The Fallacy Of Staying In The Market

Image Source: Pixabay

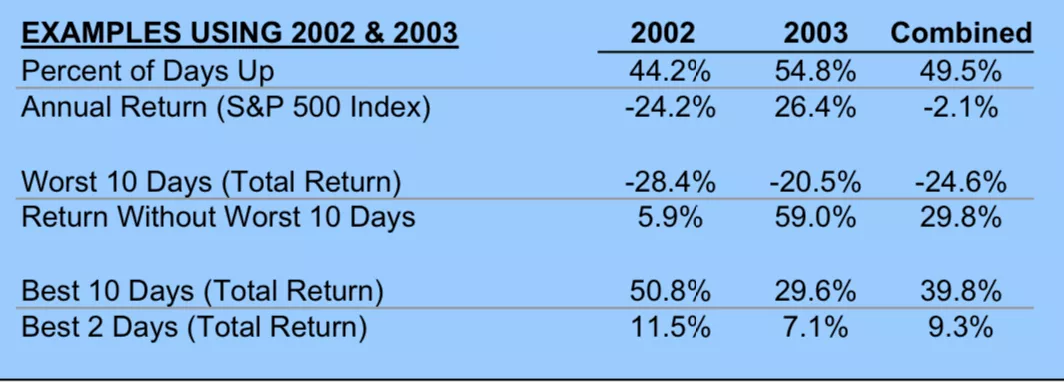

Each year, there are about 250 business days. In both bull and bear markets over the past century, "up" days have made up roughly half of all trading days, or between 45% and 55% of the days (2002 and 2003 were on either end of the spectrum). As a consequence, the majority of the days were offset from one another. Therefore, whether the net return is positive or negative, a tiny number of the most extreme days will add up to the total return for the year, regardless of the total return.

(Click on image to enlarge)

Source - Crestmont Research

The fallacy of "Staying Invested" is technically correct, but the following statements based on the same data are also true:

1. Get out of the market on those days to prevent down years because a few days will equal all of the loses in down years.

2. Learn to time the market because the two or three greatest days will always result in total returns of over 10%.

It might be a good idea to evaluate the market's characteristics and conditions to identify the secular period that is currently in effect and to adjust one's allocations appropriately. Invest when and where returns are most likely.

More By This Author:

Housing Booms End As Financial Issues Arise

CPI And Real Wage Growth

What Consequences Follow From Consistent Wage Growth?

Disclaimer: These illustrations are not a solicitation to buy or sell any ETF. I am not an investment advisor/broker