Empire State Mfg Survey: Continued Growth In May

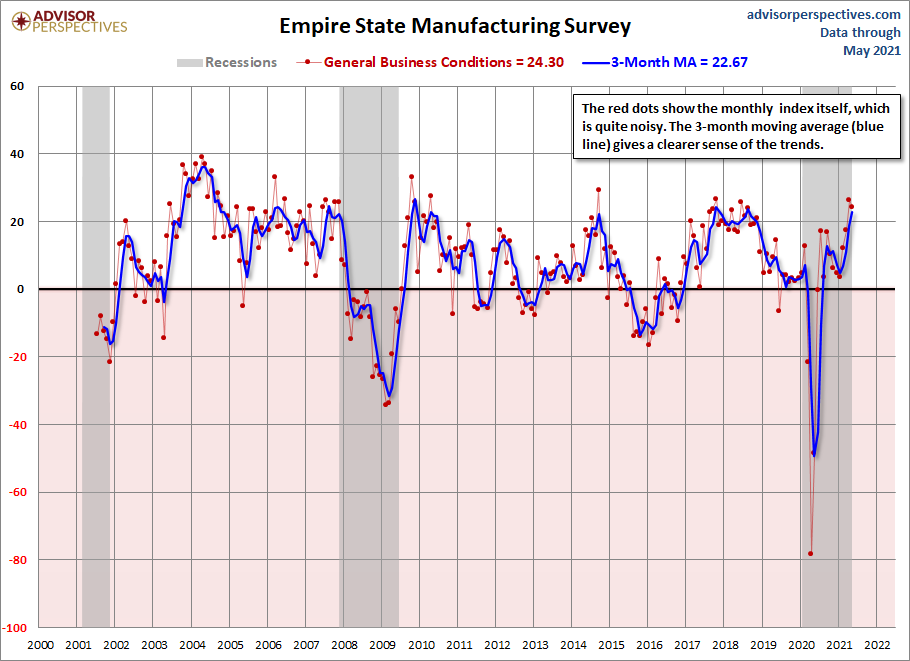

This morning we got the latest Empire State Manufacturing Survey. The diffusion index for General Business Conditions at 24.3 was a decrease of 2.0 from the previous month's 26.3. The Investing.com forecast was for a reading of 23.9.

The Empire State Manufacturing Index rates the relative level of general business conditions in New York state. A level above 0.0 indicates improving conditions, below indicates worsening conditions. The reading is compiled from a survey of about 200 manufacturers in New York state.

Here is the opening paragraph from the report.

Business activity continued to grow at a solid clip in New York State, according to firms responding to the May 2021 Empire State Manufacturing Survey. The headline general business conditions index was little changed at 24.3. New orders and shipments continued to expand strongly, and unfilled orders increased. Delivery times lengthened significantly, and inventories moved somewhat higher. Employment levels grew modestly, and the average workweek increased. Both input prices and selling prices rose at a record-setting pace. Looking ahead, firms remained optimistic that conditions would improve over the next six months, and expected significant increases in employment and prices. [full report]

Here is a chart of the current conditions and its 3-month moving average, which helps clarify the trend for this extremely volatile indicator:

Click this link to access a PDF set of charts of the individual components over the past 12 months.

Since this survey only goes back to July of 2001, we only have two complete business cycles with which to evaluate its usefulness as an indicator for the broader economy. Following the Great Recession, the index has slipped into contraction multiple times, as the general trend slowed. We saw a gradual decline in 2015 that picked up in 2016, with a giant dip in 2020 due to COVID-19.

Here is an overlay of the current and future conditions (a six-month outlook).

Meanwhile, here's another look at the latest ISM Manufacturing Business Activity Index.

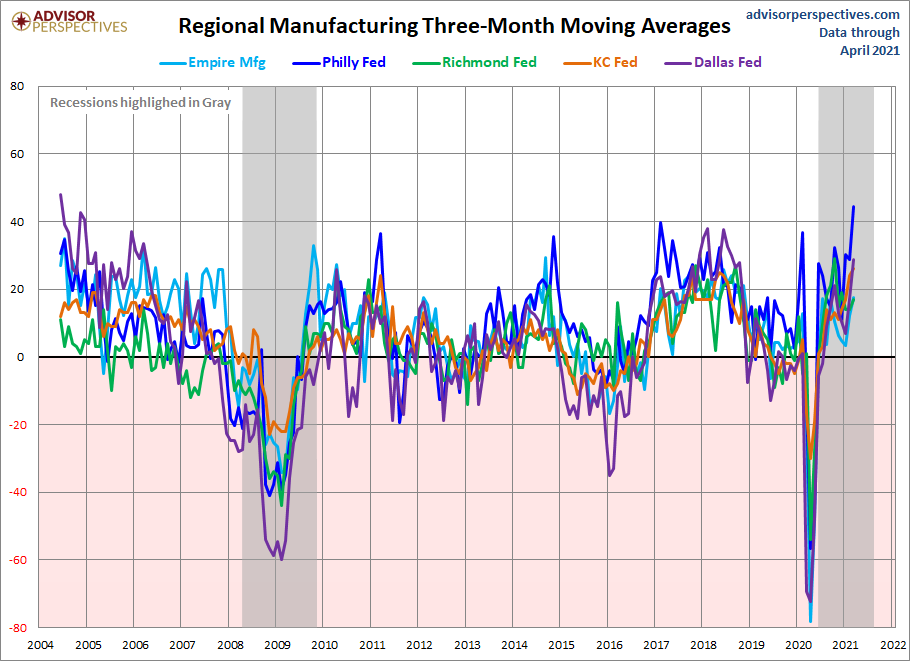

Let's compare all five Regional Manufacturing indicators. Here is a three-month moving average overlay of each since 2001 (for those with data).

Here is the same chart including the average of the five. Readers will notice the range in expansion and contraction between all regions.