The AI Power Paradox: Too Much Tech, Too Little Energy

Image Source: Unsplash

When President Donald J. Trump unveiled Project Stargate on his second day in office – a $500 billion private-sector AI initiative – it was a clear declaration: America is going all-in on artificial intelligence. We detailed what the flurry of White House executive orders could mean last month. Now, it’s moving forward at a rapid pace. Led by OpenAI, Oracle, SoftBank, and MGX, the new Project Stargate promises 100,000 new jobs and a major expansion of the nation's AI data center network. But there's one major problem: we might not have enough power to run them.

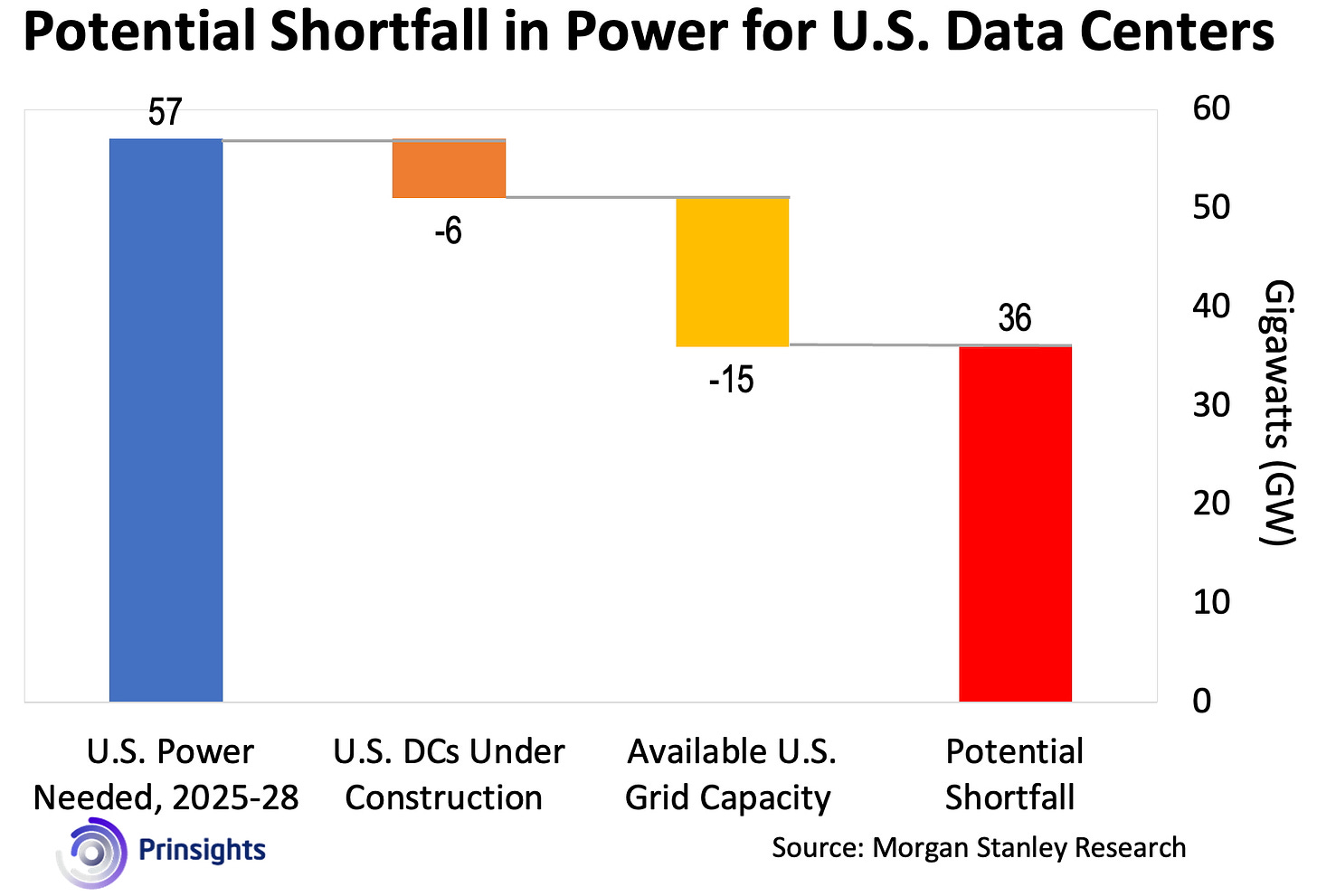

Morgan Stanley's latest research paints a sobering picture: Between 2025 and 2028, U.S. data centers will need about 57 gigawatts (GW) of power. But when you add up the available grid capacity (15 GW) and data centers under construction (6 GW), you’re left with a 36 GW shortfall – a massive energy deficit. Just take a look at the graph below.

That's not just a gap – it's a chasm.

AI’s Insatiable Appetite for Power

Every ChatGPT query burns through 3 to 30 times more energy than a Google search – as if every time you ask a question, you're leaving the engine of a high-performance sports car idling for a few minutes.

Why? Because AI systems like ChatGPT, Google’s Gemini, and Musk’s xAI don’t just pull up a database of results like a simple search engine. They run on specialized, power-hungry computers housed in massive data centers, churning through vast amounts of data in real time. And these aren’t your typical server farms. A single AI server rack devours 80 kilowatts per hour – 16 times more than a traditional server. Multiply that by thousands of racks, and you start to see the sheer scale of the problem (or opportunity).

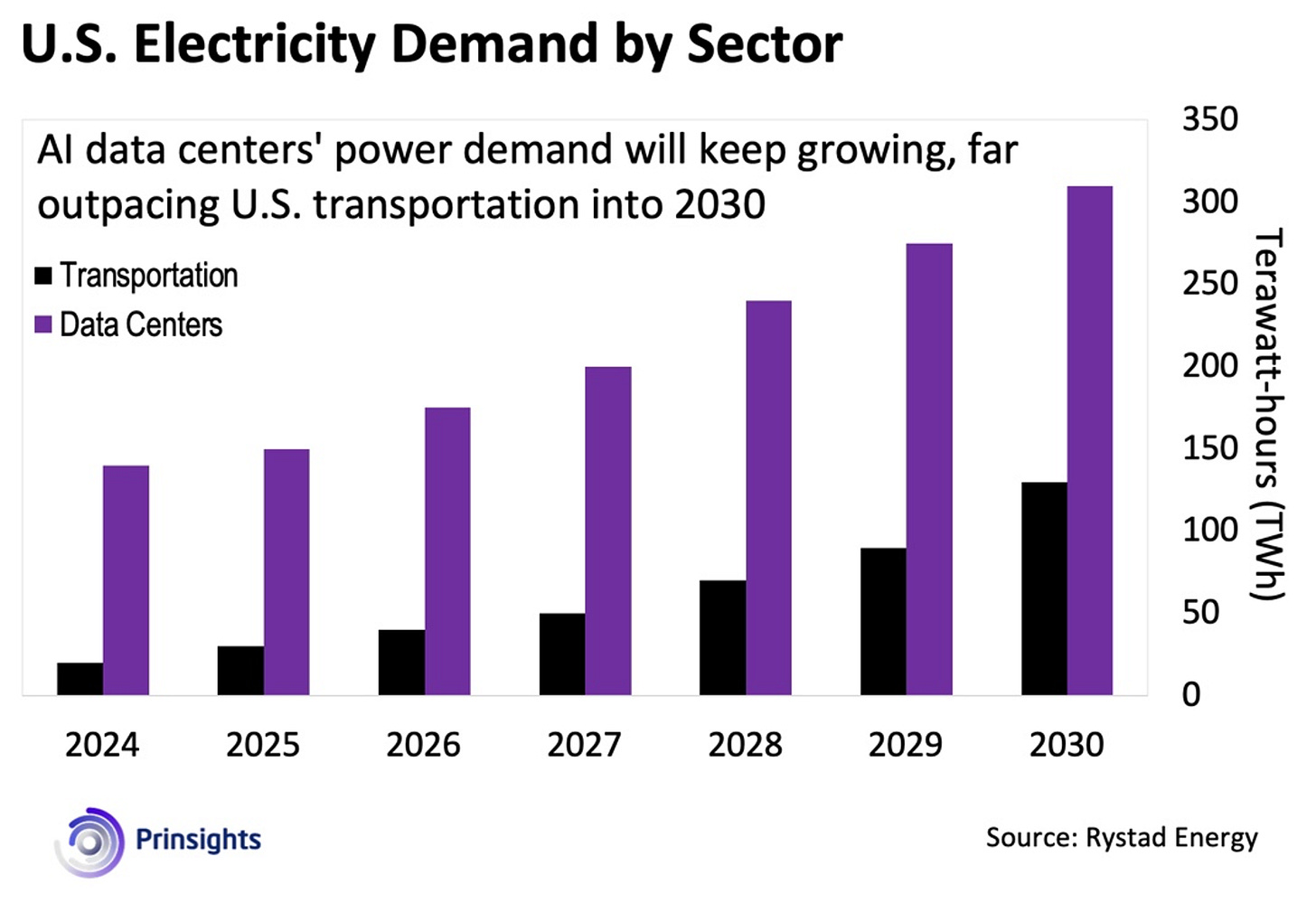

And here's the kicker: this problem is about to get much worse. Why? Because we're only at the beginning of the AI revolution, and these machines are hungry. AI data centers’ power demand will keep climbing past 2028. Just look at the next chart – they’ll also continue to use far more electricity than the entire U.S. transportation sector (and remember – this is happening while we’re trying to electrify the vehicle fleet).

(Click on image to enlarge)

The Global Power Rush

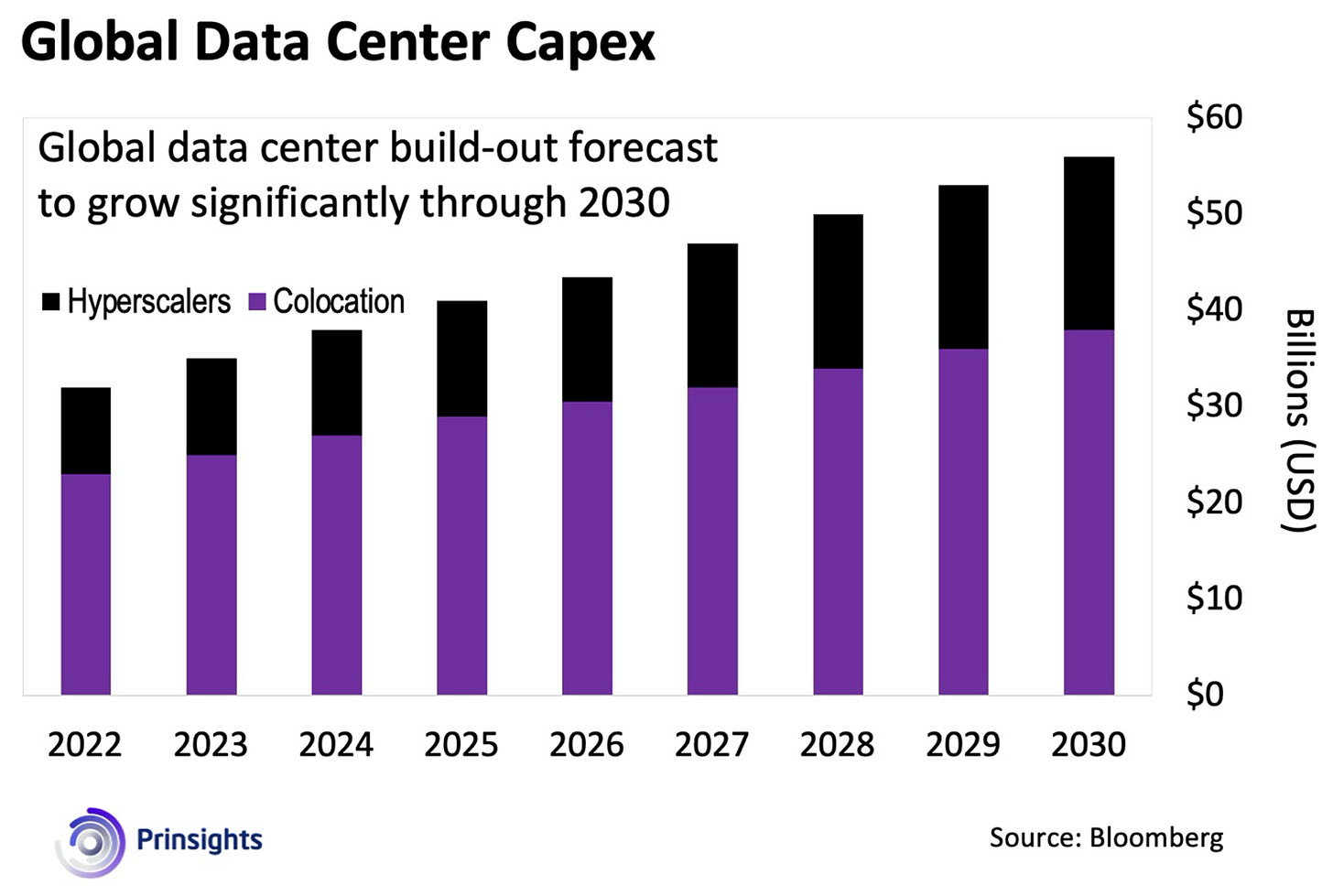

This isn't just an American problem. Looking at our second chart, global data center capital expenditure is set to hit $55 billion by 2030. That's a lot of new power-hungry facilities coming online.

(Click on image to enlarge)

Goldman Sachs Research projects global data center power demand to rise 50% by 2027 and 165% by 2030, compared to 2023 levels. That would push consumption from 55 GW in 2023 to about 83 GW in 2027 and nearly 146 GW by 2030. That’s an increase on par with adding Indonesia’s entire power generation capacity.

For perspective, Bitcoin mining runs at around 15.4 GW continuously. So, if people consider Bitcoin an energy hog, AI is about to make its appetite look tiny.

The AI-Energy Wrinkle That Isn’t

The question to consider is can advances in AI technology solve this energy-intensity problem – or at least make data centers less power-hungry?

We got a glimpse of that possibility last month with Deep Seek. As we discussed with James Eagle (catch minute 8:10 of our discussion here), there is a geopolitical angle here.

A little-known Chinese AI lab made waves by unveiling a large language model (LLM) that rivals ChatGPT – at a fraction of the usual cost. But the real shocker? Deep Seek claims to have cut AI energy consumption by up to 90%.

That had some people wondering: Could AI’s energy appetite be far less of an issue than expected?

That very question and subsequent news sent shares of U.S. power, utility, and natural gas companies plummeting in one of the biggest single-day drops on record. That was especially true of uranium companies. That’s because nuclear energy is considered one of the best ways to power future AI and data centers by many large tech firms.

Keep in mind, power producers were among last year’s biggest S&P 500 winners (thanks to soaring expectations for data center-driven electricity demand).

But here’s the thing, anyone thinking Deep Seek just erased the AI power crunch is missing the bigger picture. If their claims about lower energy use are true – and we have yet to see real proof – it won’t reduce overall electricity demand.

It’ll do the opposite – accelerate AI adoption and push energy consumption even higher.

This is Jevons Paradox in action – named after 19th-century British economist William Stanley Jevons, who observed in the 1860s that improvements in coal efficiency didn’t reduce consumption; instead, they increased demand as coal became cheaper and more accessible.

AI is no different. The cheaper and easier it gets, the more its useful applications will spread – and the more power it will consume.

As we’ve already pointed out, this will create an energy crunch like never before.

What Does This Mean for Investors?

The obvious opportunities are in power generation and grid infrastructure which we will address in our monthly issue, but the implications go much deeper:

- Tech giants may be forced to relocate data centers to regions with excess power capacity or reduced regulatory requirements.

- A boom in private power generation could emerge as companies look for ways to secure dedicated energy supplies.

- Government-backed infrastructure projects could speed up AI data center expansion, especially with policies easing permits and boosting energy development.

- Businesses specializing in energy efficiency and cooling technologies stand to benefit.

- Construction firms with strong government ties may benefit, as AI fuels demand for large-scale projects.

- Regions with abundant power could become the new "Silicon Valleys" of AI.

- Energy investment – both traditional and renewable – is set to grow, as the push to power AI ramps up.

In the end, this AI-energy co-dependent trend isn’t just about keeping the lights on and power flowing to data centers – it’s about America’s ability to stay ahead in the AI race. One thing’s certain: if we can’t power our AI ambitions, someone else will. The next few years will show who can bridge this gap – and who gets left behind.

That’s why building real things, and real infrastructure, is something investors should be following right now.

More By This Author:

Here’s What Geo-Politics Are Signaling About $5000 Gold

Top Reads: From Portfolio Updates to Rare Earth Metals

The Fed Vs Trump: An Interest Rate Tango In 2025

Disclosure: None.