US Bank Deposits Fell Ahead Of Stress Tests; Fed Bailout Facility Stuck At Massive $107BN

Image Source: Pexels

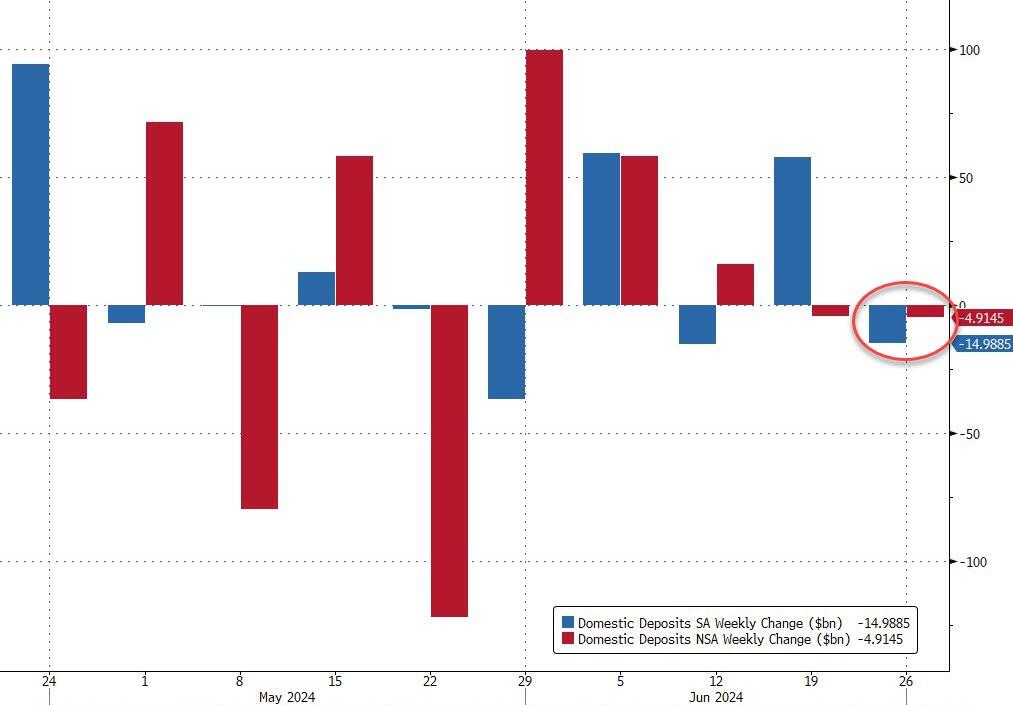

Heading into the bank stress tests, money-market fund total assets rose by a de minimus $5BN while seasonally-adjusted bank deposits fell $18BN to $17.594 TN...

Source: Bloomberg

And, on a non-seasonally-adjusted basis, deposits also fell (for the second straight week) by $14.8BN

Source: Bloomberg

Excluding foreign deposits, total domestic deposits fell on both an SA and NSA basis (-$15BN and -$5BN respectively)...

Source: Bloomberg

Small banks and Large banks both saw $7.5BN outflows (SA) each, while on an NSA basis, Small banks saw $5.9BN outflows as Large banks saw around $1BN of deposit inflows.

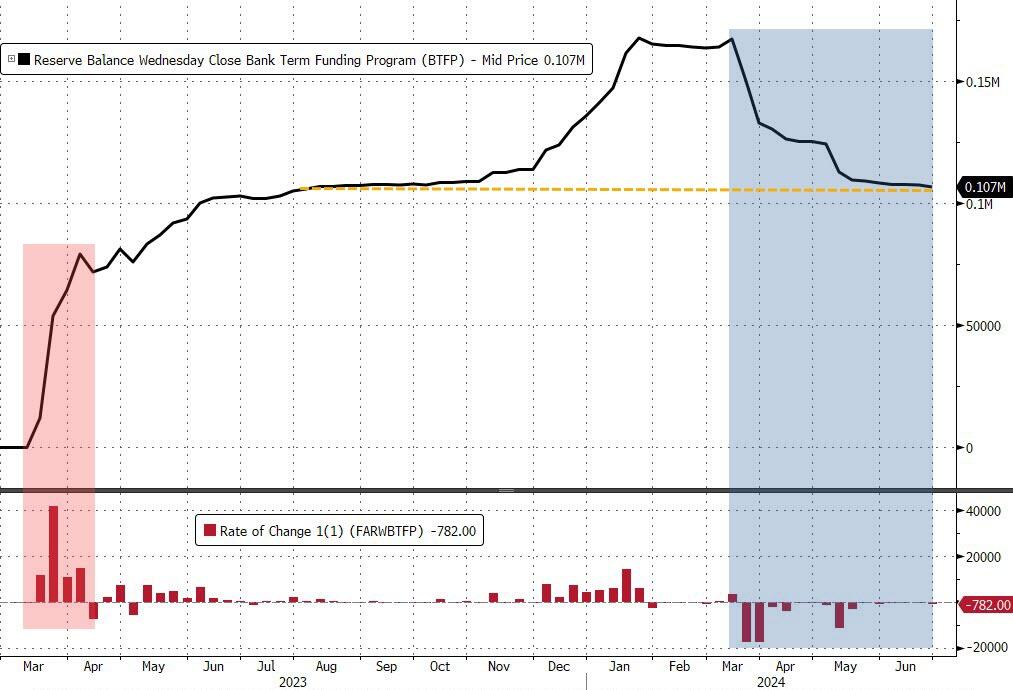

Usage of The Fed's bank bailout facility shrank a tiny amount - but still remains at an extremely high $107BN that the banks do not want to repay any time soon...

Source: Bloomberg

On the other side of the ledger, loan volumes shrank overall with a $630MN increase at large banks offset by a $3.7BN loan volume shrink at small banks...

Source: Bloomberg

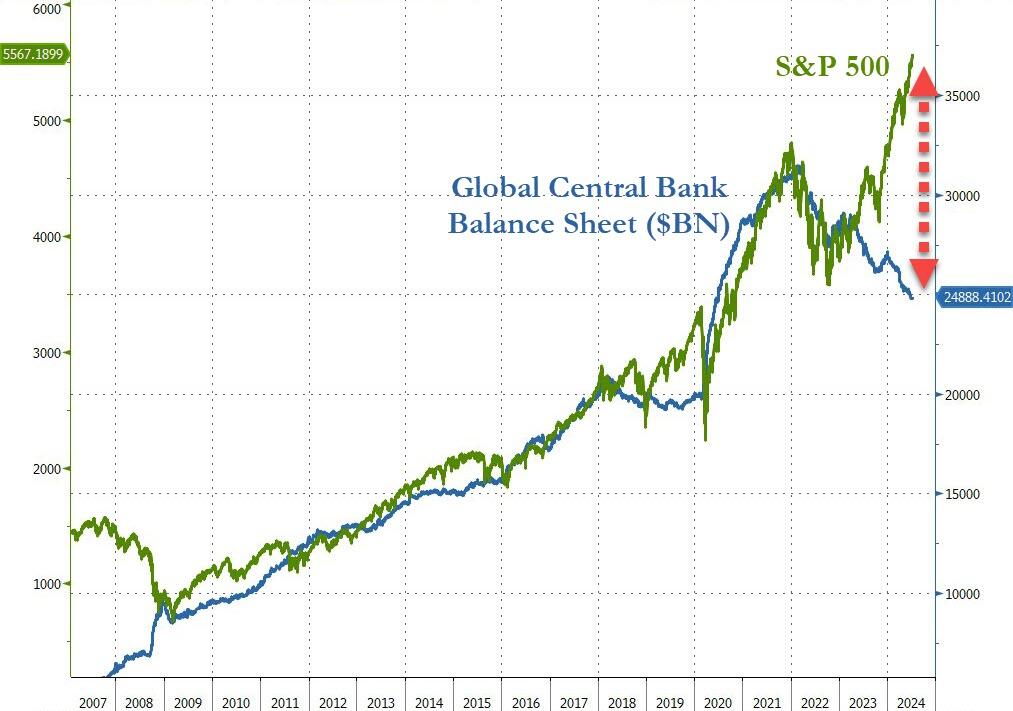

Finally, US equity market capitalization remains drastically decoupled from its historically tight relationship with bank reserves at The Fed...

Source: Bloomberg

But globally, central bank balance sheet shrinkage continues as stocks soar...

Source: Bloomberg

Now that would be quite recoupling...

More By This Author:

BYD Expands To Thailand, Cuts Prices, In Midst Of Ongoing EV War

June Payrolls Preview: Another Big Drop

Inflation Hits The Grill: The Price Of A July 4th Cookout Keeps Soaring Under Biden

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more