5 Dividend Stocks Boosted By The AI Revolution

Image Source: Pixabay

AI is transforming every industry — here are five dividend growers benefiting from it.

Over the past 18 months, I’ve been digging deep into artificial intelligence — not just reading about it but using it daily. It’s been both exciting and humbling. The more I learn, the more I realize how much there is left to understand.

One thing is clear: AI won’t replace humans, but it will replace those who ignore it.

And the same goes for companies. Every business now claims to “use AI” in some way, whether for automation, analytics, or marketing. But as investors, we know that hype doesn’t pay the bills — profits do.

AI can absolutely boost productivity, reduce costs, and create new opportunities. But only the best-run companies — those already executing well — will turn these benefits into sustained growth.

The Obvious AI Winners

We all know the big names driving the AI boom: NVIDIA for chips, Alphabet for search, Meta for data and advertising, and OpenAI for seamless integration across devices. They’re the poster children of AI.

But beyond the flashy headlines, a handful of established, dividend-growing companies are currently benefiting from the same revolution. They’re not AI companies per se — they’re just using AI to get even better at what they already do best.

Let’s take a look at five of them.

U.S. AI Dividend Plays

Visa (V): The Data-Driven Tollbooth

Visa is one of the most underrated AI players in the world. It processes over $14 trillion in payments every year and uses AI to monitor more than 500 million transactions daily — spotting fraud patterns faster than any human ever could.

AI is at the core of its network’s resilience and speed. Every transaction enriches Visa’s data model, improving fraud detection and authorization accuracy. That same AI foundation will soon power new consumer tools like AI shopping assistants, enabling instant, secure payments through chat interfaces like ChatGPT.

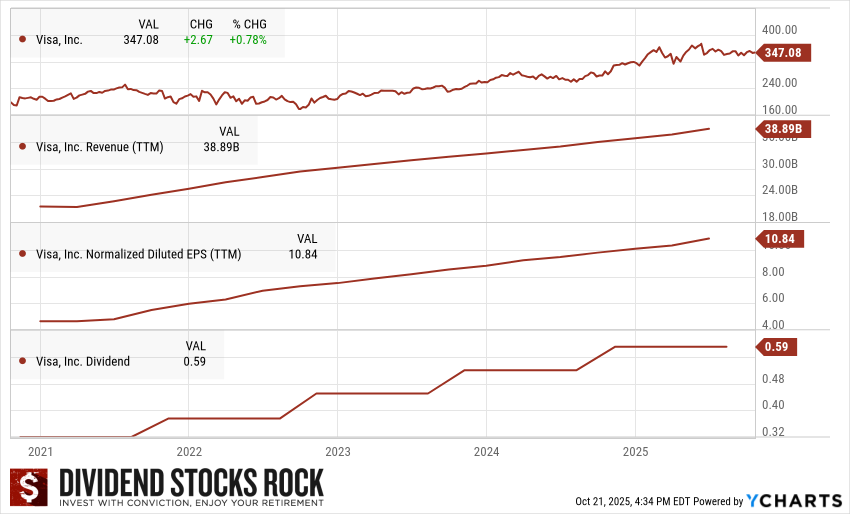

(Click on image to enlarge)

Visa (V) 5-Year Dividend Triangle Chart.

From an investor’s perspective, Visa’s business model remains one of the strongest in the world — a digital tollbooth that collects a fee on every transaction passing through its network. Its dividend triangle tells the story: steady revenue growth, double-digit EPS gains, and consistent dividend increases for over a decade.

Mastercard (MA): Growing Faster, Smarter, and Safer

If Visa is the tollbooth, Mastercard is the fast lane next to it. The company processes trillions in transactions across more than 200 countries and leverages AI across fraud detection, cybersecurity, and cross-border payment optimization.

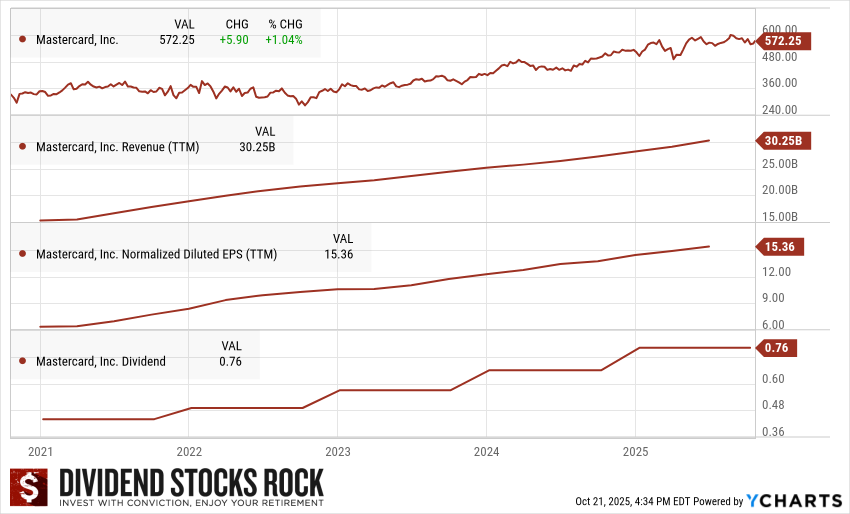

(Click on image to enlarge)

MasterCard (MA) 5-Year Dividend Triangle Chart.

Mastercard’s strength lies in its network effect — merchants and consumers are deeply tied to its ecosystem, and new entrants can’t easily compete. AI only strengthens that moat. The company now uses AI-driven analytics and cybersecurity tools to help clients detect and prevent fraud in real time.

Beyond payments, Mastercard is investing in AI-enhanced financial services, such as dynamic risk assessment and smarter credit decisioning. With strong margins (above 58%) and an expanding global presence, Mastercard continues to deliver both growth and resilience — two essential ingredients for a reliable dividend grower.

Parker Hannifin (PH): Keeping AI Cool

Everyone talks about NVIDIA’s chips — but few realize what keeps them running. High-performance AI chips produce immense heat, and Parker Hannifin provides the fluid-power systems that make advanced liquid cooling possible.

Parker’s hoses, fittings, and precision systems are key components in data center infrastructure. Without them, those shiny AI servers would overheat and shut down.

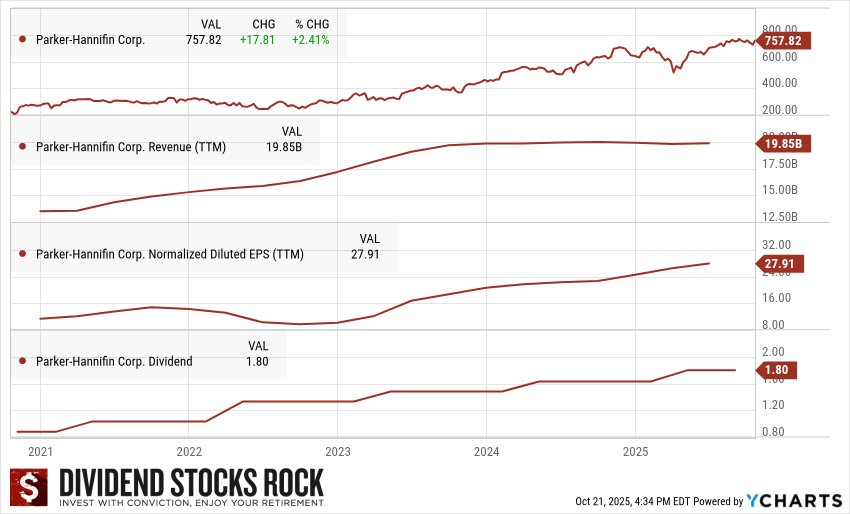

(Click on image to enlarge)

Parker Hannifin (PH) 5-Year Dividend Triangle Chart.

Outside the AI space, Parker Hannifin remains a diversified industrial powerhouse serving aerospace, motion control, and electrification markets. Its “Win Strategy,” launched in 2015, transformed it into a lean, decentralized operator that consistently improves margins and cash flow.

With recent acquisitions like Meggitt and Curtis Instruments, Parker continues expanding into aerospace and electrification — both of which benefit from automation and AI-driven efficiency. The result? Record margins, strong free cash flow, and a dividend triangle that speaks for itself.

Canadian AI Dividend Plays

Now let’s cross the border and look at two Canadian dividend payers riding the AI wave.

Toromont Industries (TIH.TO): Building the AI Infrastructure

Everyone is talking about data centers — but who’s building them? That’s where Toromont Industries comes in. As one of North America’s largest Caterpillar dealerships, Toromont supplies the heavy equipment, power systems, and cooling technology that keep those data centers humming.

Its acquisition of AVL Manufacturing adds expertise in modular cooling systems, a growing need for AI-driven facilities. Meanwhile, steady demand in mining, construction, and infrastructure keeps cash flowing.

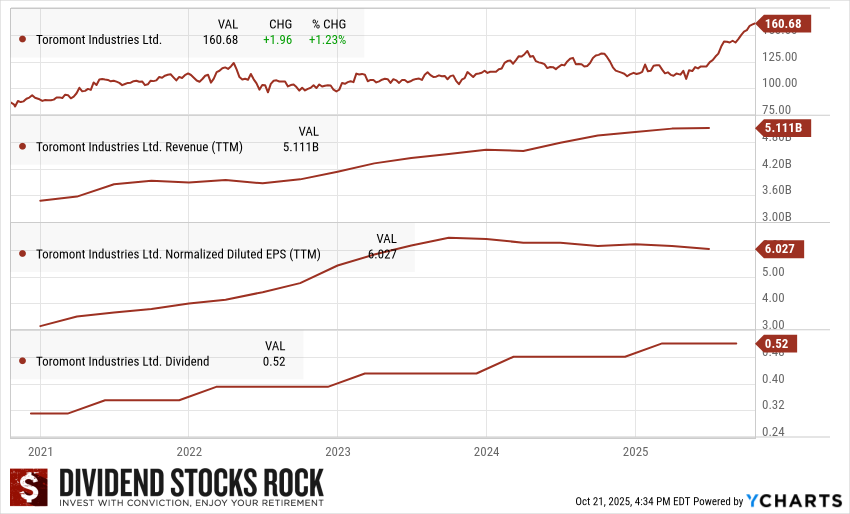

(Click on image to enlarge)

Toromont Industries (TIH.TO) 5-Year Dividend Triangle Chart.

Toromont’s diversification between equipment sales, rentals, and product support ensures resilience through economic cycles. Its dividend triangle is textbook: rising revenues, consistent earnings growth, and a long history of dividend increases.

When you combine a well-run industrial business with AI infrastructure demand, you get a quiet compounder that’s still flying under most investors’ radar.

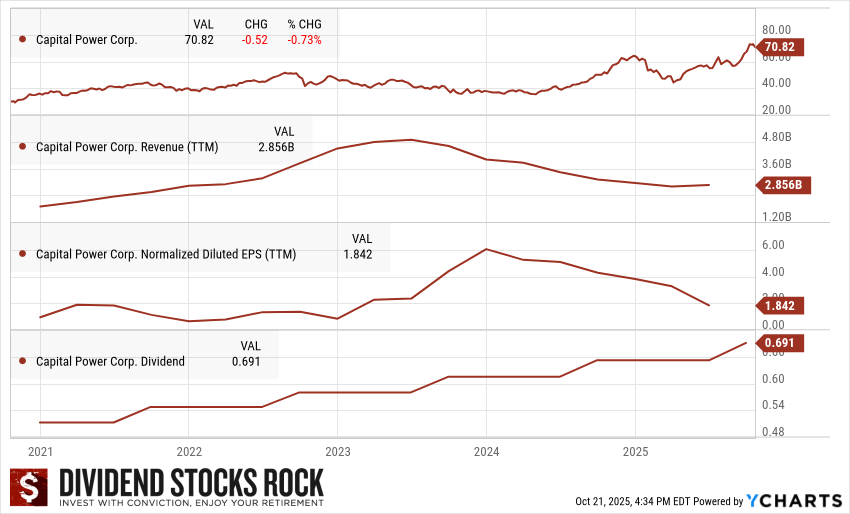

Capital Power (CPX.TO): Powering AI’s Energy Appetite

AI doesn’t run on hype — it runs on electricity. And the demand for power is surging.

That’s good news for Capital Power, one of Canada’s leading independent power producers. Management has already flagged AI data centers as a massive growth opportunity. Alberta is becoming a data hub, and CPX’s Genesee CCS project and expanding renewable capacity are perfectly positioned to feed that need.

(Click on image to enlarge)

Capital Power (CPX.TO) 5-Year Dividend Triangle Chart.

Beyond AI, Capital Power continues to transform its portfolio — reducing Alberta exposure, adding U.S. natural gas and renewable assets, and targeting 8% annual AFFO per-share growth. Its strategy combines flexibility, diversification, and a growing renewable footprint.

CPX’s dividend triangle shows reliable growth backed by disciplined capital management. It’s a compelling way to benefit from AI’s side effect — skyrocketing energy consumption — without chasing the hype stocks.

The Bottom Line: AI or Not, Quality Always Wins

AI is changing everything — from payments to infrastructure to power grids — but the fundamentals of good investing haven’t changed.

The best AI plays aren’t necessarily tech start-ups or chipmakers. They’re established, cash-generating businesses that use AI to strengthen their already winning models.

Visa, Mastercard, Parker Hannifin, Toromont, and Capital Power all share the same DNA: strong balance sheets, wide moats, consistent dividend growth, and a smart approach to innovation.

AI may reshape the economy, but dividend growth investing remains timeless.

More By This Author:

Low Debt Companies To Invest In

Confused About Stock Price Movement?

Pumping Steady Cash Flow Into Dividends