TalkMarkets Words For Wednesday: An "August" Market?

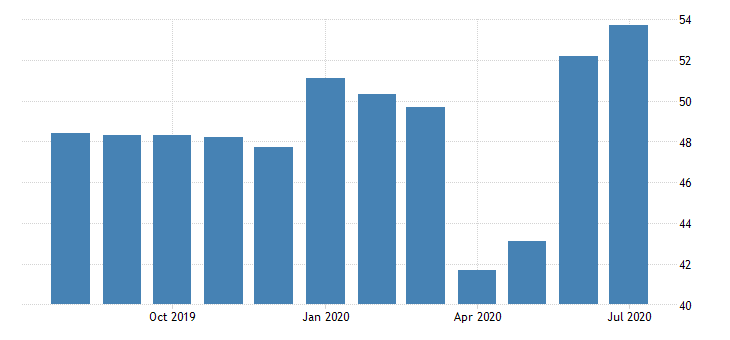

Good Morning. It is Wednesday, the market has been green all week, yesterday the S&P closed up at 3,306, the Nasdaq at 10,941 and the Dow at 26,828. Currently, the market futures are all green with the Nasdaq flashing above the 11,000 level. It has yet to close, there. Upbeat earnings from the Tech sector last week and a rise in the US PMI to 54.2 in July 2020 from 52.6 in June (beating the market expectation of 53.6), maybe helping the markets stay the course for the week, so far. In fact the July PMI is at its highest level since March 2019 reflecting a continued recovery in manufacturing, following the disruption caused by COVID-19.

1 Year United States ISM Purchasing Managers Index (PMI)

Source: Trading Economics

As usual our TalkMarkets contributors are looking to find among other things, value, understanding and good picks in the market.

On the heels of the hot Tech market Theras A.G. Wood of Visual Capitalist writing in The World’s Tech Giants, Ranked By Brand Value charts the top twenty tech firms as ranked by BrandZ. Have a look:

(Click on image to enlarge)

As might be expected, US companies dominate the chart, with China trailing second and Germany (SAP) and South Korea (Samsung) with one contributor each to the top twenty.

The article also shows data for the top 5 brands worldwide. All are US based companies. All are at the intersection where Technology and Services meet.

Good visuals and good reading. Don't miss it.

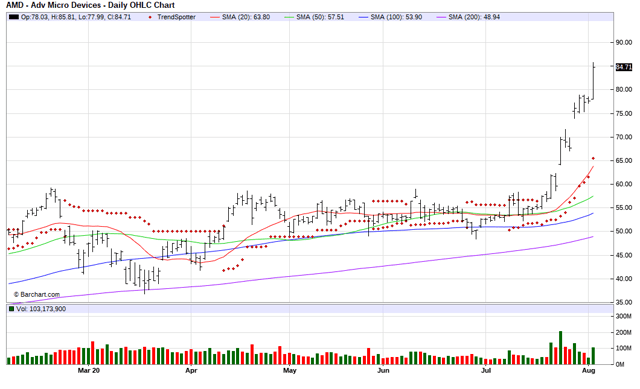

Jim Van Meerten in 5 Best Large Caps picks his current top 5 large cap stocks using a completely technical approach.

"I used Barchart to sort the S&P 500 Large Cap Index stocks first by the highest Weighted Alpha, then by the highest Barchart technical buy signals. I used the Flipchart function to review the charts for consistent price appreciation. The list includes:Nvidia (NVDA), Advanced Micro Devices (AMD), Dexcom (DXCM), Apple (AAPL) and PayPal (PYPL)."

Here is Jim's analysis for AMD, a current favorite on the street right now.

Barchart technical indicators for AMD:

- 100% technical buy signals

- 14 new highs and up 61.87% in the last month

- 163.40+ Weighted Alpha

- 187.79% gain in the last year

You should take a look at Economic Normality: When? Sooner? Never? by William Smead. Smead in a bit of a tongue-in-cheek tone, notes that there have been three phases to the economy and the market since the onset of the COVID-19 pandemic.

"In the time since COVID-19 hit the economy and stock market, there have been three phases. First, the question was ‘when’ will the economy return to pre-COVID normal? Next, came ‘sooner or later’? Recently, we have moved to ‘will the economy ever come back’? For long-duration investors like us, what are the investment implications in where we are now in a U.S. stock market with many securities priced for ‘never’?"

Smead notes, that market makers of the "sooner", then "later" school of thought have been investing in companies which could best benefit from the COVID-19 economy pushing the rise in what he calls the FANMAG (Facebook (FB), Amazon (AMZN), Netflix (NFLX), Microsoft (MSFT), Apple (AAPL), and Google, now Alphabet (GOOG)) stocks.

As a long term investor, Smead looks ahead to post COVID-19 events, using research and history as a guide. He notes that a recent UBS/U. of Maryland study shows that since 1963 value stocks, currently out of favor, have remained in the 100th percentile for all these years.

"All prior growth stock popularity episodes pale in comparison to this gap. Their study showed that value is so depressed that even if it stays at the 100th percentile, value would beat the S&P 500 Index over ten years."

"Think of it like this. Value being out of favor causes energy and banks to be very depressed. Chevron (CVX) just used this relative value in acquiring Noble Energy and Warren Buffett is backing up the truck buying depressed Bank of America (BAC) shares."

According to Smead the market is having a "when" moment with regard to buying "value" stocks. Something to consider alongside chasing the hot bio-techs.

Dividend Growth Investor of ValueWalk takes a look at Nine Dividend Paying Companies Raising Dividends Last Week. It certainly is nice to hear about nine bright spots in this topsy-turvy market. Dividend Growth Investor says they tend to focus attention on companies with at least ten years of annual dividend increases, thereby focusing on companies "with a higher chance of delivering sustainable dividends" which helps them identify companies "with a long runway for future dividend increases".

As might be expected none of the nine are "new" companies and none of them are in particularly "hot" or "jazzy" sectors. Two of their picks are W.W. Grainger and Scotts Miracle Gro.

"W.W. Grainger, Inc. (GWW) distributes maintenance, repair, and operating (MRO) products and services in the United States, Canada, and internationally.

The company raised its quarterly dividend by 6.25% to $1.53/share. This marked the 49th consecutive year of annual dividend increases for this dividend champion. During the past decade, this dividend achiever has managed to grow distributions at an annualized rate of 12.30%.

Between 2009 and 2019, W.W. Grainger managed to increase earnings from $5.62/share to $15.32/share. The company is expected to earn $15.94/share in 2020.

The stock sells for 21.40 times forward earnings and yields 1.80%."

"The Scotts Miracle-Gro Company (SMG) manufactures, markets, and sells consumer lawn and garden products in the United States and internationally. The company operates through three segments: U.S. Consumer, Hawthorne, and Other.

The company raised its quarterly dividend by 6.90% to 62 cents/share. This marked the 11th consecutive year of annual dividend increases for this dividend achiever. During the past decade, this dividend achiever has managed to grow distributions at an annualized rate of 16.30%.

The company managed to grow earnings from $2.32/share in 2009 to $8.18/share in 2019.

The company is expected to earn $6.37/share in 2020.

The stock sells for 24.90 times forward earnings. The stock offers a dividend yield of 1.55%."

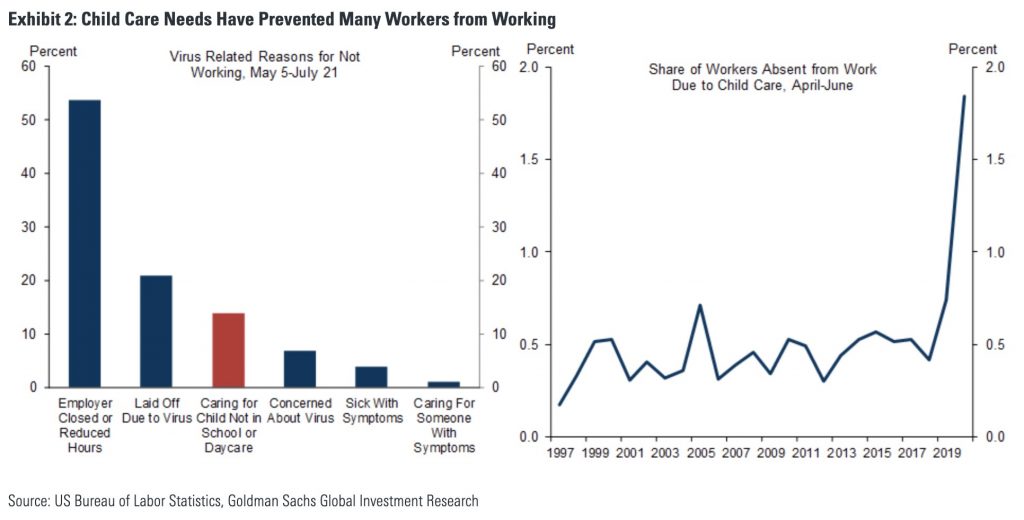

In Unusual Variable For Labor Market Recovery, TalkMarkets contributor Upfina takes a look at the impact of children staying home from school or daycare on the labor market during the COVID-19 pandemic. Upfina notes that "caring for children not in school or at daycare was the 3rd most common reason people weren’t at work from May to July". The below two charts illustrate clearly what happens to productivity when people stay home with their kids, with the percent of people not working due to child care tripling to nearly 2%. Caring for a child at home was the biggest reason for not working after employer mandated reduced working hours or COVID-19 related layoffs.

The article notes that lower educated and lower income workers continue to suffer more than higher educated and higher income workers (especially since many higher income workers can work from home). This may be the first downturn or recession where childcare (or the necessity to stay at home) plays a critical role in the pace of economic recovery. According to Upfina: "Whether or not kids can go back to school will be huge in determining where the labor market is headed. If they go back to school, the unemployment rate might drop quickly. "

While Congress works to pound out additional stimulus legislation, which may or may not include additional PPP funds, before it recesses on Friday, a reminder that the deadline for CARES Act Paycheck Protection Program loans is August 8. Check out our last minute PPP resource guide here.

President Barack Obama said this: "America isn't Congress. America isn't Washington. America is the striving immigrant who starts a business, or the mom who works two low-wage jobs to give her kid a better life. America is the union leader and the CEO who put aside their differences to make the economy stronger."

Congress are you listening? Have a good week.

Thanks for pointing out @[Bill Smead](user:26106)'s article. I enjoyed it.

👍🏼

Good stock picks @[Jim Van Meerten](user:4654), I agree completely.