Tuesday Talk: What Side, Upside?

As US markets return from the Juneteenth holiday, investors are keen to see if Friday's "rebound" will continue on Tuesday.

With all three main indexes stumbling into bear territory earlier last week, all bets seem to be off for a return to the upside any time soon.

Chart: Investing.com

Having said that, market futures are currently in the green: S&P 500 market futures are trading up 70 points, Dow market futures are trading up 500 points and Nasdaq 100 futures are trading up 231 points.

This morning's column checks the pulse of some of the bears, bulls and pragmatists among our contributors.

TalkMarkets contributor Stefan Gleason writes that The Economy Headed For A Hard Landing.

"The U.S. economy appears headed for a hard landing.

After months of ignoring the steadily growing inflation problem, the Federal Reserve is now using monetary blunt force to try to rein in rising prices.

Fed policymakers have effectively decided that inflation is so out of hand, that they are willing to induce an economic slowdown that will reduce aggregate demand for goods and services."

"Stocks, which are now fully in the bear market territory, tend to lead the economy. The message of the market is that a recession is coming...

The housing market faces a reckoning after the fastest rise in mortgage rates since 1987.

Sellers are now being forced to negotiate prices down so buyers can afford the monthly payments. Meanwhile, housing starts, home construction permits, and mortgage applications are now falling rapidly.

Other danger signs for the economy:

- The Atlanta Federal Reserve Bank’s GDPNow tracker shows economic growth coming in at 0% this spring, down from previous projections of second-quarter GDP gains.

- The Philadelphia Fed Business Index turned negative for the month of June, the first such contraction since the depths of the COVID lockdowns.

- Social mood is collapsing, with the latest University of Michigan Survey of Consumers showing consumer sentiment plunging to a record low.

- A recent survey found that small business owners are “feeling their gloomiest in nearly five decades.”

- And finally, 59% of U.S. manufacturers now believe that a recession is coming."

Gleason's Rx for this is to hold gold and silver...

See the full article for more details.

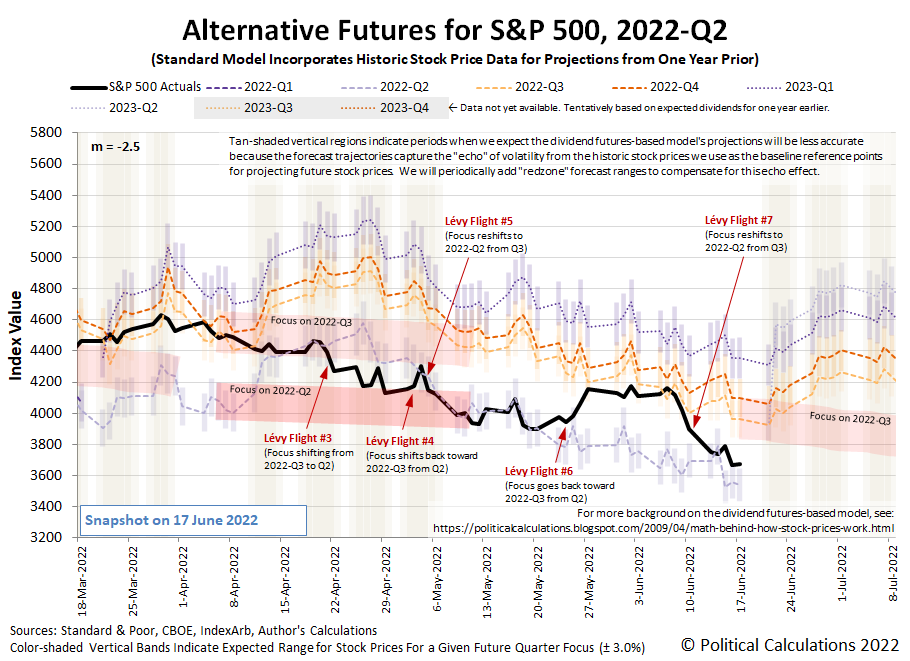

Contributor Ironman notes The S&P 500 Enters Bear Market Territory As Fed Hikes Interest Rates, but charts some alternative scenarios which show that all may not be doom and gloom. Of course there are a couple of big "ifs" included.

"The story of what happened to the S&P 500 (SPX) in the past is a simple one. After running into President Biden's wall of inflation the previous week, the index plunged into the bear market territory. Through the end of the trading week ending June 17, 2022, the index was 23.4% below its January 3, 2022 record high peak."

"From our perspective, after the May 2022 inflation report came in higher than expected, investors sent the S&P 500 lower in a new Lévy flight event, the seventh of 2022, as investors scrambled to shift their attention back toward 2022-Q2 from 2022-Q3. But with the expiration of 2022-Q2's dividend futures contracts on Friday, 17 June 2022, the market has effectively entered 2022-Q3, even though the calendar quarter won't click over for another two weeks.

We think investors will, once again, shift their forward-looking attention toward 2022-Q3, because what actions the Fed will take next as it scrambles to get ahead of inflation will hold the focus of investors on this quarter. We've updated the alternative futures chart to add a new red zone forecast range to indicate where stock prices will likely go during the next several weeks, also assuming no deterioration of expected dividends or outbreaks of noise in the market.

In the very short term, that red zone forecast range suggests a higher level for the index, but one that could be relatively short-lived. We peeked ahead at the dividend futures-based model's projections for 2022-Q3, and see that the red zone range continues to drop to roughly where stock prices are today."

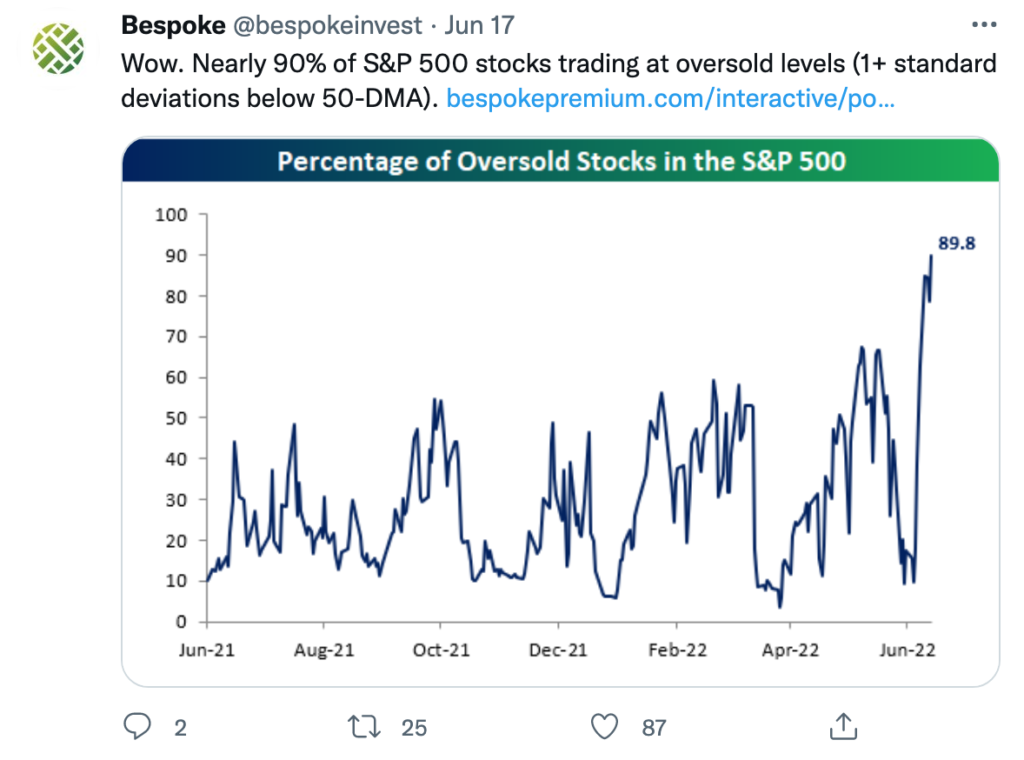

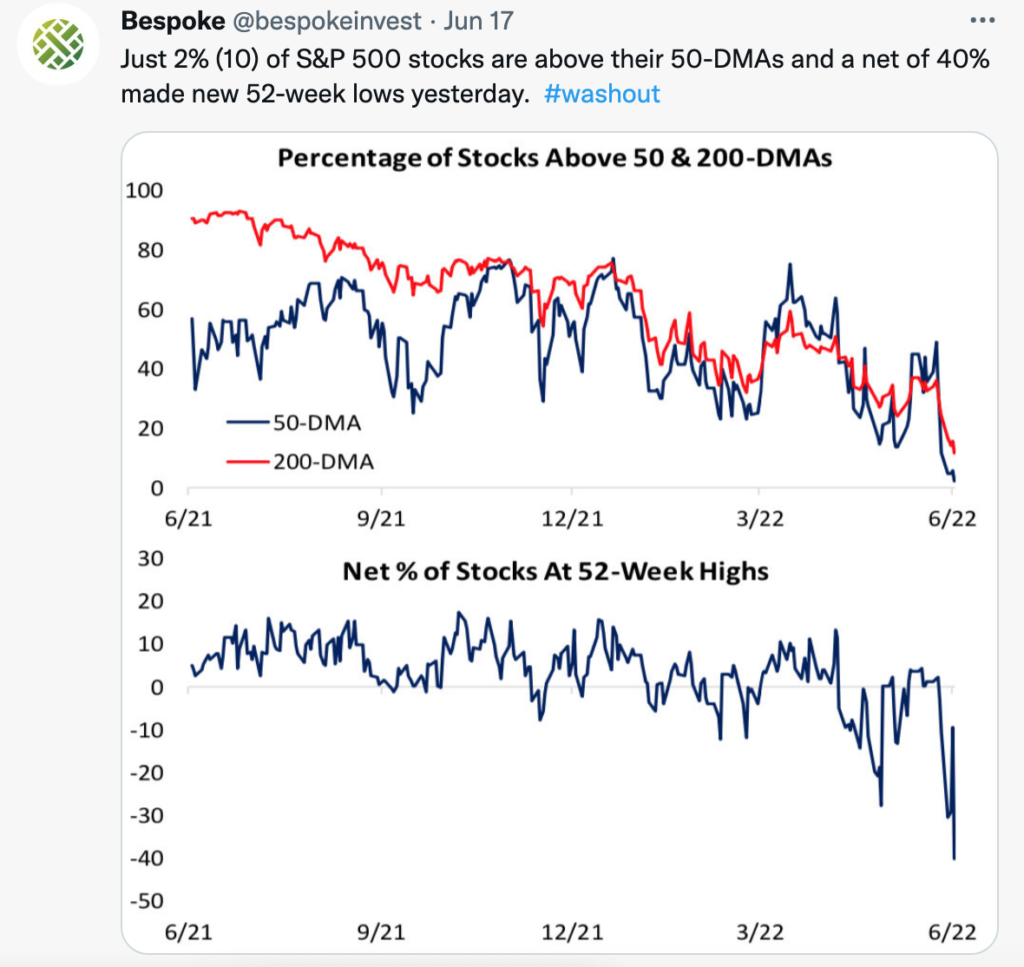

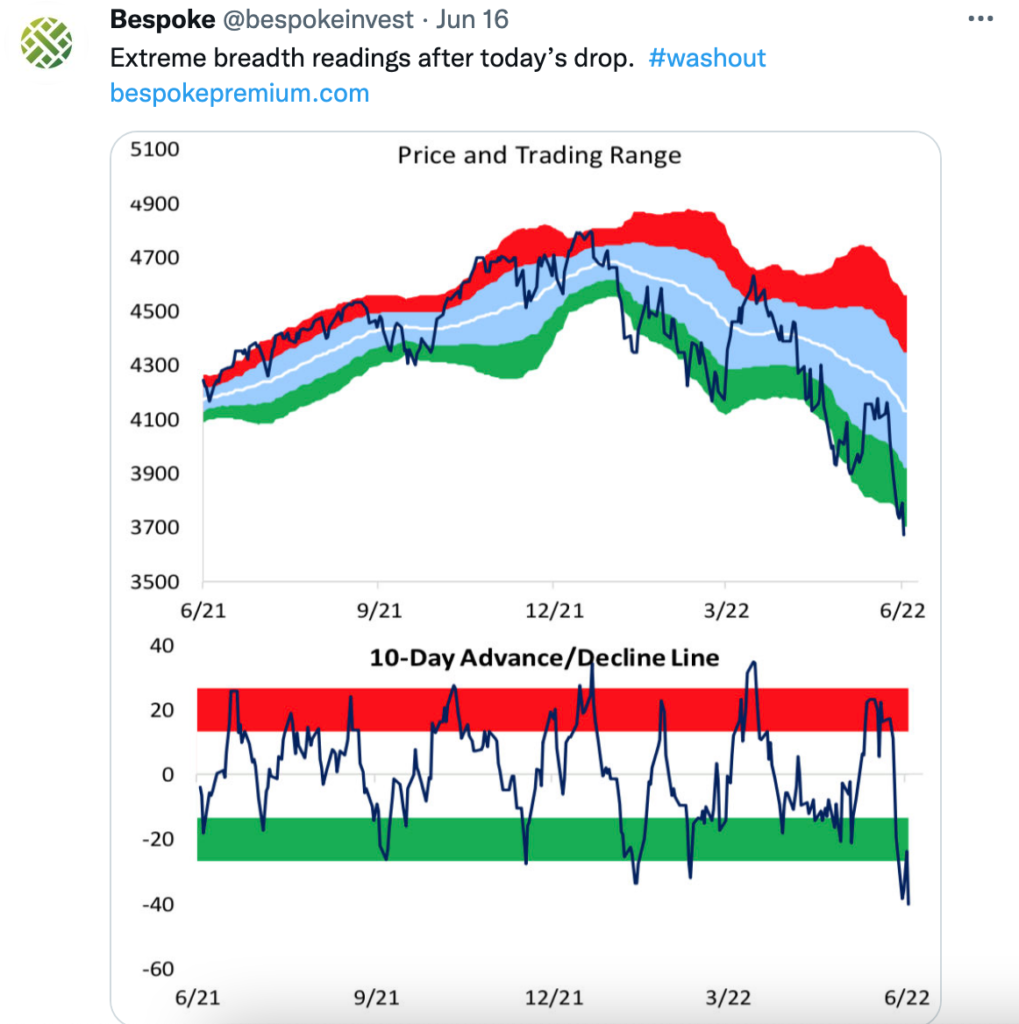

TM contributor Zachary Scheidt is the bull in today's round-up writing that The Stock Market Is So Bad, It’s Great.

"As stocks entered a bear market last week, I couldn’t help but remember the famous Rothschild quote: “Buy to the sound of cannons and sell to the sound of trumpets.“

The cannons are getting pretty loud these days. And according to many statistical measures, things have become so bad that we’re well overdue for a major market rebound.

First, the percentage of “oversold” stocks is at extreme levels.

Similarly, the number of stocks trading below key technical levels is at historical lows.

And the short-term advance-decline line confirmed the market is “washed out.”

These numbers tell us the market’s recent action is so bad, that it’s actually good news for investors...

Bear markets are famous for periods of “capitulation” followed by sharp moves higher.

That’s because investors often get fearful at the same time, selling in a panic. This is the kind of action we’ve seen in the last couple of weeks. And it’s what has led to the extreme readings on the charts above.

Sentiment levels — such as the number of investors who consider themselves “bearish” — are showing a similar picture.

Once these investors are out of the market, there are fewer people left to sell.

And without sellers, any good news naturally drives stock prices higher.

Heck, even the lack of bad news can ignite a bear market rally.

As we wait for the market to open on Tuesday morning, I’m wishing I had bigger positions in my investment accounts."

Of course not everything happens in New York and contributors Padhraic Garvey, CFA, Benjamin Schroeder and Antoine Bouvet of ING Economics in their column Rates Spark: No News Is Bad News catch readers up with European sentiment following the French national parliamentary elections last week.

"Markets ignoring French election results suggests that their fear of monetary tightening supersedes other drivers. The ECB has managed to cap sovereign spreads for now but questions remain about its new instrument and its impact on semi-core bonds such as France’s."

"The lack of strong reaction suggests that investors have a much bigger monetary fish to fry. The fate of sovereign yields and spreads is beholden to monetary policy and, in that regard, European Central Bank (ECB) comments should continue to carry disproportionate importance in setting price action. In a monetary tightening environment, it is logical that spreads would widen, to 55bp in the case of 10Y France-Germany, compared to an average of 34bp in the QE era that started in 2015...

...to what degree does the ECB need to tighten policy in the coming quarters. Lagarde repeated yesterday that the first increment will be a 25bp hike in July but the pressure is building for a larger move. Assuming the ECB sticks to its guns, this will only increase the market hike discount for subsequent meetings. This is particularly true with energy prices remaining stubbornly high, and with elevated geopolitical tensions in Eastern Europe."

Linking hikes to wages would raise fears of over-tightening at the ECB

Image Source: Refinitiv, ING

See the full article for more on what sure is the definition of a "hot-mess"...

There has been an abundance of chatter, (now that the market has cratered) about the wisdom of holding individual stocks instead of funds, whether you agree with that particular POV or not, contributor Sweta Killa suggests 5 Safe ETFs To Play Amid Recession Fears.

"The U.S. stock market is shaping up for the worst year in decades. This is especially true as the S&P 500 slipped into the bear market on renewed inflation concerns that could push the economy into a recession. Russia’s invasion of Ukraine, tightening monetary policy and surging commodity prices have been weighing on investors’ sentiment.

Given the myriad of woes, investors should stash their cash in ETFs of some safe investing zones. These are SPDR Gold Trust ETF (GLD), iShares 20+ Year Treasury Bond ETF (TLT), iShares Edge MSCI Min Vol USA ETF (USMV), Vanguard Dividend Appreciation ETF (VIG) and AGFiQ US Market Neutral Anti-Beta Fund (BTAL).

Below are abbreviated excerpts. Please see the full article for more particulars.

"Gold - SPDR Gold Trust ETF

...SPDR Gold Trust ETF tracks the price of gold bullion measured in U.S. dollars and kept in London under the custody of HSBC Bank USA. It is an ultra-popular gold ETF with an AUM of $62.4 billion and a heavy volume of nearly 8 million shares a day. SPDR Gold Trust ETF charges 40 bps in fees per year from investors and has a Zacks ETF Rank #3 (Hold) with a Medium risk outlook.

Long-Dated Treasury - iShares 20+ Year Treasury Bond ETF

The products tracking the long end of the yield curve often provide a safe haven. TLT provides exposure to long-term Treasury bonds by tracking the ICE U.S. Treasury 20+ Year Bond Index. It holds 33 securities in its basket and charges 15 bps in annual fees. iShares 20+ Year Treasury Bond ETF has an average maturity of 25.87 years and an effective duration of 8.13 years. TLT is one of the most popular and liquid ETFs in the bond space, with an AUM of $18.8 billion and an average daily volume of 21 million shares.

Low Volatility - iShares Edge MSCI Min Vol USA ETF

Low volatility products have the potential to outpace the broader market providing significant protection to the portfolio. These include more stable stocks that have experienced the least price movement. Further, these allocate more to defensive sectors that usually have a higher distribution yield than the broader markets. While there are several options, USMV, with an AUM of $25 billion and an average daily volume of 3.9 million shares is the most popular ETF...iShares Edge MSCI Min Vol USA ETF tracks the MSCI USA Minimum Volatility Index, holding 173 stocks in its basket. The product charges 15 bps in annual fees and has a Zacks ETF Rank #3 with a Medium risk outlook.

Dividend - Vanguard Dividend Appreciation ETF

The dividend-paying securities are the major sources of consistent income for investors when returns from the equity market are at risk. This is especially true as these stocks offer the best of both these worlds — safety in the form of payouts and stability in the form of mature companies that are less volatile to large swings in stock prices... Vanguard Dividend Appreciation ETF holds 289 stocks in its basket with an AUM of $59.4 million. The fund trades in a volume of 1.6 million shares a day on average and charges 6 bps in annual fees. Vanguard Dividend Appreciation ETF has a Zacks ETF Rank #1 (Strong Buy) with a Medium risk outlook.

Long/Short - AGFiQ US Market Neutral Anti-Beta Fund

AGFiQ US Market Neutral Anti-Beta Fund has the potential to generate positive returns regardless of the direction of the stock market as long as low-beta stocks outperform high-beta stocks. It invests primarily in long positions in low-beta U.S. equities and short positions in high-beta U.S. equities on a dollar-neutral basis within sectors. AGFiQ US Market Neutral Anti-Beta Fund has an AUM of $175.4 million and an expense ratio of 2.53%. It trades in an average daily volume of 196,000 shares."

Caveat Emptor!

Today is the first day of summer!

I'll be back on Thursday.

Support Ukrainian relief efforts