Theta Token Crypto Price News Today

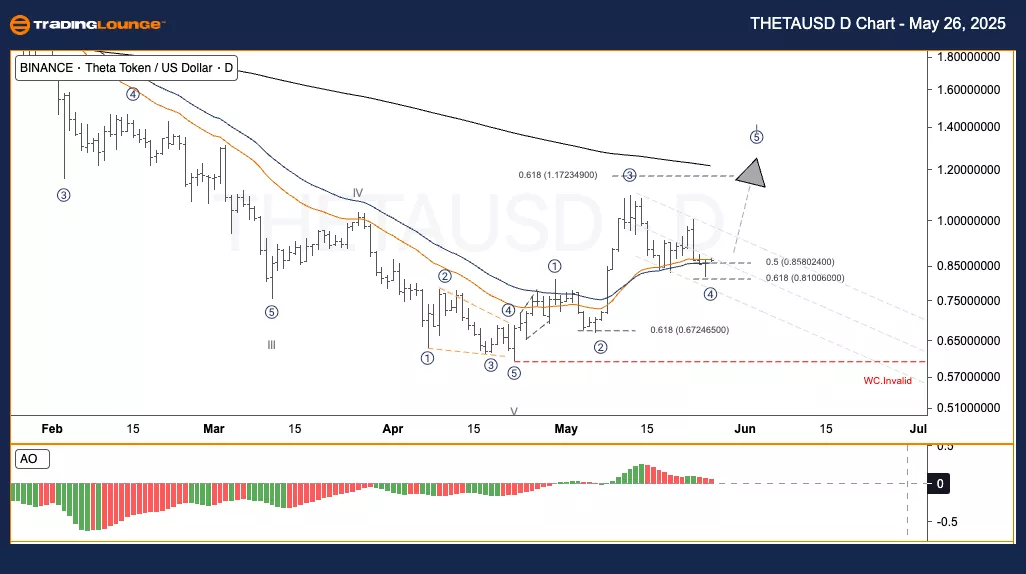

Elliott Wave Analysis TradingLounge Daily Chart,

Theta Token/ U.S. Dollar (THETAUSD)

THETAUSD Elliott Wave Technical Analysis

Function: Follow trend

Mode: Motive

Structure: Impulse

Position: Wave 4

Direction Next Higher Degrees: –

Wave Cancel Invalid Level: –

Theta Token/ U.S. Dollar (THETAUSD) Trading Strategy:

Theta Token (THETAUSDT) is currently moving sideways within wave 4, maintaining a larger bullish Elliott Wave structure. The asset is now in the optimal retracement zone that traders anticipate for initiating wave 5 — a fresh bullish impulse. Following the completion of waves III and V in the earlier phase, the price established a new pattern. With waves 1 to 3 already in place, the market is now stabilizing within wave 4, which is projected to conclude in the Fibonacci support range of 0.5 ($0.8580) and 0.618 ($0.8100). If the market respects this zone and shows a positive reversal, the next upward move, wave 5, is expected to target between $1.17 and $1.30.

Trading Strategies

Strategy

Short-Term Approach (Swing Trading):

Look for bullish reversal patterns from wave 4 like a bullish engulfing candle or a breakout signal.

Risk Management:

Set Stop Loss slightly below $0.80 and aim for profit at the expected wave 5 target zone.

Elliott Wave Analysis TradingLounge H4 Chart,

Theta Token/ U.S. Dollar (THETAUSD)

THETAUSD Elliott Wave Technical Analysis

Function: Follow trend

Mode: Motive

Structure: Impulse

Position: Wave 4

Direction Next Higher Degrees: –

Wave Cancel Invalid Level: –

Theta Token/ U.S. Dollar (THETAUSD) Trading Strategy:

Theta Token is still consolidating within wave 4, positioned inside a larger bullish setup as identified by Elliott Wave principles. This phase marks the anticipated “golden zone” for initiating the fifth wave. Following the earlier completions of waves III and V, price movements have formed a new structure. With waves 1 through 3 already completed, wave 4 is now unfolding, likely to bottom out between 0.5 ($0.8580) and 0.618 ($0.8100) Fibonacci levels. Should the asset hold this level and bounce, wave 5 is likely to rally towards the $1.17 to $1.30 range.

Trading Strategies

Strategy

Short-Term Focus (Swing Trade):

Wait for confirmation of a bullish reversal from wave 4 — a breakout or engulfing candle.

Risk Management:

Use Stop Loss below $0.80, target the peak of wave 5.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Unlocking ASX Trading Success: Insurance Australia Group Limited - Friday, May 23

Elliott Wave Technical Analysis: The Procter & Gamble Co. - Friday, May 23

Elliott Wave Technical Analysis: Euro/U.S. Dollar - Friday, May 23

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more