Twenty Percent

Lucy Van Pelt: I know how you feel about all this Christmas business, getting depressed and all that. It happens to me every year. I never get what I really want. I always get a lot of stupid toys, or a bicycle, or clothes, or something like that.

Charlie Brown: What is it you want?

Lucy Van Pelt: Real estate.

Source: YouTube

The stock market is pretty boring these days. Even crypto is pretty boring these days. It’s the summer. There’s nothing going on.

There is quite a bit of action in residential real estate, as you probably heard. Real estate went vertical after the vaccines and the inauguration. I’ll do my best to analyze this.

The real estate market has suffered from chronic underinvestment since the financial crisis. Meanwhile, the population has slowly grown, and the undersupply of homes has become more acute.

Plus, interest rates have dropped below 3%, and we had a big sentiment blastoff from the end of COVID. Now prices have jumped as much as 30% in some places—in six months. Especially where I live, in coastal South Carolina.

I’ve been spending the last few days surfing Zillow, looking at stuff in my neighborhood and in and around Charleston. Prices have reached stratospheric levels.

The typical home in Mount Pleasant, a suburb north of Charleston, costs $1,000 per square foot or more. There are seven-figure teardowns on Isle of Palms. Stuff is up 5x–10x in ten years.

This is a direct result of the migration that’s happening from blue states like New York to red states like South Carolina. And everyone who works in the real estate business—from brokers to contractors to land speculators—is positively giddy.

The reflex here is to declare it a bubble and short it. Because, well, that is what worked the last time. And I think there are a lot of people who saw The Big Short who have dreams of putting on the short trade of a lifetime and walking off a hero.

I think it’s a bit premature to do that, to say the least.

Structural Imbalance

I don’t have the statistics at my command, but I can say anecdotally that there simply haven’t been enough houses built to keep up with population growth in the last ten years. The shortage is particularly problematic in multifamily housing.

It will be a good 3–5 years before we achieve equilibrium again. Until then, prices will rise.

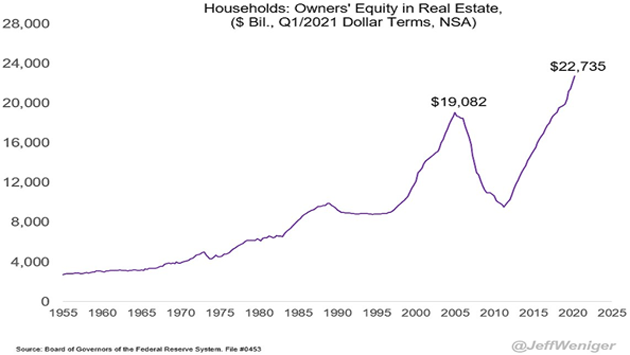

And rising they are. Here’s a chart of total home equity in housing, going back to the last housing bubble and beyond.

Source: @jeffweniger

It’s been a long time since we talked about wealth effects from home equity, but we’re going to see them once again.

We didn’t have Zillow the last time around. Now we do, and it’s very easy for people to pull up a ballpark estimate of the value of their home… And then go out and buy a TV the size of a parking space.

Interest rates are low and may go higher, but not by much. A few months ago, when tens were teasing 1.80%, we were having open discussions about yield curve control out of the Fed. That proved to be the top in yields.

Rates may rise, but I’m skeptical that mortgage rates will move meaningfully above 4% (at least in the next couple of years). Even a 100-basis point move in mortgage rates wouldn’t be enough to slow down demand.

Meanwhile, Fed money printing (or whatever you want to call it) has set off a commodity boom and an increase in the price of virtually all the raw materials that go into making a house.

If houses cost more to make, they will cost more to sell, or the builders will experience margin compression. I am in the process of building a house, so I know all about this.

In order to experience a meaningful correction in housing, it has to become unaffordable. And with mortgage rates below 3%, we have a long way to go—housing is still very affordable.

High prices are the cure for high prices. And there is no sign that banks are loosening their underwriting standards…yet.

Asset Allocation

In The Awesome Portfolio, I recommend a 20% allocation to real estate. That can take the form of equity in your own home, or rental properties, or publicly traded REITs.

A portfolio without real estate would have dramatically underperformed in the past six months—that is why we have it. Real estate is strongly correlated to the inflationary impulse. We are witnessing this in real-time.

I don’t think this is a bubble—yet. It’s a bull market with strong fundamentals. I was lucky enough to buy a piece of land right before the blastoff simply on the basis that it looked cheap, using no other analytics than eyeballs. I must have good instincts.

There is not much cheap real estate left. But if you are on the cusp of making a large real estate decision, you shouldn’t let the last six months of activity deter you.

Disclaimer: The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Patrick Cox’s Tech Digest, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, Just One ...

more