The Importance Of Stable Inflation To Bull Markets

Image Source: Pexels

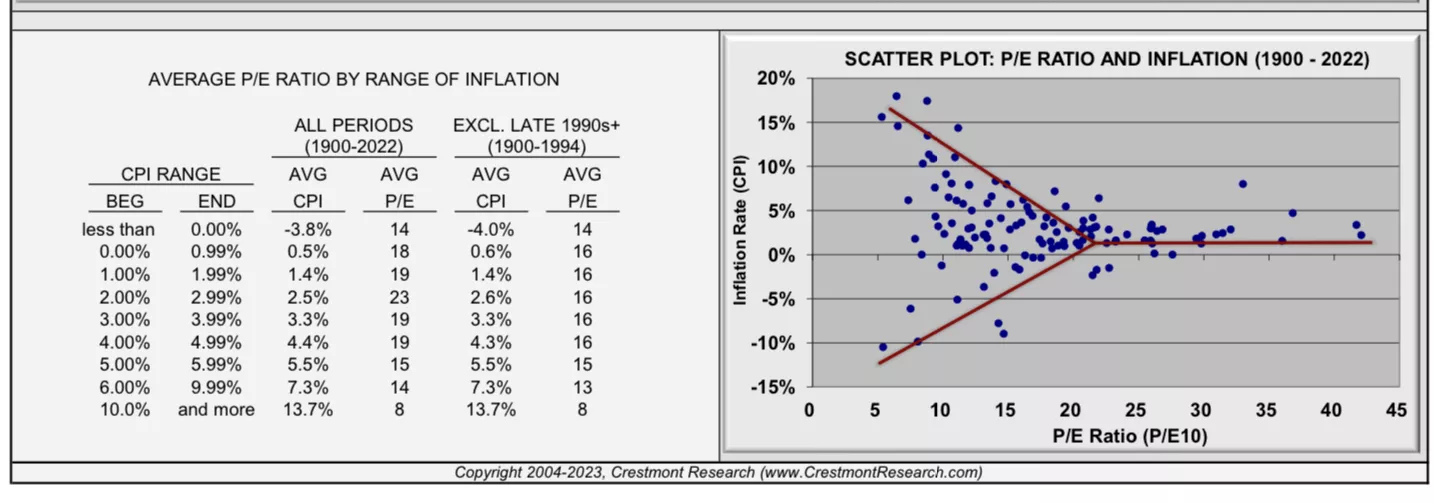

The crucial premise that inflation is positive has been depended upon. P/E ratios rise when the inflation rate tends toward price stability (near 1% inflation), as shown in the figure, and fall when the inflation rate tends toward instability. As a consequence, P/E declines into deflation despite low-interest rates, creating a "Y Curve" effect.

(Click on image to enlarge)

Since it would be anticipated that profits and dividends would decline during a period of deflation and consequently lead to lower valuations, this impact is consistent with the modern dividend discount model.

More By This Author:

What’s Behind Equity Returns

The Fallacy Of Staying In The Market

Housing Booms End As Financial Issues Arise

Disclaimer: These illustrations are not a solicitation to buy or sell any ETF. I am not an investment advisor/broker