Thoughts For Thursday: Putin Didn't Blink

Russia has launched a major assault on Ukraine. Missiles have hit Kyiv and other cities as ground forces invade and Putin warns against interference from foreign countries.

Reports of casualties are flowing into media outlets and the internet is awash with devastating video footage. It remains to be seen if Putin's unbridled aggression can be stopped before a descent into to some broader Hell.

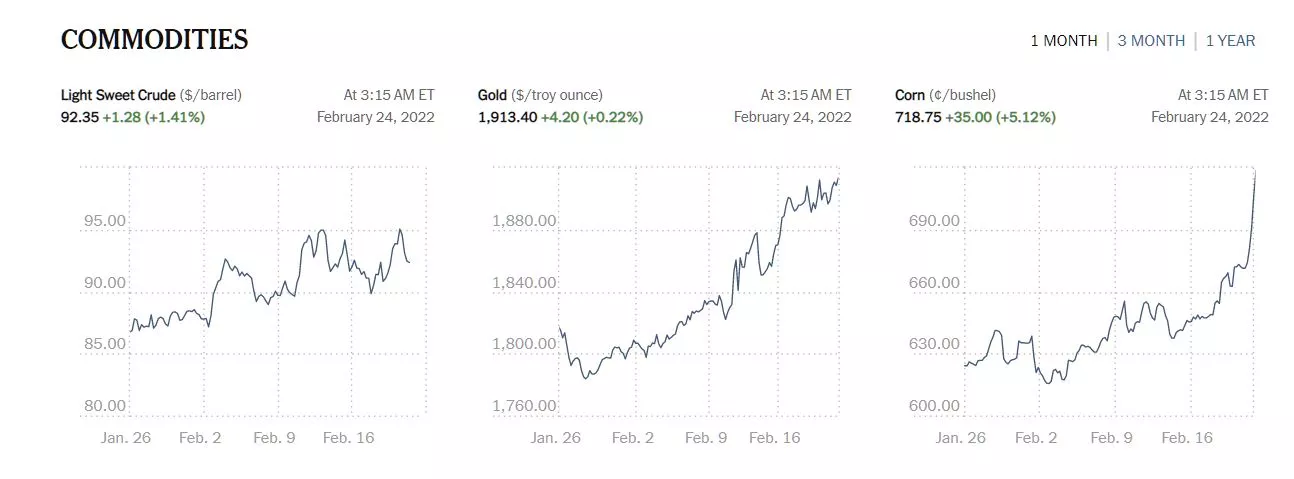

As expected, market reaction to news of a Russian invasion into Ukraine was negative. At the close of trading on Wednesday, the S&P 500 was down 79 points or 1.84%, closing at 4,226, the Dow was down 465 points or 1.38%, closing at 33,132 and the Nasdaq Composite was down 344 points or 2.57%, closing at 13,037. Commodities such as oil, gold and corn have moved higher.

Chart: The New York Times

In early morning trading U.S. market futures continue to trade lower. S&P futures are trading down 102 points, Dow futures are trading down 805 points and Nasdaq 100 futures are trading down 413 points.

For those readers who are not up to date on Russia or may simply be seeking more information TalkMarkets contributor Ryan McMaken has prepared just such an easy to read primer entitled Russian Weakness And The Russian "Threat" To The West.

It is worthwhile background reading as events unfold. While McMaken details a Russia many years behind both developed and developing nations towards the end of his article he offers the following explanation as to why Putin has decided to wage war on Ukraine.

"When it comes to Ukraine, the Russian regime could be willing to endure very high costs that the West is not politically prepared to endure. Moscow might be willing to cut deeply into that "disposable surplus" that is necessary for war-making. If the history of Russia proves nothing over the past 210 years, it's that Russian regimes are willing to expose the population to extreme deprivation in pursuit of protecting what the regime sees as vital interests.

This, however, must not be confused with the ability to engage in power projection or an ability to muster up offensive military capabilities. A country with an anemic GDP and declining population doesn't have these capabilities. Russia is strong enough—but only strong enough—to resist real great powers in defensive wars near its own borders. This, coupled with the fact that backing Moscow into a corner could lead to nuclear war, is all the more reason to avoid misreading the reality of Russia's offensive capabilities.

All these realities also help explain why relatively weak states like Russia are willing to court crisis even from a weakened position. As Kelly Greenhill and Joshua Shifrinson explain in Foreign Policy this week:

Why would states take such seemingly irrational steps as … military escalation that risk[s] antagonizing much more powerful states and triggering punishing retaliation? Why turn to the creation of crises as a method of influence? …Far from irrational, crisis generation is a tried-and-true strategy of weak actors seeking negotiations and concessions from stronger actors opposed to granting either.

Russia's actions in Ukraine are not the actions of a strong state with the capability of extending its power over vast new frontiers. Rather, the Ukraine situation is the result of the West's refusal to take seriously Moscow's concerns over extending NATO closer to the Russian heartland...This is what is now at work in eastern Ukraine. But none of this means Russia is a great power in the same league with the US, or even with Western Europe."

Contributor Adonis T Alagasi notes that Gold Soars To 13-Month Peak As Russia Invades Ukraine.

"Gold prices climbed more than 2% on Thursday as Russian forces attacked Ukraine. Bullion prices already rose by about 8% this month and are set for their highest monthly gain since July 2020. Spot gold is currently trading at $1,943.21 per ounce as of 0730 GMT...OANDA senior market analyst Jeffrey Halley commented that gold has regained its status as a safe-haven asset and could post new all-time highs in the coming weeks. City Index senior market analyst Matt Simpson added that the sanctions against Russia might not have their intended effects. He suggested that the West is at a disadvantage and that is the reason why gold prices are rising.

Some experts expressed concerns about the impact of sanctions on key commodities produced and exported by Russia. Russia is the third-largest gold producer in the world, producing around 310 tons in 2021. It is also a major producer of other commodities, such as aluminum, wheat, palladium, and platinum."

In a TalkMarkets Editor's Choice column the Staff at Equity Management Academy pronounces Russia Sets The Stage For A Global Currency War.

"The markets are confused right now, with black swans appearing, such as the Russia-Ukraine crisis, China is making noises on various fronts over Taiwan, their domestic economy, and Hong Kong. Global debt is still massive compared to GDP, which puts pressure on the integrity and purchasing power of currencies. Inflation is at 7 or 8% and governments continue to print money to prop up the economy. Supply shortages continue to hamper recovery. Crude oil may hit $100, which is not positive for the global economy. Interest rates and wages are starting to rise, in order to adjust to inflation...If the Russia-Ukraine crisis turns into a war, then the US dollar will shoot up, which usually happens since it is seen as a safe haven. However, since the dollar has a negative yield compared to inflation, such as with the 10-Year Note, it is not the safest of havens today. As an alternative, silver, gold, and Bitcoin will also be safe havens and will probably shoot up, too."

While markets react to sentiment they are not sentimental hence this headline (below tweet included) from contributor Greg Feirman: Buy The Invasion.

Buy the invasión 👇👇 pic.twitter.com/qUifW80mQE

— Álvaro Oviedo (@alvoviedo) February 21, 2022

"What investors have been fretting about finally happened: Russia invaded Ukraine Wednesday night. Bears have been correct in saying that we won’t see even an intermediate bottom until there is a real fear – and we haven’t seen it yet. Well, guess what? We’re going to see you at the open Thursday morning!

As I write (4 am EST), S&P Futures are -2% and Nasdaq Futures -2.5%. If these hold, the Nasdaq will have erased all of its gains since the beginning of 2021 and be down 20% from its November peak. Combined with the fact that similar post-WWII geopolitical events have been buying opportunities the correct move IMO is to BUY THE INVASION...My security of choice for doing so is Cathie Wood’s formerly loved – now hated – Ark Innovation ETF (ARKK). If you want to be more conservative, QQQ is a fine option. At $320, it will be down 20% from its November high and have just about erased ALL of its gains since the beginning of 2021. This is blood in the streets…. literally."

To close-out the column we move from the Ukraine, to U.S. consumer sentiment and TM contributor Mish Shedlock who notes Ebay And RealReal Shares Hammered On Declining Customers And Profit Respectively.

"eBay (EBAY) Still Losing Customers

Bloomberg reports eBay Warns Investors It’s Still Losing Customers

eBay Key Points

- eBay Inc. warned investors that first-quarter sales will miss estimates as shoppers return to pre-pandemic spending habits.

- Chief Executive Officer Jamie Iannone maintains the company’s advertising and payments businesses can boost profits even if total spending on the site falls.

- eBay ended the quarter with 147 million active buyers, down 9% from a year earlier. Gross merchandise volume, which is the value of all goods sold on the site, fell 10% to $20.73 billion in the period ended Dec. 31.

RealReal

The RealReal, Inc. (REAL) is an online and brick-and-mortar marketplace for authenticated luxury consignment. The RealReal sells consigned clothing, fine jewelry, watches, fine art, and home decor... the demand for luxury goods from the pretend wealthy is about to collapse into the gutter along with the stock market. The chart of EBay shows it's not just luxury goods at risk. The most amusing thing about the EBay chart is the P/E of 3.0. The market doesn't seem to believe that and neither do I.

This is a warning to value investors. What looks cheep can get a lot cheaper."

Caveat Emptor.

As ominous events continue to unfold in Ukraine, I leave you with this link to the Trepak (Tropak) sequence from Modest Mussorgsky's "Songs and Dances of Death". (Tropak is the name of a traditional Ukrainian folk dance.)

Be well.

Does Ukraine have any chance at all against Russia? It's a big country but can't imagine that their military compares to Russia's.