Looking For The Right Time To Buy Micron

Micron (MU) stock is on fire, gaining nearly 55% in the past year on the back of solid financial performance from the company and improving demand prospects for the sector. The stock may be too hot in the short term, but it still offers attractive upside potential in the years ahead.

Solid Performance And Improving Prospects

Even a mediocre company can deliver good numbers when the wind is on its back, but it takes a well-managed business to produce solid earnings and cash flows in times of falling industry demand.

Micron has focused on improving its cost structure and increasing the mix of high-value solutions in its portfolio over the past several years. This has allowed the company to generate 2,000 basis points of EBITDA margin improvement relative to its peers since 2016

The numbers from the most recent quarter confirm that the business remains solid in spite of falling industry revenue. Revenue declined by almost 39% year over year, but the company still retained a healthy 38.2% of revenue as gross profit, while operating profit amounted to 21.1% of sales during the period. Operating cash flow was $2.71 billion, and the company ended the quarter with a net cash position of $3.02 billion.

Management said in the most recent conference call that demand for NAND products is already increasing, and the company is anticipating a recovery in DRAM in the second half of 2019. Inventory levels still remain high, though:

Over the last few months, customer inventory improvements have progressed largely in line with our expectations in most end markets. This reinforces our confidence that bit demand for DRAM will return to healthy year-over-year growth in the second half of calendar 2019. NAND bit demand is also increasing in most markets as elasticity kicks in, in response to price declines over the last year. Even as customer inventory levels of DRAM and NAND improve across most end markets, producer inventory levels are elevated.

Management is always an interested party in these discussions, so we need to take the comments from the management team with a grain of salt. That said, recent research reports from Deutsche Bank and Mizuho are also positive on industry demand prospects over the coming months.

Interestingly, the stock market tends to put too much attention on short-term demand metrics, but it can be more important to consider the long-term growth drivers for the business. From a secular perspective, key trends such as Artificial Intelligence, autonomous vehicles, 5G, and the Internet of Things should be powerful tailwinds for the sector over the years ahead.

Valuation Is Remarkably Attractive

Micron is more cyclical than other companies in the technology sector, and even more cyclical than a typical semiconductor stock. For this reason, the stock can arguably deserve a valuation discount. However, the size of the valuation discount looks quite big already.

The table shows a wide variety of valuation ratios for Micron in comparison to median values for the sector. With a price to earnings ratio of 5.2 and a price to cash flow ratio of 3.4, the stock is clearly priced at bargain-low levels.

| Micron | Sector Median | % Diff. to Sector | |

| P/E Non-GAAP (TTM) | 5.29 | 21.4 | -75.28% |

| P/E Non-GAAP (FWD) | 7.94 | 22.65 | -64.93% |

| EV/Sales (TTM) | 1.97 | 2.81 | -29.72% |

| EV/EBITDA (TTM) | 3.25 | 15.26 | -78.73% |

| Price/Sales (TTM) | 2.05 | 2.6 | -21.35% |

| Price/Cash Flow (TTM) | 3.36 | 19.3 | -82.62% |

Source: Seeking Alpha Essential

The main question when it comes to forward-looking valuation is what level of revenue, cash flow, and earnings Micron is going to produce the coming quarters. Management is clearly expecting some kind of recovery in 2019-2020, and recent reports from Wall Street analysts are supporting this view.

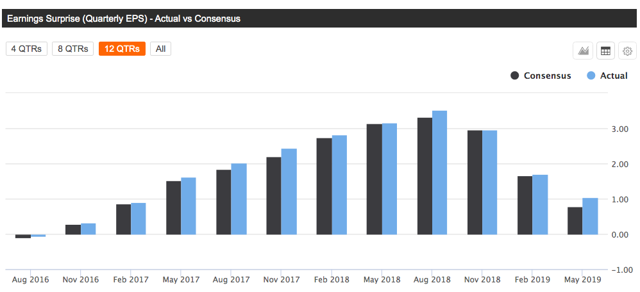

It's also worth noting that Micron has a solid track record in terms of delivering earnings numbers above Wall Street expectations. The company has beaten expectations in each of the past 12 consecutive quarters, quite an impressive track record for a business operating in such a cyclical and challenging industry.

Source: Seeking Alpha Essential

Fundamental momentum is a pervasive phenomenon in the market, meaning that companies that consistently deliver earnings numbers above expectations tend to continue doing so more often than not. If this trend remains in place, better-than-expected earnings from Micron would mean that the stock is actually more undervalued than what current expectations imply.

Valuation should always be analyzed in its due context. A company with solid financial performance and delivering better-than-expected earnings deserves a higher valuation than a business that is losing money and underperforming expectations.

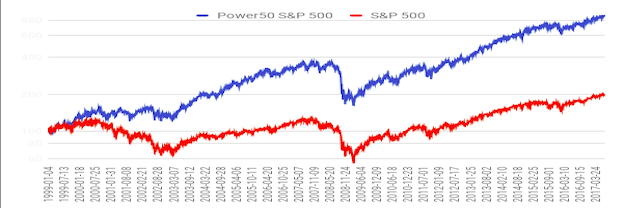

But sometimes it can be challenging to incorporate the multiple factors into the analysis in order to see the complete picture from a quantitative perspective. In that spirit, the PowerFactors system is a quantitative algorithm that ranks companies in a particular universe according to a combination of factors, including financial quality, valuation, fundamental momentum, and relative strength.

In simple terms, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and this has bullish implications for Micron stock.

Micron has a PowerFactors ranking above 80 as of the time of this writing, meaning that the stock is in the top 20% of companies in the US stock market based on financial quality, valuation, fundamental momentum, and relative strength combined. In other words, valuation levels are compelling when analyzed in the context of other quantitative return drivers for Micron.

Going Forward

With the stock delivering massive gains and trading close to its highs of the last year, it makes sense to be patient when building a position in Micron. It is important to keep in mind that the industry is quite cyclical and globally integrated, so demand is quite sensitive to macroeconomic conditions and to the trade war negotiations between China and the U.S.

That being acknowledged, Micron has proven to investors that it can sustain solid earnings and cash flows during challenging times, industry conditions seem to be improving, and the stock is attractively valued at current levels.

The stock may be overbought in the short term, but it still offers plenty of potential for gains over the long term.

The PowerFactors algorithm is available to members in The Data Driven Investor. Statistical research has proven that stocks and ETFs showing certain quantitative attributes tend to outperform the market over the long term.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in MU over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more

Good read. I think a lot of the negative hype surrounding $MU and the #tradewar ware overblown. China makes up a tiny fraction of #Micron's revenue.