Tuesday Talk: Slip Sliding Sideways

With the Middle East seemingly going to Hell in a proverbial handbasket the markets seem to be slip sliding, not away (as the Paul Simon song would have it) but, sideways as it were. Yesterday the S&P 500 closed down 11 points, at 4,163, the Dow closed down 54 points, at 34,328 and the Nasdaq Composite closed down 51 points, at 13,379. Currently futures for all 3 indices are trading in the green.

Nevertheless, TalkMarkets contributor Jill Mislinski brings us the latest New York recovery stats in her article, Empire State Mfg Survey: Continued Growth In May She notes that though general business sentiment dropped from 26.3 in April to 24.3 in May, economic activity continues to expand a healthy rate. Mislinski includes this quote from the beginning of the report:

"Business activity continued to grow at a solid clip in New York State, according to firms responding to the May 2021 Empire State Manufacturing Survey. The headline general business conditions index was little changed at 24.3. New orders and shipments continued to expand strongly, and unfilled orders increased. Delivery times lengthened significantly, and inventories moved somewhat higher. Employment levels grew modestly, and the average workweek increased. Both input prices and selling prices rose at a record-setting pace. Looking ahead, firms remained optimistic that conditions would improve over the next six months, and expected significant increases in employment and prices. [full report]"

Mislinski includes several charts showing manufacturing activity in New York and nationwide, including the chart below which plots activity by five Fed regions and the average of all 5. As she notes, one can clearly see the timing differences in expansion and contraction by region, but the expansion from the 2020 COVID-19 recession is strong in all regions (despite the current m-t-m drop).

Contributor Alex Barrow takes us through his weekly set of charts to help readers understand what's going on in the markets and with the recovery in general. In a TM Editor's Choice article one of the questions he asks is, is it Time To Buy Weed Stocks? But before tackling that questions he gives this take on on the current state of inflation.

"(According to data from Bank of America (BAC): “It’s hard even to imagine a wage-spiral tail risk. It would take steady wage gains of 10-12% to push inflation to the levels of the 1970s & 80s, and the US economy is structured very differently today. Non-elite unions are politically toothless. Technology penetrates every industry. The offshoring of more services is coming.” I agree with this take in regards to stickier secular inflation though I believe cyclical inflation will be more persistent than many are expecting. "

Barrow includes the following chart:

Whether to help us deepen the haze or get through it greener than when we entered it Barrow concludes with the following note:

"There’s a number of great tapes and values in the (Cannabis) space. Canadian listed US MSO GreenThumb Industries (GTBIF) is one of them."

More to the point of today's column headline TalkMarkets contributor Douglas Gammons in an Editor's Choice piece entitled Signs Of A Fake-Out Rally? is happy to be a participant in the market's run-up since its' 2020 lows, but is concerned about the trends for the year. Worth the read. Here are a few of his takes:

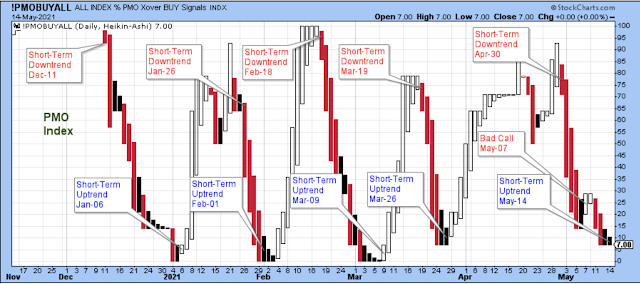

"Last week, I said that a new short-term uptrend had started on Friday, May 7, but that was a bad call. However, a week later on Friday, May 14, a new short-term uptrend has started - although it is not yet confirmed by some of the important indicators. In other words, watch for signs that this is another fake-out rally (see chart below)."

"I was happy with the way I executed my trading plan during this past week...I just held onto positions unless they stopped me out, and fortunately only a couple triggered sells."

"I am hoping to continue to participate in the uptrend for as long as it lasts, and I am also hoping to be out when it falters. Additionally, I am not considering any purchase to be "long-term" with the market so extended, no matter how good the story or earnings in the stock."

He sums up the state of the market in these four bullets:

-

The short-term trend is up for stock prices as of May 14. This is where the change in trend began.

-

Contrarian sentiment is unfavorable for stock prices as of Nov. 14.

-

The economy is in expansion as of Sept. 19.

-

The medium-term trend for treasury bonds is down as of Oct. 10 (prices lower, yields higher).

Contributor Jesse in Stocks And Precious Metals Charts - Who Let The Dawgs Out? - Gold And Silver Rally Higher notes that precious metals day traders had a chance to make some hay, but also gives us some heady charts such as "Blow-Off Top No. 8" for Nasdaq 100 futures below.

"Stocks were off again today, but gathered themselves and managed to take back quite a bit of the loss in the afternoon. But gold and silver were the real surprises today, bolting higher and never looking back. Who let the dawgs out?"

Contributor Sweta Killa closes out this week's column with a look at 5 Sector ETFs That Survived Last Week's Turmoil.

"Wall Street saw tumultuous trading last week with the Dow Jones and the S&P 500 dropping 1.1% and 1.4%, respectively...The spike in inflation has made investors jittery, compelling them to dump the growth stocks in particular. This is because rising prices tend to squeeze margins and erode corporate profits for the growth companies, which usually have higher valuations...However, the stocks rebounded later in the week as investors jumped in to cash the beaten down prices and snapped up the stocks that would benefit from an economic recovery. Against such a backdrop, we have highlighted five sector ETFs that performed well last week and survived the broad market rout.

JPMorgan Alerian MLP Index ETN (AMJ)

MLPs gained popularity on President Joe Biden’s capital gain tax hike plan as they offer huge capital tax benefits. While most MLPs gained, AMJ topped the list. This fund provides investors a way to gain exposure to midstream energy MLPs.

iShares MSCI Global Gold Miners ETF (RING)

Gold logged in the second consecutive week of gains as U.S. dollar declined...This ETF follows the MSCI ACWI Select Gold Miners Investable Market Index and holds 40 securities in its portfolio. Canadian firms take half of the portfolio, while the United States and South Africa round off the next two spots. RING is the cheapest choice in the gold mining space...

Invesco S&P SmallCap Consumer Staples ETF (PSCC)

The consumer staples sector generally act as a safe haven amid political and economic turmoil. Stocks in these sectors generally outperform during periods of low growth and high uncertainty. This fund targets the small-cap segment of the consumer staples sector by tracking the S&P SmallCap 600 Capped Consumer Staples Index...

iShares U.S. Pharmaceuticals ETF (IHE)

This ETF provides exposure to 45 U.S. companies that manufacture prescription or over-the-counter drugs or vaccines by tracking the Dow Jones U.S. Select Pharmaceuticals Index.

Global X Cybersecurity ETF (BUG)

This ETF offers exposure to the companies that stand to benefit from the increased adoption of cybersecurity technology and follows the Indxx Cybersecurity Index. It holds 32 stocks in its basket..."

Read the full article for more details. As always, caveat emptor.

It's going to be another tumultuous week on many fronts. Here's a YouTube clip of Simon and Garfunkel "Slip slidin" to help get you through.

See you next week.

I see things differently. All it takes to start and grow inflation is dumping in money. Wages do not need to rise for inflation to take off. Does anybody actually believe that dumping FIVE TRILLION DOLLARS into the economy will not launch a cycle of inflation that will cause a whole lot of damage ao a whole lot of people? And it will be serious damage that will threaten the stability of society. Things will change, and not one atom of that change will be for the better. When a whole lot of people suddenly become both homeless and hungry they may not listen so politely as they do while they are at home and fed.

For a good take on Biden’s ambitions for the infrastructure program(s) check out NPR’s Special Edition of it’s UpFirst podcast with Presidential historian Doris Kearns which was put up over the weekend.

My point was that the records show that in the past, every time money was dumped into the economy, inflation resulted. So why should this time be any different?? There does not seem to be any change in the mechanism of inflation, and so it seems that the results of the action will be the same, although the time delay might be different.

My other concern is about the effect of all that debt on the future. The bad thing about debts is that they must eventually be paid off. ( I keep saying this, I believe it is true.)