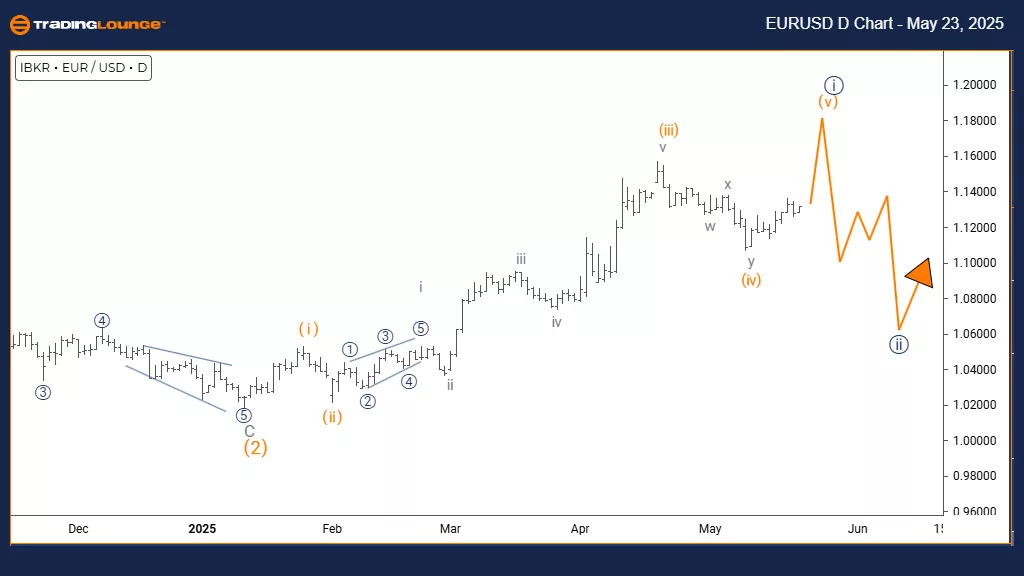

Elliott Wave Technical Analysis: Euro/U.S. Dollar - Friday, May 23

Euro/ U.S. Dollar (EURUSD) – Day Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 1

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Navy Blue Wave 1 of Gray Wave 1 is currently active, indicating a new trend initiation.

The daily analysis reveals a positive market sentiment for EURUSD, showcasing the development of a new bullish trend characterized by impulsive movement. Within this framework, Navy Blue Wave 1 is progressing inside a larger structure labeled Gray Wave 1. This indicates that the EURUSD pair has likely started a new upward cycle, suggesting the beginning of a broader bullish movement.

The current technical view places EURUSD in Navy Blue Wave 1 of Gray Wave 1, pointing to the early phase of a new upward trend. This impulsive rally reflects significant market buying interest, suggesting that the trend could last for a notable duration. The structure’s positioning implies that the movement is more than a short-term rise; it may lead into a sustained uptrend.

This outlook offers valuable insight for traders, indicating that EURUSD might be in the early stage of a potentially extended bullish run. Navy Blue Wave 1 highlights the initial strength within the larger Gray Wave 1. Following this advance, a corrective movement identified as Navy Blue Wave 2 is expected, marking the next phase of this trend sequence.

Traders should observe market behavior for signs supporting the current impulsive wave and monitor indicators typical of emerging trends, such as increasing volume and momentum. Although the setup appears favorable for continued upward movement, caution is advised as all impulse phases eventually encounter corrections. The daily chart strongly supports a long-term bullish scenario in the EURUSD market.

Euro/ U.S. Dollar (EURUSD) – 4 Hour Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 5 (Started)

DETAILS: Orange Wave 4 appears completed; Orange Wave 5 is currently unfolding.

WAVE CANCEL INVALID LEVEL: 1.106

The 4-hour analysis indicates a strong bullish trajectory for EURUSD as it progresses through the final phase of its current Elliott Wave cycle. The technical structure highlights the formation of Orange Wave 5, following the completion of Orange Wave 4, within the broader Navy Blue Wave 1 framework. This setup signals that the pair is likely nearing the top of its current bullish impulse wave.

Orange Wave 4 has concluded, and the pair is now advancing in Orange Wave 5, suggesting continued upward pressure. However, traders should watch for potential signs of trend exhaustion, as this is the final wave in the current sequence. An important invalidation level is set at 1.106; a break below this point would invalidate the current wave count and suggest a possible shift in market structure.

This analysis provides a strategic context for forex traders regarding the pair's current position within the broader trend. With one final upward move likely before a larger correction, traders should watch for signs typical of a Wave 5, such as momentum divergence or declining upside strength.

The insights gained here are valuable for managing positions during what appears to be the last leg of this bullish sequence. While some upside potential remains, vigilance is required, especially near the invalidation threshold. This 4-hour perspective effectively outlines both the opportunity and the caution warranted as the pattern nears completion.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Analysis: Binance Crypto Price News For Friday, May 23

Elliott Wave Technical Forecast - Block, Inc.

Elliott Wave Technical Analysis: Qualcomm Inc. - Thursday, May 22

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more