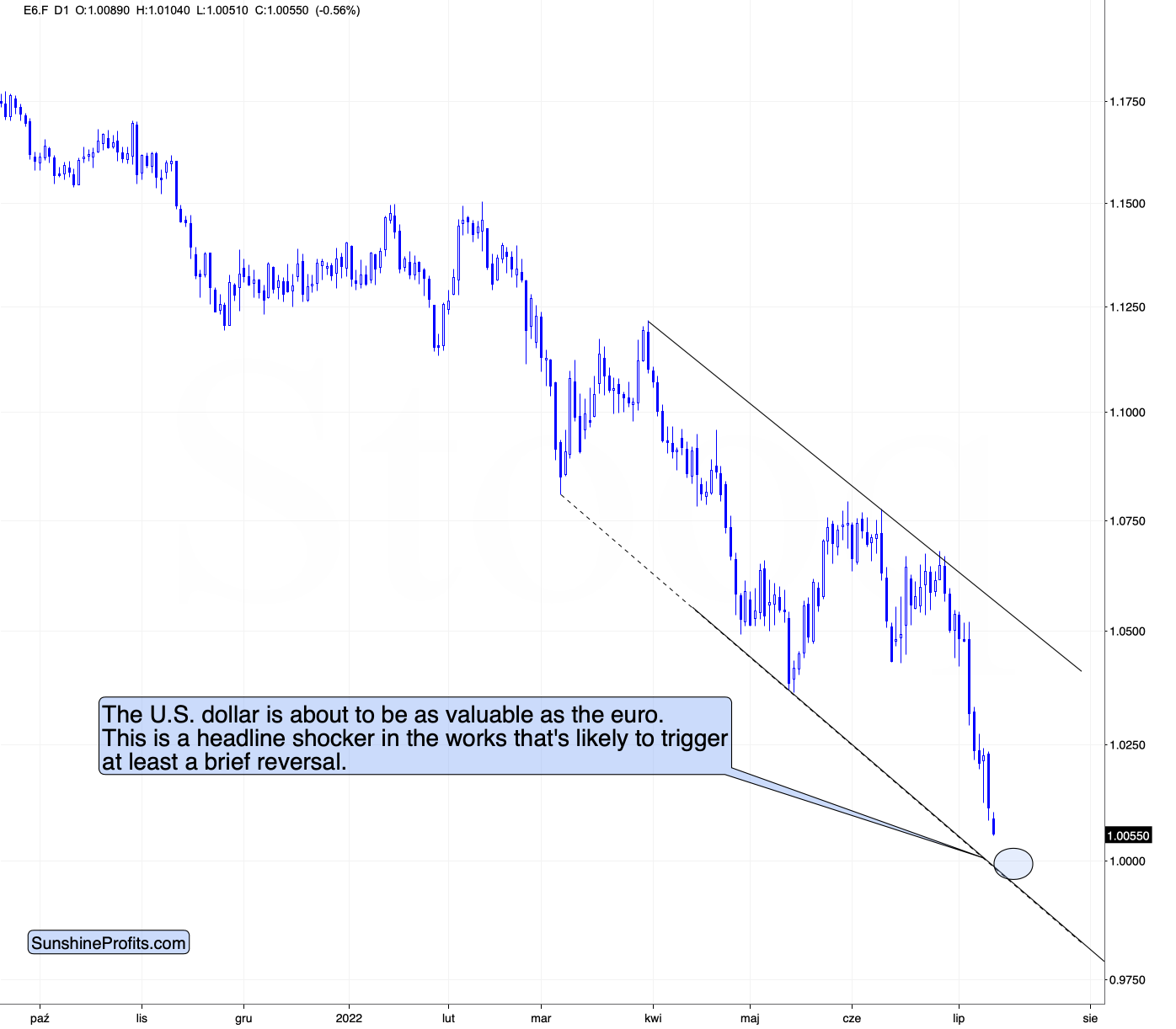

(Click on image to enlarge)

The euro futures (visible in the above chart) are plunging, and they are about to reach a very strong support level.

As you can see, the lower border of the declining trend channel is about to be reached, but there’s also something very special about the level at which it’s likely to be reached.

It’s the most important round number of them all: 1.

This means that if the trend continues, any hour now, the U.S. dollar is about to be as valuable as the euro!

This is a headline shocker in the words, and it’s very likely that it will trigger fresh buyers. “Enough is enough” they might say, not wanting to believe that the euro can be cheaper than the buck. Of course, it can, but it’s unlikely that this level (and buyers) will allow that without a fight.

This fight is likely to trigger at least a brief reversal and a rally.

This, in turn, is likely to trigger a decline in the USD Index, which would be in perfect tune with what’s likely based on the USD’s long-term chart.

And since in today’s pre-market trading the USD Index is rallying and the euro is declining, gold is surely declining as well, right?

Wrong.

(Click on image to enlarge)

Gold declined initially, but then it reversed at its previous support level (that already worked several times), and it then moved back up despite the bearish forces coming from the forex market.

Instead of declining, gold showed strength and formed a reversal. This is a very bullish combination of factors. And the fact that it’s happening at the previous lows is notable also in light of the analogy to 2013 that I described yesterday.

Moreover, please note that gold’s Friday’s bottom formed right at gold’s triangle-vertex-based reversal. It moved slightly below Friday’s low today, but since it rallied back up, the breakdown was already invalidated. Overall, it seems that the bottom is either in or at hand.

So, we have a situation in which it seems that the USD Index is about to reach its top, but gold is not willing to react to the USD’s rallies. This is a very bullish combination for the short term. And there are ways to profit from this bullishness.

More By This Author:

These Signs May Indicate A Short-Term Reversal In Gold MinersWhat Needs To Happen For The GDXJ To Hit New Lows?

Gold’s Inability To Pass The $2000 Mark Is A Very Bearish Clue

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more