Why Tesla Should Be Aware Of The New 'Holy Grail' In Lithium Batteries

Summary

- Mass production in gigafactory 1 with important outcomes in scale economies and cost reduction resulted in the kind of competitiveness that Tesla was seeking to dominate the global EV market.

- Despite this significant progress, Tesla may still have some room for improvement in its goal to reach the $100/kWh “magic number” that brings EVs to cost parity with ICE vehicles.

- Further reduction in cost may have to come via a decline in material cost through advances in recycling/recovery, change of chemistry in the battery, and/or access to the minerals themselves.

- This paper discusses a type of next-generation lithium-metal batteries that may be crucial for the second possibility, encouraging Tesla to learn about this opportunity and get ready to grasp it.

- Lastly, provided the new “Holy Grail” takes off and consolidates in the near future, the prospect demand for and subsequent production of lithium metal will imply profound changes in the upstream of the lithium value chain.

As a recent scientific paper shows, mass production in Tesla’s (NASDAQ:TSLA) gigafactory in Nevada, with important outcomes in economies of scale and cost reduction resulted in the kind of competitiveness that Tesla was looking for to dominate the EV market worldwide.

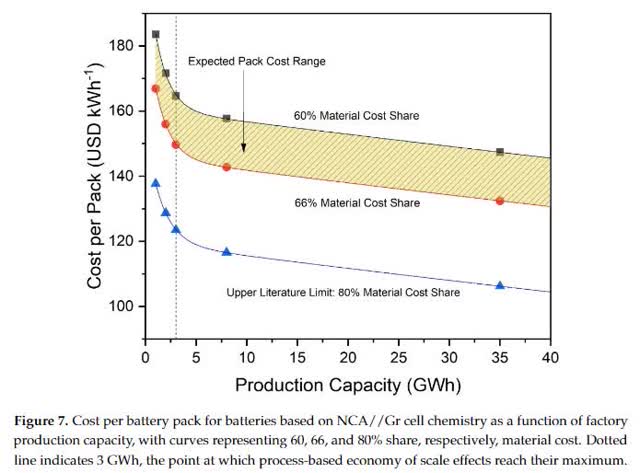

In effect, battery pack costs per kWh for a typical Tesla battery chemical composition (NCA//Graphite) with a share of material cost between 60% and 66% on total manufacturing costs for 1GWh production capacity would be in the range of $184 and $167. However, those figures would go down to $147 and $132, respectively, should the production capacity increase to 35GWh (See Figure 1).

As is well known, Tesla’s original plan was to build a gigafactory with a cell output of 35GWh and a pack output of 50GWh by 2020. It was, therefore, aiming at producing 35GWh battery packs for EVs with cells produced at the gigafactory, and 15GWh battery packs for energy storage applications with cells produced elsewhere.

A little over a year ago, Elon Musk himself indicated that cell production at the gigaplant had thus far been running at a real capacity of around 24GWh, which is relatively consistent with the total number of EVs that Tesla produced in 2019. Indeed, if we agree that Tesla produced 365,300 EVs last year, we can extrapolate that the gigafactory ran at a real capacity of 25.6GWh.

Regardless of whether or not Tesla finally meets its capacity goal by the end of this year, the above figures speak well of the plausibility of the scientific study referred to above and are most relevant to the real capabilities of the disruptive company to change the global automotive industry forever.

Likewise, Cairn Energy Research Advisors (cited by InsideEVs) estimates that Tesla’s pack-level costs reached $158.27 per kWh in 2019. At our estimated capacity of 25.6GWh, this might be slightly outside of the 60% material cost curve in Figure 1, meaning that although Tesla seems to be on the right track, it still has some room to diminish its processing costs as it strives to reach full capacity in Gigafactory 1.

Interestingly enough, the peer-reviewed article also sustains that for a share of material cost reaching 80%, the same numbers would be $138 and $106, respectively. This would get us close to the $100/kWh “magic number” that will likely bring EVs to cost parity with internal combustion engine (ICE) vehicles.

It would then follow that there are two conditions for Tesla to reach the “magic number”: One, more scale economies, through process optimization, in its gigaplant that would allow for further diminution of manufacturing/processing costs from a bit over 40% down to 20% of total cost, and two, operation at full or near-full capacity (35GWh) in its gigafactory.

From here, an additional reduction in battery cost would have to come via a decline in material cost. However, this will not be automatic. It could come through recycling and recovery of the most expensive materials such as cobalt, lithium, and nickel (in that order), through the change of chemistry in the battery, and/or through access to the minerals themselves. Tesla has been seen making some progress in the two first options, leaving, for the time being, aside, the third. At least, that is reflected in a new Reuters article. In the rest of this article, I will attempt to go deeper into the last two arguments leaving the first for future contributions.

The question remains, though, as to whether Tesla will continue pushing manufacturing/processing costs to the “literature” limit without paying significant attention to material costs or maybe it will choose to go the other way around in the “mother of all its battles” against the “legacy” carmakers in the very near future. We cannot discard either an intermediate strategy whereby Tesla starts affecting the material costs without necessarily pushing manufacturing costs to the limit.

Figure 1

Battery Pack Costs Reduction with Increases in Capacity

Source: Wentker et al (2019).

Continue reading on Seeking Alpha.

Disclosure: None