Russia Sets The Stage For A Global Currency War

Fundamentals

Russia has recognized two separatist regions, which is causing increased tensions. The UK has issued various restrictions to banking in relation to the regions. Russian troops continue to move into the area and into the separatist regions. Russia already has troops in what was Ukrainian territory, so the invasion has already begun, it is just a question of whether it will expand.

The markets are confused right now, with black swans appearing, such as the Russia-Ukraine crisis, China is making noises on various fronts over Taiwan, their domestic economy, and Hong Kong. Global debt is still massive compared to GDP, which puts pressure on the integrity and purchasing power of currencies. Inflation is at 7 or 8% and governments continue to print money to prop up the economy. Supply shortages continue to hamper recovery. Crude oil may hit $100, which is not positive for the global economy. Interest rates and wages are starting to rise, in order to adjust to inflation.

“There is a huge gap between the 10-Year Note and inflation, which will have to close,” Interest rates will have to rise or inflation will have to come down, although raising interest rates is probably much more challenging given global debt levels. Interest rates have already risen sharply over the past two years. Anything more and the expense of financing the debt will lead to widespread defaults. The markets could rapidly deleverage, as, over the past few years, people have entered the markets with basically free money – which appears to be ending.

Stocks continue to be sensitive to the headlines about Russia and Ukraine. Mohamed El-Erian, Chief Economic Advisor for Allianz, said on February 17, 2022, on Yahoo! Finance that the conflict, if it worsens, would “blow a very strong stagflationary wind throughout the markets.” The market has also has had a very accommodating liquidity regime, but that is no longer a given from the Fed.

The tensions in Europe have pushed up prices in oil, with concerns about oversupply. But the effects are far more than just oil. Russia and Ukraine are major exporters of many commodities and products. Russia exports 46% of the world’s palladium and 15% of the world’s platinum, as well as 9% of the world’s gold supply.

The market appears to be pricing in a resolution or a continuation of the current tense period, El-Erian argued. It has not factored in the possibility of an actual war.

If there is war, oil could go well over $100.

If there is a war and stagflation, it does not necessarily mean a recession. The US economy is strong and the biggest risk, El-Erian said, is the Fed doing something wrong to harm the economy.

El-Erian said the Fed could hike by 50 and be aggressive, but it could then factor in the need to move up in 50 increments instead of 25. But if the Fed does 25, then the market may wonder why they didn’t do 50 and worry the Fed may do a higher increase later. The Fed, he said, has lost the policy narrative.

The direct economic effect of such a hike should not be great, he said. The Fed is still injecting liquidity and that does not stop until next month. It is still, El-Erian said, a very liquid environment.

It is an unknown time because we have never had a time of huge liquidity on top of interest rate hikes and inflation.

Inflation usually hits high levels when there is a shock to the system, such as the oil crisis in the early 1970s, then people begin to expect inflation. You want people to believe that inflation is short-term, so they do not change their behavior. But this is already happening, as workers ask for more money and businesses raise prices. The key is to prevent worries about future inflation from becoming the main driver of the economy. The Fed must act to ensure that does not happen.

There has been some pullback in many sectors. The Fed, the most reliable buyer in the marketplace, is pulling out of the market to the tune of $120 billion a month. That does not have to be disorderly, El-Erian said, but if the Fed is late, then earnings become less certain and the market will be more disorderly.

I think that the Fed will raise rates a quarter-point and see how the market and economy react and then go from there.

Technicals

Precious Metals

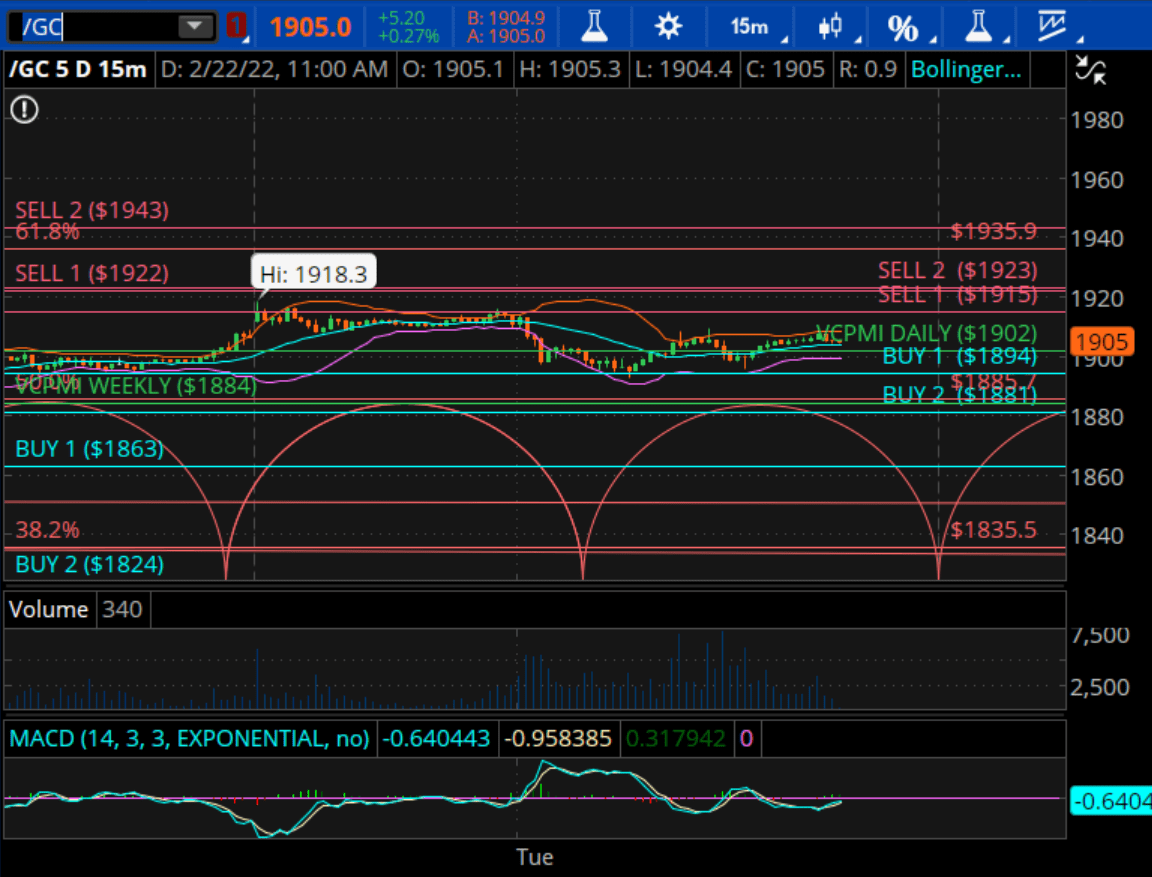

(Click on image to enlarge)

gold (ema2trade.com)

Silver is up to $24.26, up 27 cents, while gold is at $1904, back above the $1900 level again. For the weekly gold data, the average price is $1884 according to the Variable Changing Price Momentum Indicator (VC PMI). The extreme level above the mean, the Sell 1 level, is $1922. Sell 2 is at $1943. The Sell 1 level has a 90% chance and the Sell 2 level has a 95% chance that, if the market reaches those levels, it will revert back toward the mean. On the downside, the weekly Buy 1 level is $1863, which has a 90% chance of the market reverting from there back up toward the mean.

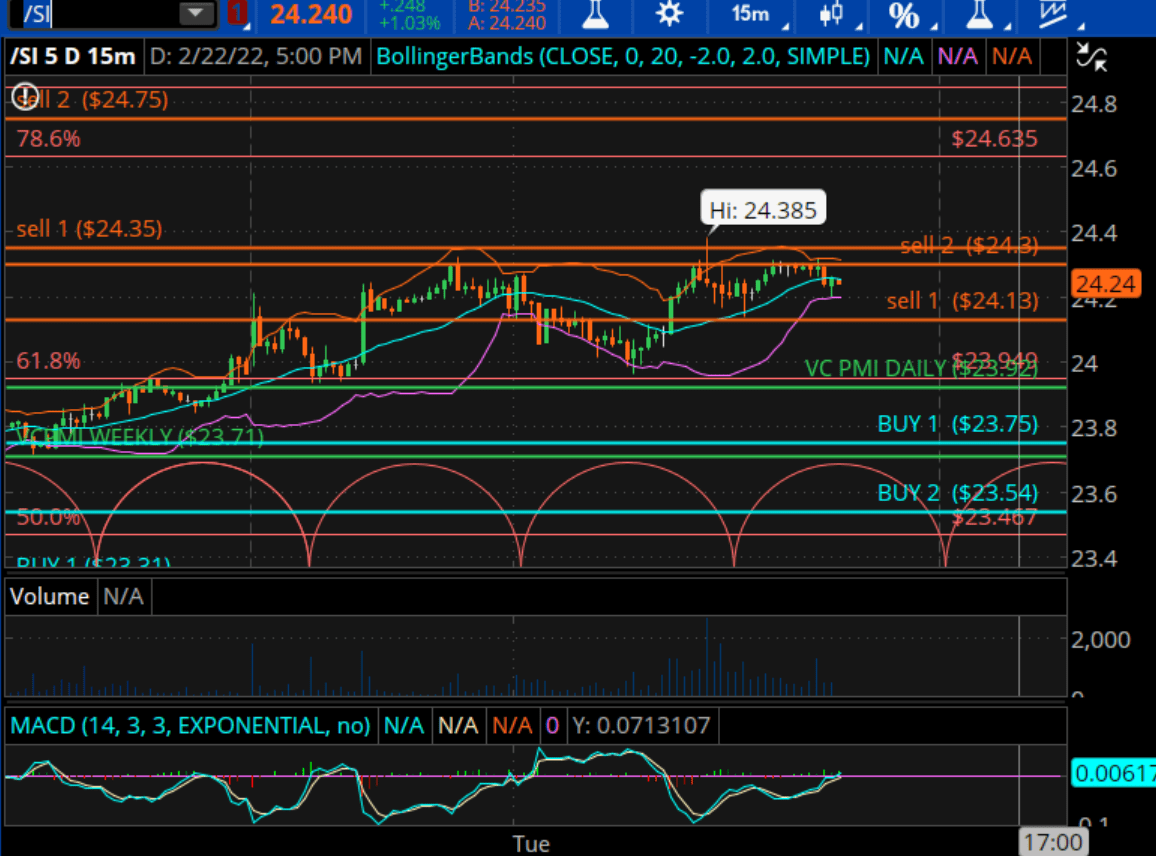

Silver traded above the daily and weekly average recently. Once it was above the averages, it activated a bullish price momentum, which is the market momentum within the bigger trend of the market. Silver appears to be on the verge of a major move up, which could take silver all the way up to about $26, which is the upper end of a long-term trading band. The low was made on September 28, which was a seasonal low. It was tested on December 15, which was an annual low and a higher low than the seasonal low and the market has moved back up from there.

(Click on image to enlarge)

silver (ema2trade.com)

The weekly Sell 2 level is $24.75 for silver and is the ceiling. We want to see a lot of strength to break through that resistance, then the next target is about $25.50 and there is nothing above that until the $26 or $27 area.

“We could be looking at a $3 move in silver very fast,” I said. “Silver is going to be seen as a hedge against the collapse of currencies in response to the amount of monetary stimulus in the system.”

If the Russia-Ukraine crisis turns into a war, then the US dollar will shoot up, which usually happens since it is seen as a safe haven. However, since the dollar has a negative yield compared to inflation, such as with the 10-Year Note, it is not the safest of havens today. As an alternative, silver, gold, and Bitcoin will also be safe havens and will probably shoot up, too.

Disclaimer: I/we have a beneficial long position in the shares of GDX, SILJ, BTC-USD either through stock ownership, options, or other derivatives.

To learn more about how the VC PMI ...

more